GALA has bounced off the lower line of its descending triangle and is poised for an upside breakout.

However, readings from the token’s three-day chart showed that the current uptrend may be short-lived.

Gala Bulls Have a Challenge Ahead

GALA currently trades at $0.0437. Its value has risen by almost 5% in the last week, causing it to trade above a long-term support level of $0.03.

However, the decline in the altcoin’s network activity has shown that its price growth in the last week merely mirrors the uptrend in the general cryptocurrency market during that period. GALA’s price growth has not been backed by any significant demand from its traders.

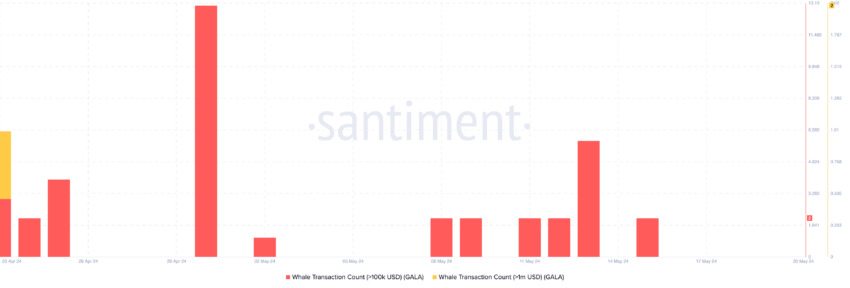

An assessment of the token’s whale activity confirmed this. Since May 16, the market has not seen any significant count of GALA transactions exceeding $100,000 or $1 million.

Generally, the absence of large whale transactions is interpreted as a lack of confidence or interest from major investors. This can affect an asset’s general market sentiment.

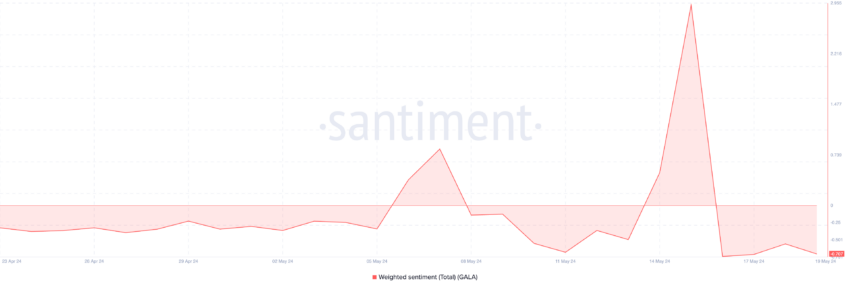

This has played out in GALA’s case. As of this writing, the token’s Weighted Sentiment returns a negative value of -0.707.

Read More: How to Buy Gala (GALA) and Everything You Need to Know

It is key to note that this metric began falling below zero on May 16, when the number of large transactions started to fall.

GALA Price Prediction: Why a Decline is More Likely

GALA’s Chaikin Money Flow (CMF) has trended downward despite its price rally in the last week. Currently below the zero line at -0.14, the negative value of the token’s CMF indicator has led to the formation of a bearish divergence.

A CMF bearish divergence is formed when an asset’s price rallies while the indicator trends in the opposite direction. When this happens, it suggests that, despite rising prices, buying pressure is weakening. Traders often view it as a signal of a potential price reversal to the downside.

Also, the dots of GALA’s Parabolic SAR indicator rest above its price as of this writing. This indicator identifies potential trend directions and reversals in an asset’s price movements.

When its dots lie above an asset’s price, it is a bearish sign. It suggests that the market is in decline, and prices may continue to fall.

If GALA’s price fails to rally above the upper line of the descending triangle and initiates a decline, the altcoin’s value might dip below $0.04 to exchange hands below support at $0.03.

Read More: Gala (GALA) Price Prediction 2024/2025/2030

However, if demand begins to trickle in and sentiment changes to positive, the bulls may be able to push the token’s price above resistance and toward $0.053.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.