The International Monetary Fund (IMF) has introduced a three-step approach named the Crypto-Risk Assessment Matrix (C-RAM) to evaluate macro-financial risks associated with cryptocurrencies within countries.

It notes that the main sources of risk to the external sector come from cross-border payments and the volatility of cross-border capital flow.

IMF Proposes Three-Step Approach To Combat Crypto Risks

According to the report, the Crypto-RAM approach allows countries to dissect the complexities of crypto risks step by step while maintaining an overarching perspective.

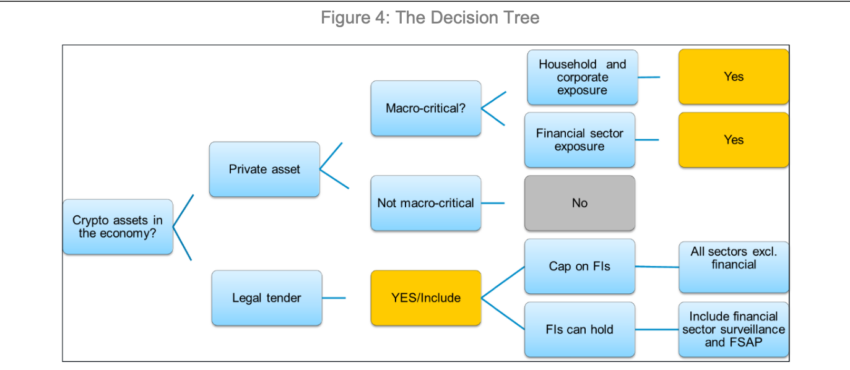

It begins with the application of the decision tree method as its initial phase. This method is based on evaluating the “macrocritical” nature of crypto assets within an economic context.

Macrocriticality assesses an economic issue that significantly influences the current or future balance of payments or domestic stability.

Likewise, the decision tree approach assesses whether crypto assets are being used in a way that significantly impacts the economic landscape of a country.

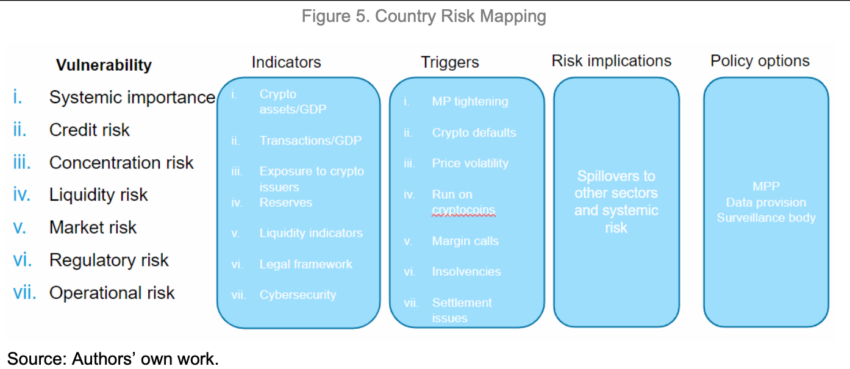

In the second phase of C-RAM, the emphasis shifts towards the quantification of crypto-related risks within an economy. This can be conducted through the process of country risk mapping.

At the forefront of the vulnerability list is systemic importance. This gauges the significance of crypto or other elements within the ecosystem to the economy.

This can be assessed using metrics like the crypto asset market cap as a percentage of GDP. Furthermore, it can also use a country’s crypto adoption indicators, or DeFi adoption within a country.

IMF Advises Against Banning Crypto in Nations

Meanwhile, the third step to mitigating crypto risks involves the assessment of crypto from a global perspective.

However, it highlights the limited availability of data and regulatory frameworks for crypto assets. By utilizing a table and the decision tree approach, the IMF recommends governments use this method for crypto policy proposals. Additionally, it can also assess the potential consequences and the probability of their occurrence.

Meanwhile, the IMF has issued a recent warning against the imposition of sweeping bans on crypto.

Collaborating with the Financial Stability Board (FSB), they jointly released a report advocating for specific regulatory measures aimed at mitigating the inherent risks linked to the crypto industry.

Furthermore, the report highlights that implementing regulations on crypto service providers and strengthening anti-money laundering protocols will be a more effective approach compared to an outright ban on digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.