Since the beginning of the year, PENDLE has surged by 502% to new all-time highs.

This is indicative of its substantial growth amidst an increasing protocol activity.

What Is Driving PENDLE’s Growth?

Pendle Finance, an Ethereum-based yield trading protocol, employs a unique approach to yield farming by dividing assets into Principal Tokens and Yield Tokens. This framework enables users to trade tokens while earning yields as high as 47% on the underlying assets.

Despite its inception in 2021, Pendle has recently witnessed a surge in adoption. This uptick can be attributed to heightened Ethereum liquid restaking activity and airdrops from DeFi protocols like Ether.Fi.

Many users have been depositing their Ether.Fi restaking token, eETH, on Pendle Finance in anticipation of an upcoming airdrop from EigenLayer, another restaking protocol. This is because restakers receive points from EigenLayer.

Read more: Ethereum Restaking: What Is It And How Does It Work?

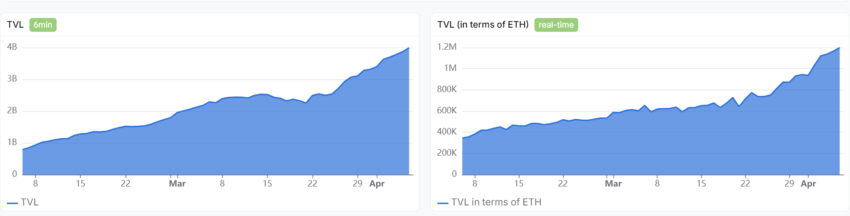

However, the recent spike in Pendle’s activity can be chiefly attributed to raising the cap for its Ethena’s USDe pool to 400 million. This growing protocol activity has propelled Pendle’s total value locked (TVL) to surpass $4 billion.

This marks a staggering increase of over 1,500% since the beginning of the year when Pendle’s TVL stood at a modest $233 million. The platform’s total trading volume has soared to $10.5 billion. Notably, most of these trading activities occur on Ethereum, but the project is gaining traction on Layer-2 networks like Arbitrum and Mantle.

Read more: Which Are the Best Altcoins To Invest in April 2024?

Pendle’s exponential growth has cemented its position as the largest DeFi yield protocol. This remarkable rise prompted BitMEX’s co-founder Arthur Hayes to declare the platform as “the future of DeFi.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.