Robert Mitchnick, BlackRock’s Head of Digital Assets, indicated a tepid interest from the firm’s client base in an Ethereum exchange-traded fund (ETF), starkly contrasting the growing demand for Bitcoin.

This revelation came during the Bitcoin Investor Day conference in New York, where Mitchnick shared insights into the company’s digital asset strategy and its reception among investors.

No Interest in Ethereum ETF

Despite the growing interest in various cryptocurrencies, BlackRock’s clientele exhibits a pronounced preference for Bitcoin, relegating Ethereum to the sidelines. Mitchnick’s comments reflect a critical assessment of the demand within the crypto market, suggesting that, aside from Bitcoin, the appetite for other cryptocurrencies, including Ethereum, remains tepid at best.

“I can say that for our client base, Bitcoin is overwhelmingly the number one focus and a little bit Ethereum,” Mitchnick said.

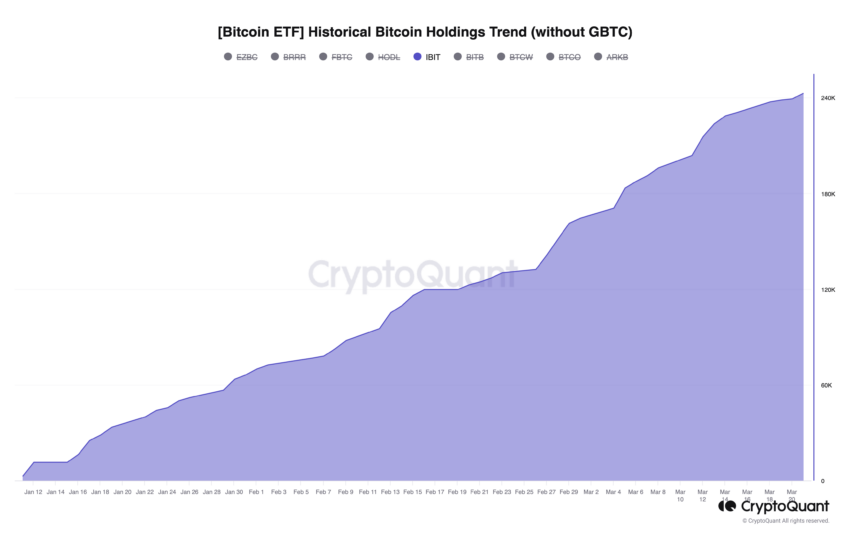

BlackRock’s strategic moves in the cryptocurrency market have been closely watched. Especially, following the successful launch of its iShares Bitcoin ETF (IBIT) earlier this year. The fund’s rapid ascent to becoming one of the top five ETFs in the market, with an impressive $15 billion in assets, reflects a keen investor interest in Bitcoin.

This contrasts sharply with the “very, very little” interest in the possibility of an Ethereum ETF.

Still, BlackRock’s journey into crypto has been fraught with enthusiasm and caution. For example, launching a $100-million money market fund on the Ethereum blockchain brought to light the unforeseen challenges of operating within the cryptocurrency market. BlackRock’s Ethereum wallet, intended for legitimate transactions, quickly became a magnet for an array of low-quality meme coins and NFTs.

This incident highlighted the legal and operational challenges that come with embracing blockchain technology, prompting a reevaluation of strategies for managing and securing digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.