BlackRock recently filed a proposal for options trading and listing on its spot Ethereum (ETH) exchange-traded fund (ETF), iShares Ethereum Trust (ETHA).

The proposal was submitted to the US Securities Exchange and Commission (SEC) on August 6 via the Nasdaq International Securities Exchange.

Nasdaq and BlackRock Leverage Experience with Commodity ETFs for Crypto

According to the filing, the newly proposed iShares Ethereum Trust assets will consist solely of ETH, which Coinbase will hold. Meanwhile, the Bank of New York Mellon will hold the cash assets. Furthermore, the document affirmed that the trust will remain non-engaged in Ethereum staking to earn additional income.

Nasdaq outlined that this move aims to broaden the range of investment tools for Ethereum and make crypto investments more accessible within traditional financial markets. Although these shares do not equate to a direct investment in ETH, they enable investors to gain exposure to Ethereum. This is because the approach takes place through the public securities market, which might be more familiar to traditional investors.

The options market allows traders to buy or sell an asset, like a stock or an ETF, at a specified price before a certain date. They often use options to protect against potential losses or to speculate on an asset’s future price. Unlike futures, options provide flexibility since the trader can decide whether to execute the trade.

Read more: An Introduction to Crypto Options Trading

Both Nasdaq and BlackRock have notable experience in listing options on other commodity ETFs structured as trusts. These include iShares COMEX Gold Trust and iShares Silver Trust. Hence, this move to add options to the spot crypto ETF marks a significant development in this context.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on Nasdaq and BlackRock’s filing to add options on Ethereum ETFs. He noted that the SEC’s final decision will likely be around April 9, 2025.

“SEC is not the only decision maker on adding options here. Also need signoff from Options Clearing Corporation (OCC) and Commodity Futures Trading Commission (CFTC),” Seyffart added.

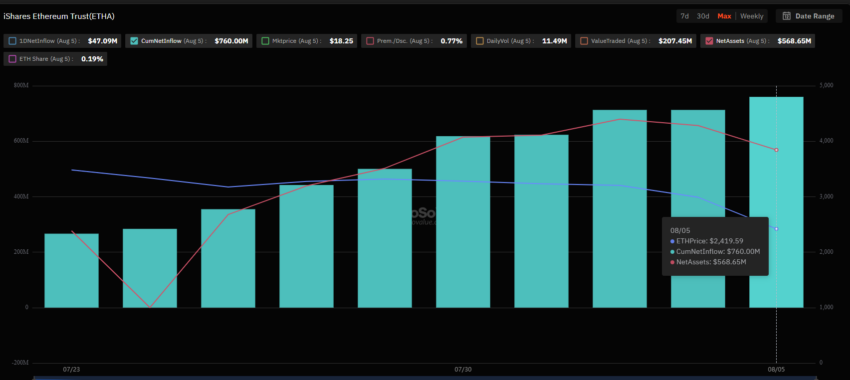

BlackRock is a prominent issuer of spot Bitcoin and Ethereum ETFs in the US. According to SoSo Value data, BlackRock’s iShares Bitcoin Trust (IBIT) had net assets of $18.28 billion as of August 5, making it the largest spot Bitcoin ETF.

Read more: Ethereum ETF Explained: What It Is and How It Works

The data also showed that iShares Ethereum Trust (ETHA) had net assets of $568.65 million as of the same date. It ranked as the third largest spot Ethereum ETF in the US market after Grayscale’s ETHE and Ethereum Trust.

Ryan Lee, Chief Analyst at Bitget Research, notes that the response from the broader ETF market and investor preferences will play a crucial role in determining these funds’ future.

“Investor sentiment towards cryptocurrencies and ETF products may shift quickly due to regulatory changes, market conditions, and macroeconomic factors. Recent approvals and launches of various Ethereum ETFs, including Grayscale’s, have had a significant impact on the market, coinciding with periods of market volatility. The performance of Ethereum and broader market trends will also affect investor behavior. If Ethereum prices stabilize or rise, it may encourage investors to hold or invest in ETFs, potentially reducing outflows,” Lee told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.