Last Friday, Bitcoin’s price fell from $72,000 to $69,000, causing a 10% average drop across many cryptocurrencies.

This sharp decline has caused the market to be concerned, leading to questions about what’s driving these changes and how investors are reacting. To better understand what might happen next, we’re looking at on-chain data for clearer insights.

Bitcoin’s Whale Activity: Insights Into the Market’s Silent Movers

The on-chain data indicates that whales, the large holders of Bitcoin, are not only retaining their holdings but are also increasing their supply. This strategic accumulation during price dips suggests that these influential market players view the current lower prices as favorable buying opportunities.

Their actions can significantly impact market sentiment and price stabilization, hinting that they may foresee a potential rebound or at least do not expect further significant declines in the short term.

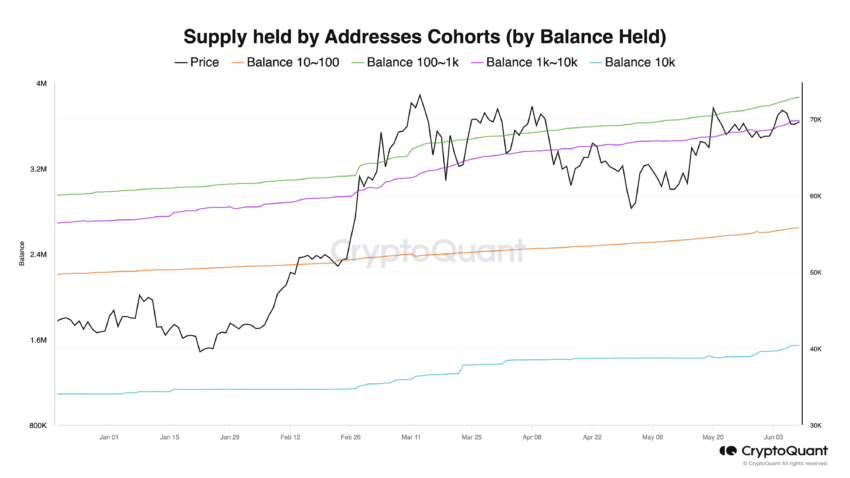

The changes in Bitcoin balance across different cohorts show notable increases.

Specifically, addresses holding 100 to 1,000 BTC saw an increase of 30,601 BTC, those with 1,000 to 10,000 BTC increased by 34,834 BTC, and the largest holders, those with over 10,000 BTC, increased their balances by 24,176 BTC.

These significant increases suggest that larger Bitcoin holders are accumulating more BTC during the recent market correction.

BTC Current Price: Watching the Critical Support Level

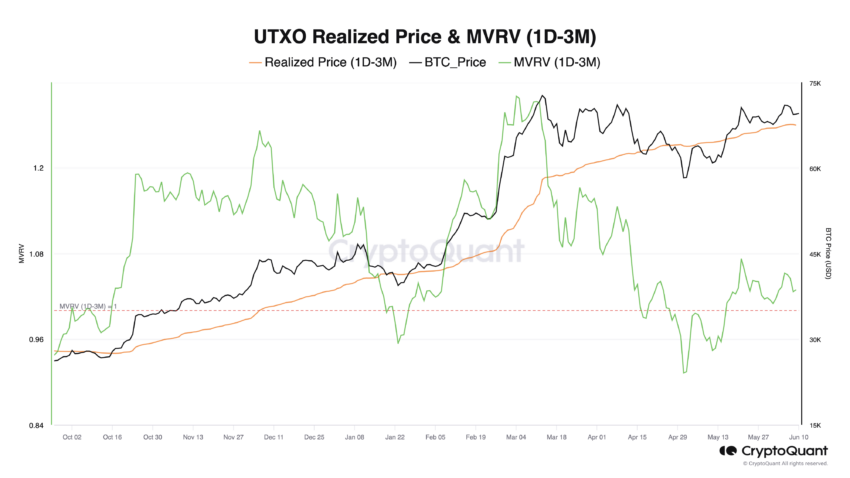

The average acquisition price for Bitcoin bought between one day and three months ago is $67,500. Bitcoins bought within this timeframe account for 17% of the total circulating supply.

Should the price fall below this level, it could potentially initiate a cascade of sell-offs as investors rush to minimize losses.

If the price falls below the $67,500 level, it may find support in the $61,000 – $62,000 range, which aligns with the realized price of significant wallet cohorts.

The “realized price” is a financial metric that estimates the average cost at which all Bitcoins in circulation were last moved or transacted. Unlike the “market price,” which fluctuates based on trading activity, the realized price provides insight into what investors paid for their holdings, aggregating this data across all Bitcoins.

If the market price falls below the realized price, it could indicate that, on average, 17% of the circulating Bitcoin supply is held at a loss. This situation might prompt selling pressure as investors attempt to minimize their losses.

On the other hand, if the market price remains above this realized price, 17% of the Bitcoin supply will be in profit. This incentivizes holders to retain their positions for extended periods, potentially signaling a positive trend for the market.

A price surge toward the $72,000 level could be decisive this time, potentially leading to an all-time high breakout in the mid-term.

As detailed in the analysis, this scenario is plausible if Bitcoin can hold its position above the $67,500 support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.