The price of leading meme coin Dogecoin (DOGE) may climb to a monthly high as its 50-day exponential moving average (EMA) gears to cross above its 200-day EMA.

Dogecoin Is on the Cusp of a Rally

At press time, DOGE’s 50-day EMA (blue line) is poised to cross above its 200-day EMA (yellow line).

An asset’s 50-day EMA calculates its average price over the last 50 days. It is considered a short- to mid-term trend indicator. When an asset’s price crosses above it, the market is in an uptrend.

On the other hand, the 200-day EMA measures the average price of an asset over the last 200 days. It is a long-term trend indicator, and when price rallies above it, it indicates a long-term uptrend.

When the 50-day EMA crosses the 200-day EMA, a Golden Cross occurs. This crossover is a notable bullish sign, which confirms a shift from a downtrend to an uptrend. It suggests that the asset’s price will rise, and traders often interpret it as a signal to go long.

At press time, DOGE’s 50-day EMA lies on its 200-day EMA. If buying pressure persists, the Golden Cross will be completed.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

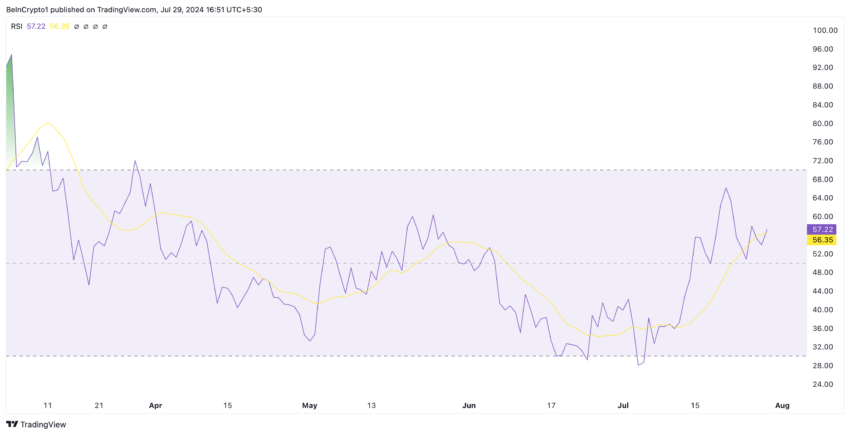

The meme coin’s rising Relative Strength Index (RSI) confirms this possibility. As of this writing, DOGE’s RSI is at 57.59, suggesting a steady rise in buying pressure.

This indicator measures an asset’s overbought and oversold market conditions. At 57.59, DOGE’s RSI shows that buying activity outweighs coin distribution.

DOGE Price Prediction: Futures Traders Share the Same Sentiment

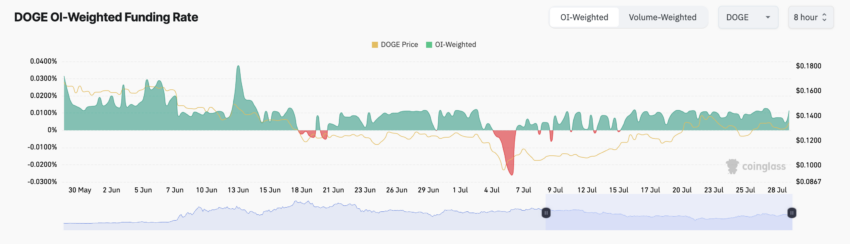

The bullish bias trailing DOGE is also present in its futures market. This is gleaned from its funding rate across cryptocurrency exchanges, which has remained positive since July 14. At press time, the meme coin’s funding rate is 0.011%.

When an asset’s funding rate is positive, it means there is more demand for long positions. More traders are buying the asset expecting a price rally than those buying and anticipating a price fall.

If the bullish trend persists, DOGE’s price may rally to a monthly high of $0.15.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Price Analysis. Source: TradingView

However, if the trend shifts from bullish to bearish, the meme coin will fall to a six-month low of $0.10.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.