Dogecoin’s (DOGE) price has increased by 27% in the last seven days. This surge makes DOGE one of the biggest gainers among the cryptocurrencies in the top 10.

Despite recent consolidation, on-chain data reveals that the coin may undergo another price increase. Here is why.

Dogecoin Whales Buy Billions of Coins

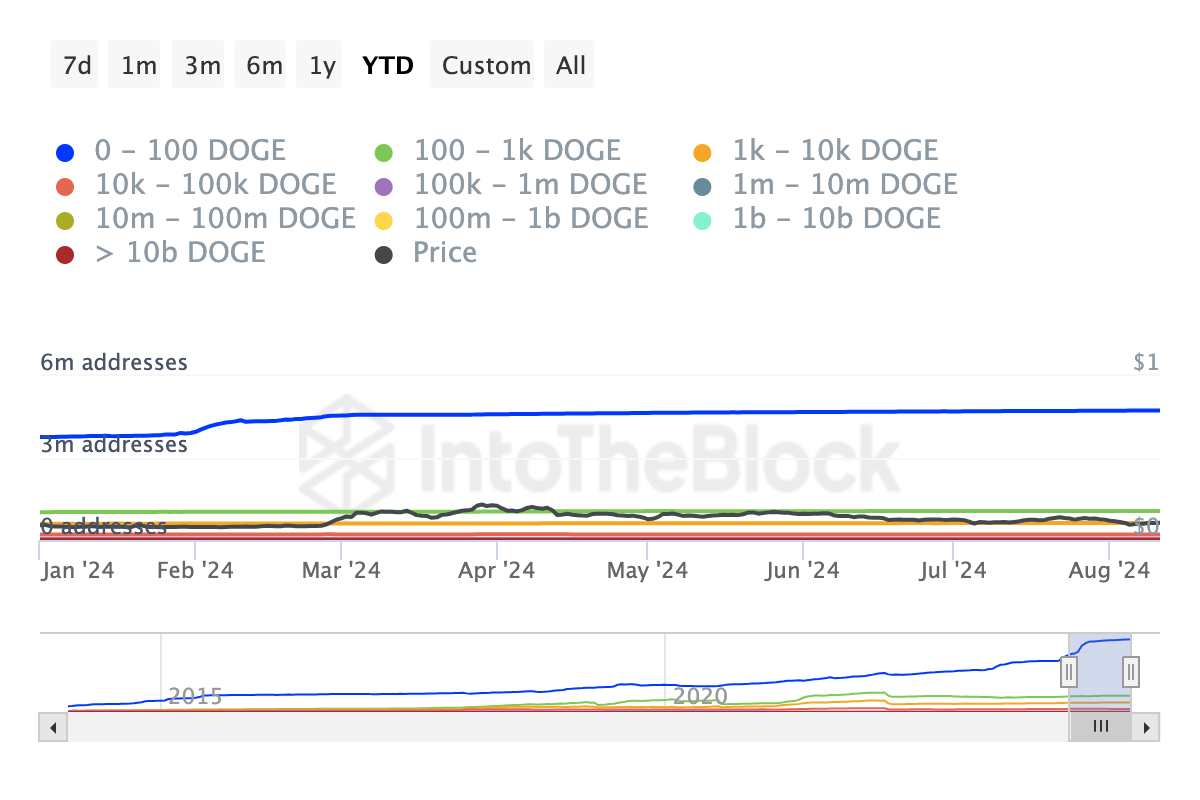

According to IntoTheBlock, the number of addresses holding 10 billion DOGE has increased by 50% in the last 30 days. This group, commonly referred to as whales, has a big influence on price.

Typically, a drop in whale holdings indicates that these large investors are selling, which could lead to a price decline if it continues. However, recent strategic accumulation suggests that whales are bullish on the coin’s short-term potential.

If the number of addresses holding large amounts of DOGE increases, the price may break out of consolidation and potentially rise.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

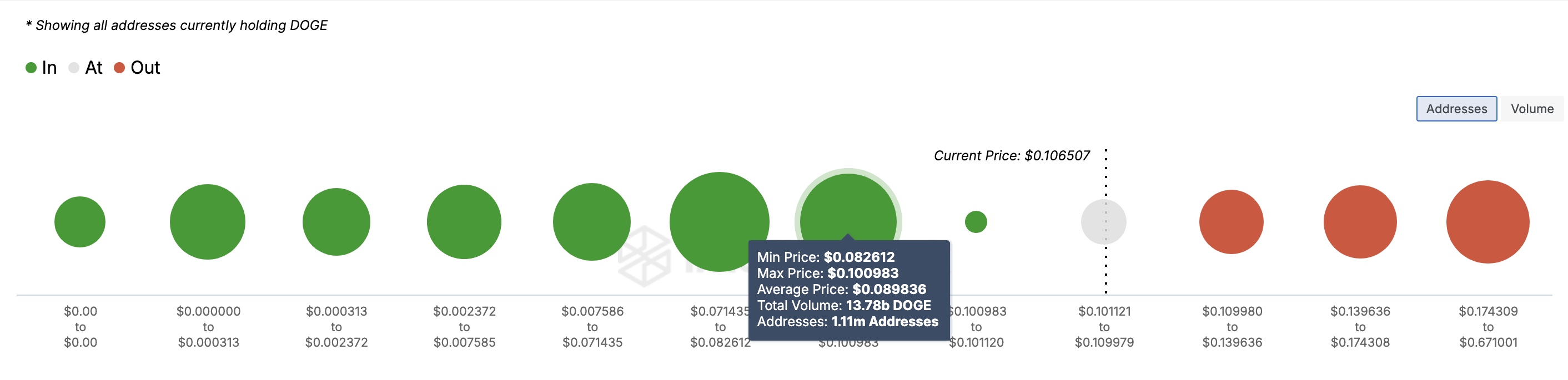

Data from the In/Out of Money Around Price (IOMAP) further supports this bias. The IOMAP tool identifies addresses that are in the money, out of the money, or at the breakeven point.

An address is considered in the money if the average cost is lower than the current price. Conversely, an address is out of the money if the current price is higher than the cost basis. If the on-chain cost basis matches the current price, the address is at the breakeven point.

Also, the higher the number of addresses in the money, the stronger the support. Conversely, the higher the number of addresses out of the money, the stronger the resistance.

At press time, 1.11 million addresses that purchased 13.78 billion DOGE between $0.089 and $0.10 are in the money. Meanwhile, 360,970 addresses, holding over 48 billion coins at an average price of $0.12, are out of the money.

According to these dynamics, DOGE appears to have strong support around $0.10. If buying pressure increases, the meme coin could break past resistance and potentially reach $0.13.

DOGE Price Prediction: The Meme Coin Wants $0.13 Back

Before DOGE jumped to $0.10, the price lost 39% of its value to drop to $0.082. However, the daily chart shows a positive Cumulative Volume Delta (CVD), which tracks the difference between buying and selling volume.

Each bar illustrates when buying pressure exceeds selling pressure (green) and when selling pressure dominates (red). Currently, the green bars indicate stronger buying pressure.

If this trend continues, DOGE’s price could retest $0.11 in the short term. Additionally, if selling pressure remains low, the price upswing might persist, potentially reaching the upper-level resistance at $0.13.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, if whales begin to distribute, the coin may face a decline, which could take its price below $0.10 again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.