The value of the leading meme coin, Dogecoin (DOGE), has declined by almost 5% in the last week despite the general rally in the altcoin market.

This price dip is attributable to the decline in daily demand for the coin during that period and the negative weighted sentiment that continues to trail it.

Sellers Targeting Dogecoin

At press time, Dogecoin (DOGE) exchanged hands at $0.15. The coin’s price rallied to a peak of $0.17 on May 26 and has since declined by 12%.

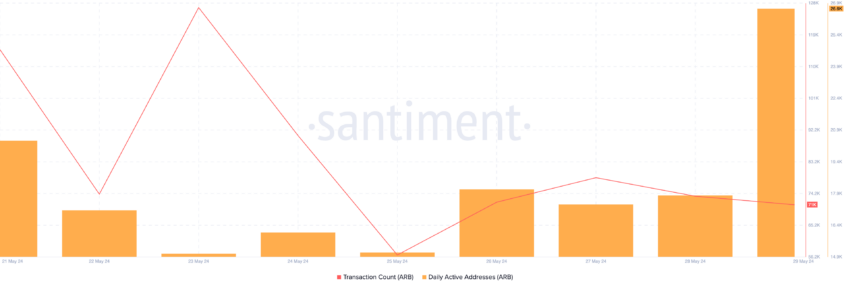

This drop in DOGE’s value is primarily attributable to the fall in its demand during that period. The daily count of addresses executing DOGE transactions has dropped by 9%.

Because fewer addresses demand the altcoin, its daily transaction count has also dropped. During the period under review, the number of daily unique transactions has fallen by 5%.

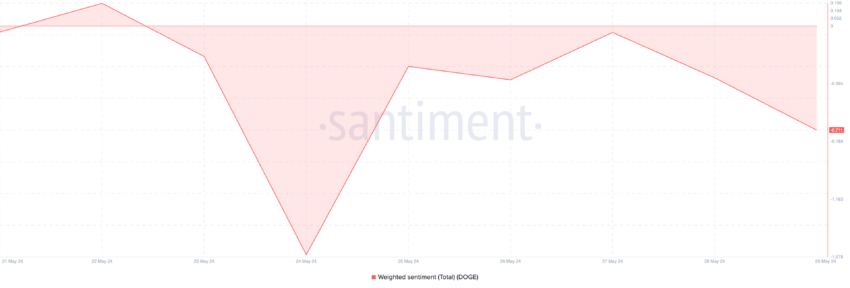

The negative weighted sentiment that has trailed DOGE for most of the month may be why few addresses are trading it. Still negative at press time, DOGE’s weighted sentiment was -0.71.

Read More: How To Buy Dogecoin (DOGE) and Everything You Need To Know

This value suggests a heavy dominance of negative commentary surrounding the meme coin on social media platforms.

DOGE Price Prediction: More Pain Ahead

At press time, DOGE’s Relative Strength Index (RSI) was poised to breach its 50-neutral line and fall below it.

This indicator gauges the momentum behind an asset’s price movement and identifies potential buying and selling opportunities. At its current position, DOGE’s RSI suggested that the coin was neither overbought nor oversold, but there was an undergoing shift towards coin distribution.

Likewise, its Chaikin Money Flow (CMF), which tracks how money flows into and out of an asset, was under zero at -0.01. This value showed increased liquidity exit from DOGE’s market by its investors.

If this trend continues, the coin’s price may fall under $0.15 to exchange hands at $0.12.

However, if this is invalidated and the bulls intensify coin accumulation, they can drive DOGE’s value above $0.16,

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.