Cryptocurrency exchanges in South Korea are getting back to business, which may be what’s behind Bitcoin’s latest relief rally.

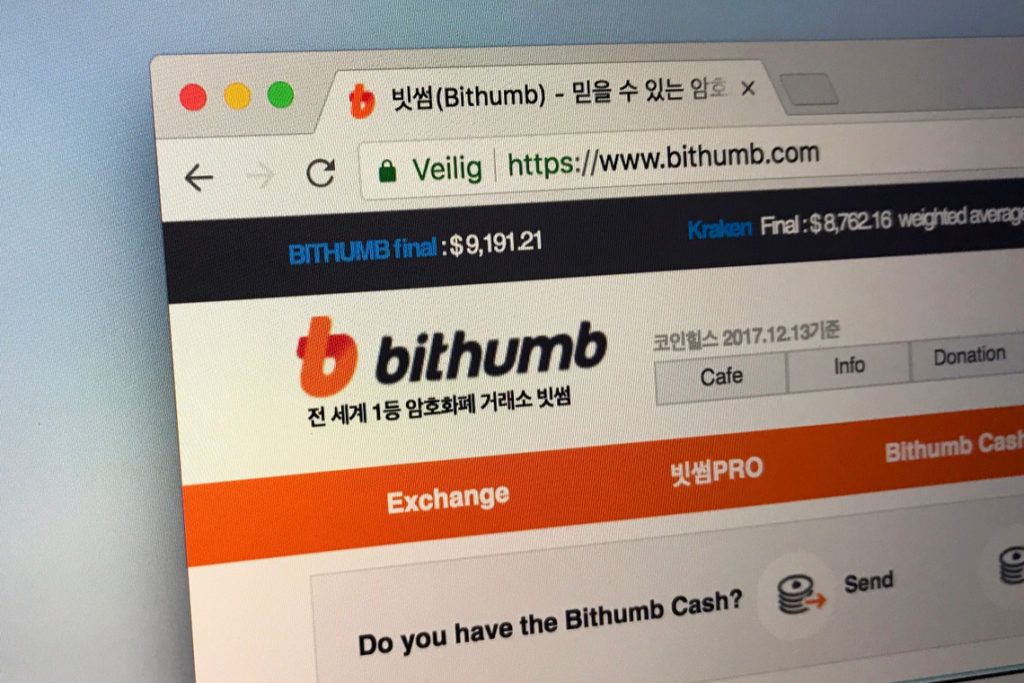

The news that Bithumb has re-opened account registrations following its $30 million jack in June has largely flown under the radar this week, with local media news outlet Yonhap News reporting on the story.

Bithumb is the world’s fifth largest cryptocurrency exchange, so it isn’t surprising that the return of new registrations has helped Bitcoin’s rally.

As reported by CNBC, Bithumb’s exchange volume has rallied significantly from $72 million to $362 million. The increase may be taken as a positive sign for the world’s fourth-largest bitcoin market.

Institutional Investment

Further bolstering Bitcoin’s potential is yesterday’s news that Morgan Creek Digital and Bitwise Asset Management have joined forces to help facilitate institutional investment into a basket of cryptocurrencies. The companies’ Digital Asset Index Fund features a minimum investment of $50,000 and tracks the Morgan Creek Bitwise Digital Asset Index (MCBDAI) — a new index. Onboarding institutional investors always provides cause for bullishness, whether warranted or not. Morgan Creek Capital Management Chief Investment Officer Mark Yusko himself is calling for Bitcoin to reach $500,000 per coin in a matter of years.

ETF Review

Though many in the cryptocurrency space are eagerly awaiting a bitcoin exchange-traded (ETF) in hopes that it will spark another bull run, such a fund is unlikely to appear anytime soon. Nevertheless, the U.S. Securities and Exchange Commission has provided some reason to keep positive, despite its recent rejection of nine bitcoin ETF applications. Last week, the independent agency announced that it would review the decisions. While overturning the decisions is unlikely, the SEC’s willingness to take a closer look may suggest an eventual bitcoin ETF is on the horizon. What do you think about Bithumb opening up new account registrations? Do you think institutional investors will soon enter the market in force? When will a bitcoin ETF be approved? Be sure to let us know your thoughts in the comments below!

What do you think about Bithumb opening up new account registrations? Do you think institutional investors will soon enter the market in force? When will a bitcoin ETF be approved? Be sure to let us know your thoughts in the comments below!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Dani P

Dani Polo is the co-founder of BeInCrypto, one of the most-read crypto media platforms globally. With a background in fintech and digital strategy, he has led its global expansion and business innovation. Recognized with multiple international awards, Dani combines technology, content, and automation to scale audiences in emerging financial markets.

Dani Polo is the co-founder of BeInCrypto, one of the most-read crypto media platforms globally. With a background in fintech and digital strategy, he has led its global expansion and business innovation. Recognized with multiple international awards, Dani combines technology, content, and automation to scale audiences in emerging financial markets.

READ FULL BIO

Sponsored

Sponsored