The total crypto market cap (TOTAL) lost over $66 billion over the last 24 hours, with Bitcoin (BTC) continuing its consolidation, holding above $117,200. Fartcoin (FARTCOIN) is emerging as the biggest loser of the day, having declined 14.8%.

In the news today:-

- Coinbase is reportedly in talks to acquire CoinDCX, a leading cryptocurrency exchange in India, after its valuation dropped from $2.2 billion to under $1 billion. The decline follows a $44 million hack, though CoinDCX has since recovered from the incident.

- The US SEC has delayed decisions on approving Bitcoin and Solana exchange-traded funds (ETFs), extending its cautious approach toward crypto-linked investment products. The SEC will decide on the Truth Social Bitcoin ETF by September 18 and the Grayscale Solana Trust conversion by October 10.

The Crypto Market Balances Its Gains

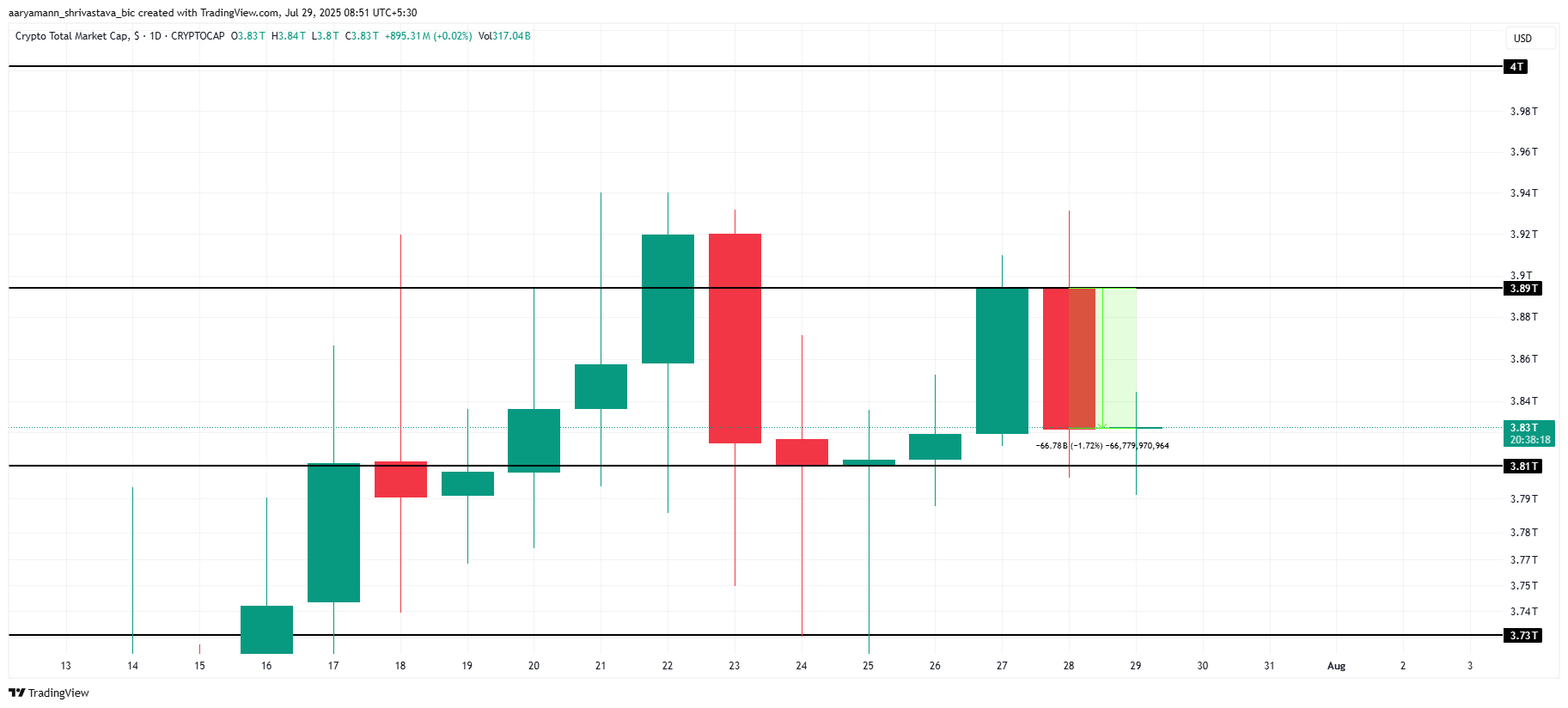

The total crypto market cap has decreased by $66 billion in the last 24 hours, now standing at $3.83 trillion. Despite this, TOTAL maintains support of above $3.81 trillion.

Yesterday, the crypto market cap hit $3.89 trillion, reflecting a rise that was temporarily offset by the current decline. The market is showing mixed signals, creating uncertainty for investors. As a result, fluctuations in the market cap have become common in recent days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If the market continues its downward trend, TOTAL could breach the $3.81 trillion support level, potentially falling to $3.73 trillion. However, should the broader market recover, it could push TOTAL back up to $3.89 trillion, stabilizing the market.

Bitcoin Sits Comfortably Rangebound

Bitcoin’s price is currently at $118,335, maintaining a rangebound movement between $120,000 and $117,261 for over two weeks. The lack of significant price movement within this range shows ongoing consolidation, with market participants awaiting further directional cues.

The Relative Strength Index (RSI) is showing continued bullish momentum, remaining above the neutral mark. This positive indicator suggests that Bitcoin has the potential to break out of its current range and push toward the $120,000 mark in the coming days.

If Bitcoin successfully breaches the $120,000 resistance, it could invalidate the skepticism surrounding its price action and drive it further towards $122,000 or beyond. However, should bearish conditions take hold, Bitcoin may slip below $117,261, potentially falling to $115,000.

Fartcoin Loses Considerably

FARTCOIN’s price has dropped 14.8% over the last 24 hours, currently trading at $1.14. The altcoin is facing selling pressure, trading below the critical $1.15 support level. This decline indicates a potential for further losses if the bearish trend continues, with the next support at $1.00.

The meme coin’s decline marks a near three-week low, signaling that the price may continue to fall as skeptical investors sell off their holdings. With the bearish sentiment persisting, FARTCOIN may experience further downside and approach $1.00 if the market conditions do not improve.

If FARTCOIN manages to reclaim the $1.15 support level, it could see a rebound towards $1.24, ultimately testing the $1.43 mark. A successful recovery above this level would invalidate the current bearish trend and set the stage for a possible price rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.