Injective (INJ) price is attempting a recovery after falling through the $35 support level, marking a monthly low.

Crypto whales will likely be the catalysts of the recovery, given their recent massive INJ accumulation.

Crypto Whales Support Recovery

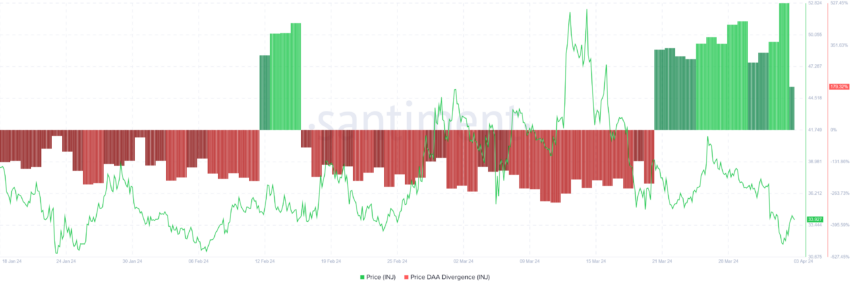

Injective price is presently trading at $34 after correcting by over 16% in the past week. During the same duration, the network activity grew, as can be noticed in the daily active addresses (DAA).

In instances when the price falls and DAA rises, the market flashes a buy signal. This is the case with Injective as the altcoin presents a buy signal for the past week.

This cue was seemingly picked up by crypto whales. These entities made the most out of the price dip, adding over 740,000 INJ in the span of a day. These $24.8 million worth of INJ brought the supply of the crypto whale addresses to 10.69 million INJ.

It is worth noting that crypto whales are known to have a massive impact on prices. During periods of accumulation, prices go up, and during bouts of selling, prices decline.

This would likely impact INJ as well, given the recent accumulation.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

Injective Price Prediction

Injective price is close to breaching the $35 resistance level. Slicing through this barrier and flipping it into support would enable a recovery, potentially sending INJ to $40.

However, if the break of resistance fails and the altcoin witnesses bearish broader market cues, INJ could decline to $30. Falling through this support floor would invalidate the bullish thesis, causing a fall toward $28.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.