Sonne Finance, a decentralized liquidity market protocol operating on Optimism and Base, has been struck by a significant cyber attack.

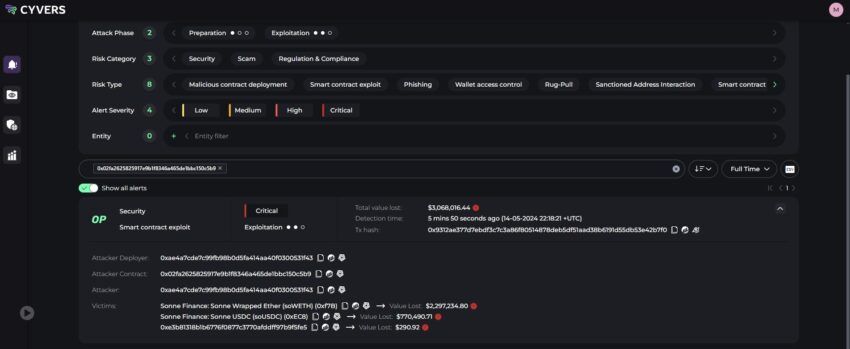

Blockchain security firm Cyvers detected the attack on May 15 in the early morning of Asia.

Sonne Finance’s Optimism Market Suspended Following the Incident

Initially, Cyvers reported that $3 million had been stolen from Sonne’s USD Coin (USDC) and Wrapped Ethereum (WETH) contracts on its Optimism chain. However, the situation quickly worsened. Within 30 minutes, Cyvers updated the loss estimate to $20 million.

“Sonne Finance, please take immediate action,” Cyvers warned.

Read more: Top 5 Flaws in Crypto Security and How To Avoid Them

About one hour after the warning, Sonne Finance addressed the incident on X (Twitter). The team also promised to provide more information later.

“All markets on Optimism have been paused. Markets on Base are safe,” it stated.

Following the incident, BeInCrypto discovered that scammers were attempting to exploit the situation. A fake X account, mimicking Sonne Finance, urged users to revoke all approvals to prevent loss.

It shared a suspicious link to “check exposure to the exploit” and revoke approvals. However, the tweet was later deleted.

Read more: Crypto Project Security: A Guide to Early Threat Detection

BlockTower Capital, a crypto investment firm, also experienced a cyber attack in a separate development. Bloomberg cited undisclosed sources saying fraudsters partially drained BlockTower Capital’s main hedge fund. The funds are still missing, and the hacker remains at large.

Furthermore, the source said the firm hired blockchain forensics analysts to track the stolen money. They also recently updated their limited partners about the heist. As of now, BlockTower Capital has not made any official statements about the incident.

Indeed, hacking incidents continue to trouble the crypto space. BeInCrypto had previously reported a reduction in hacking incident frequency by over 65% as of April 2024.

Yet, the loss amounts remain significant. According to the SlowMist Weekly Security Report from April 28 to May 4, 2024, the total losses from crypto-related security incidents reached $71.39 million.

This attack on Sonne Finance highlights the vulnerabilities in the decentralized finance (DeFi) sector. It also shows the need for strong security measures to protect digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.