A so-called decentralized exchange platform, CryptoBridge has surprised users today by suddenly introducing strict know-your-customer checks.

CryptoBridge made the announcement that it would require customers to submit evidence of their identity with immediate effect.

Regulatory Changes for CryptoBridge

The decentralized exchange platform detailed the changes via a blog post earlier today. Citing regulatory concerns, CryptoBridge writes:“… starting October 2019, all existing and new users are required to submit user verification before continuing to use deposits and withdrawals, to protect customers and CryptoBridge from being held responsible for any illegal intentions or money laundering activities.”The exchange claims to have been forced to act in accordance with the 5th EU Anti-Money Laundering Directive. The suddenness of the announcement, which effectively forces anyone that might have deposited at the exchange to surrender their identity before getting their own money back, has understandably angered many cryptocurrency advocates:

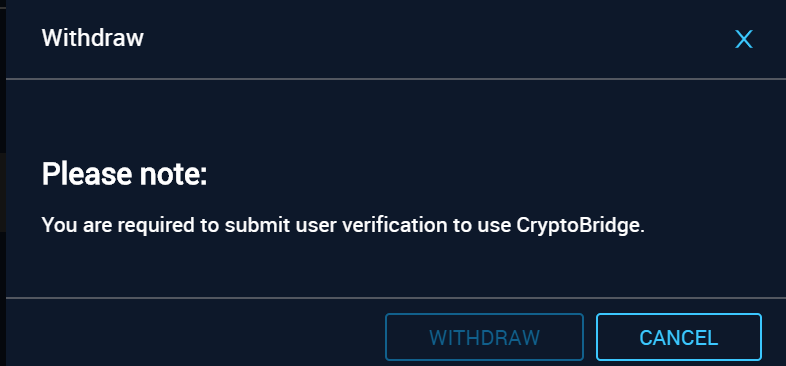

The most common cause for complaint was the fact that users were not forewarned of the introduction of the new KYC requirement. Many responses to the exchange’s tweet containing the blog post drew attention to the underhand move, with some suspecting an exit scam and others simply vowing to never use the platform again. We did a bit of investigation and discovered that, sure enough, the changes mentioned in the blog post had indeed gone into effect. After signing up for an account at CryptoBridge, we were immediately greeted with a message prompting customers to complete the KYC checks. We ignored that and attempted to make a deposit. However, we were greeted with the following message, just as we were when attempting to withdraw. Although we were only able to test this on a brand new account, it seems a fair assumption that the same message is displayed for those with active balances at the exchange platform too:This terrible company has essentially stolen all user funds with increasingly hostile practices.

— COFFEE TRADES☕ (@overheardcoffee) October 1, 2019

All while claiming to be a DEX.@CryptoBridge how are you going to fix this? https://t.co/0B4BXosegC

A Centralized Decentralized Platform?

Along with the obvious injustice for those that have cryptocurrency trapped on the CryptoBridge platform, the introduction of such immediate freezes on user withdrawals clearly shows a high level of centralization on the so-called decentralized platform. One Twitter user amusingly summed up the apparent hypocrisy of the exchange’s new policy:As BeInCrypto previously reported, there were similar fears regarding Binance’s decentralized exchange back at its launch. What do you think about CryptoBridge complying so easily with regulations? Do you think other decentralized exchanges will follow their lead? Let us know below.But but.. who I send my details to if this shit is decentralised?

— NANOissuperior (@nanoissuperior) October 1, 2019

Images are courtesy of Twitter, Shutterstock, CryptoBridge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rick D.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

READ FULL BIO

Sponsored

Sponsored