Dogecoin (DOGE) price posted a loss for the seventh consecutive day as the price fell to $0.11. This movement has raised concerns about the short-term potential of the largest meme coin by market cap.

However, on-chain analysis shows that the concerns may be valid, largely due to potential selling around the current price.

Dogecoin’s Recovery Is at Risk

Having faced a 13.67% downturn over the past seven days, DOGE holders will be hopeful that respite will be on the way. But data from IntoTheBlock suggests that the opposite.

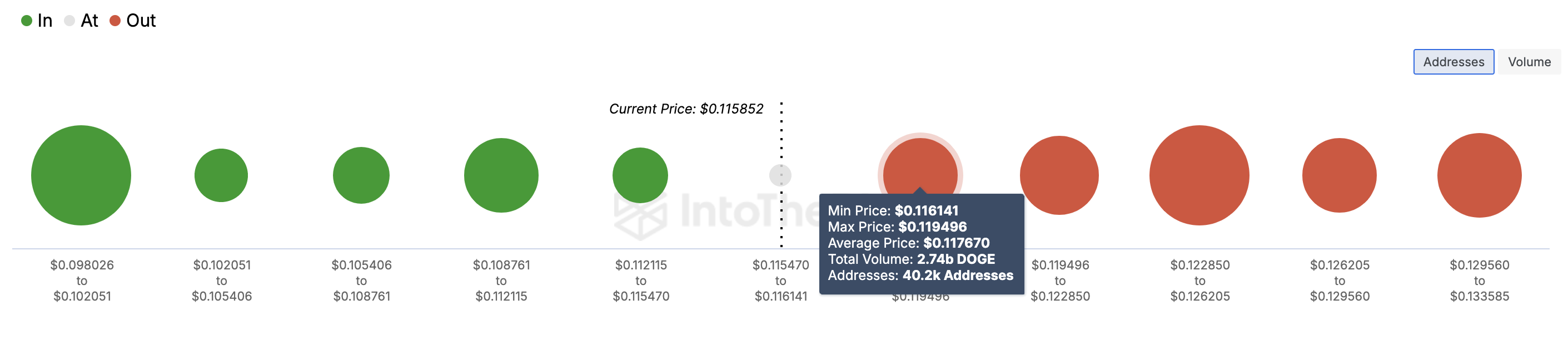

According to the blockchain analytics platform, the In/Out of Money Around Price (IOMAP) shows a potential sell wall close around the $0.11 level. The IOMAP classifies addresses as either making money, breaking even, or losing money to spot support and resistance areas.

The larger the cluster of addresses in a price range, the stronger the support or resistance. In the range on the left side of DOGE’s price, data shows that 17,960 addresses purchased 1.49 billion coins, potentially preventing a significant price drop. However, as shown below, 40,200 addresses hold 2.74 billion coins, currently valued at around $300 million to the right.

Read More: Dogecoin vs. Bitcoin: An Ultimate Comparison

This is a crucial resistance barrier that could prevent others in the support region from initiating a price rebound. If validated, DOGE may encounter another downward phase, with the next support levels lying between $0.09 and $0.10. Another metric aligning with this bias is the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio gives insights into the level of unrealized profits or loss; high values indicate high unrealized gains, suggesting a possible increase in willingness to sell. Low values indicate unrealized losses, indicating a potential resolve to hold. However, historical data also points to ratios where prices may bounce. At press time, Dogecoin’s 30-day MVRV ratio is -7.26%.

Historically, DOGE price tends to recover when the ratio is between 9.53% and 21.88%. Therefore, if the pattern rhymes, DOGE holders may have to deal with another round of unrealized losses.

DOGE Price Prediction: Rebound Could be Hindered

An assessment of the daily chart shows that the DOGE decline began on July 27, after the price had initially rebounded from $0.13. This decline represents a 17.55% decrease over the mentioned timeframe.

Furthermore, the Exponential Moving Average (EMA) gives further insights into the price potential. The EMA is a technical indicator that measures trend direction over a given period of time.

Previously, BeInCrypto reported the possibility of a golden cross whereby the shorter EMA rises above the longer one. But at press time, the 50 EMA (yellow) is above the 20 EMA (blue), indicating that the trend is bearish.

If this remains the same, DOGE may continue trading within the $0.11 range. However, if selling pressure increases, Dogecoin’s price may drop to $0.09.

However, if the golden cross finally appears, this prediction may be invalidated, and DOGE’s trend could turn bullish. Should this be the case, DOGE’s price may jump to $0.12 or $0.13.

Read More: How To Buy Dogecoin (DOGE) With eToro: A Complete Guide

Meanwhile, on July 31, an analyst, Javon Marks, suggested that Dogecoin may experience a notable bullish breakout later in the cycle.

“Based on the previous 2 breakouts, each of these runs has consecutively gotten larger, and if we are to see this take place again, we can be looking forward to a more than $10 DOGE in a >7,200% Bull Run.” Marks posted.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.