Render (RNDR) price largely depends on the broader market cues that suggest the path of price action.

However, the shift in investors’ behavior could also potentially impact the direction of price.

Render Finds Resistance

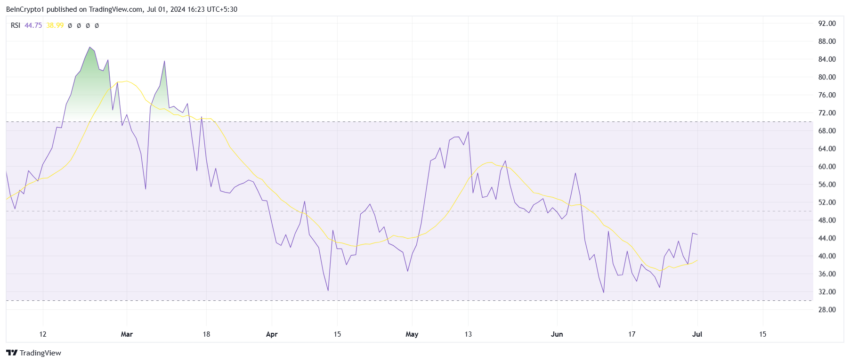

Render’s price does not look at a straight rally due to the Relative Strength Index (RSI). The indicator is still lingering in the bearish zone, reflecting continued negative momentum and a lack of buying pressure. This suggests that the token has not yet gained the strength needed to initiate a significant upward movement.

The Render Token needs to push beyond the neutral line on the RSI to shift the momentum. This would indicate a change in market sentiment and could signal the beginning of a positive trend. This push suggests increased buying interest and the potential for price recovery.

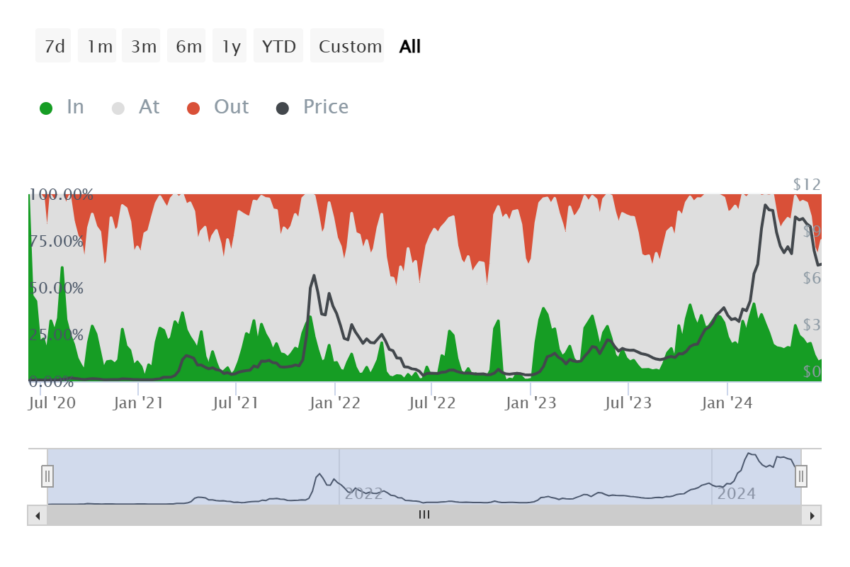

However, while the market is unsure of a rise, the investors are evident in their behavior. We can note that only a little over 11% of the participating investors are profitable by observing the active addresses by profitability.

This means that the majority of the investors conducting transactions on the network are not looking to sell for profits at the moment. Such bullishness could help the altcoin reverse the losses it noted, provided it can sustain this.

Read More: How To Buy Render Token (RENDER) and Everything You Need To Know

RNDR Price Prediction: Recovery Is Difficult

Following the path established by the aforementioned cues, Render’s price could be looking at consolidation instead of recovery. The range for this would be $8.0 as resistance and $6.8 as support.

A breakout, although difficult, could take place if the resistance at $8.0 is breached. This could send RNDR towards $9.0 and higher to reclaim the profits lost during the early June crash.

Read More: Render Token (RNDR) Price Prediction 2024/2025/2030

However, if unforeseen volatility and/or bearish market conditions push Render’s price below the support at $6.8, this would invalidate the bullish thesis, resulting in a dip to $6.5 and lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.