As much of the financial market awaits a regulatory ruling on BlackRock’s application to launch a spot Bitcoin ETF, the asset manager aggressively builds its presence on the ETF front with other ambitious products.

BlackRock is in the process of rolling out its Advantage Large Cap Income ETF BALI, which offers investors a diversified strategy, Dow Jones reported on Thursday.

BlackRock Offers Hybrid ETF

According to the Dow Jones report, the new ETF will invest in dividend-paying stocks and will also offer an option-focused strategy. The dividend-paying stocks will provide one monthly income stream.

At the same time, the ETF will sell call options via the S&P 500 index, said Jay Jacobs, BlackRock’s US head of thematic and active equity ETFs.

This diversified approach aims to meet the needs of investors bent on quick returns as well as growth over time, the report noted.

The new product comes on the heels of BlackRock’s offering of bond ETFs last year.

But the real development that BlackRock appears to be anticipating is approval of its spot Bitcoin ETF. A product that will facilitate direct trading of the underlying asset rather than futures contracts.

Last month, Galaxy CEO Mike Novogratz told Bloomberg ETF analyst Eric Balchunas that approval is all but a fait accompli. Or as Novogratz put it, “a question of when, not if.”

More Action on the ETF Front

BlackRock is not the only player in the market aiming to pitch itself as an ETF innovator. Recent tweets from crypto trader Bjorn Solstad and others have celebrated the news that asset manager VanEck plans to launch an Ethereum Futures ETF.

Frustratingly for VanEck and many in the market, however, the SEC has put off approval of VanEck’s ETF, and those of other players, until at least the end of this year.

Learn more about VanEck’s long quest to gain regulatory approval for a spot cryptocurrency product.

VanEck, like BlackRock, sees enormous potential in ETFs offering direct exposure to Bitcoin. But, while no one can predict the future, there is a significant chance BlackRock may get there first.

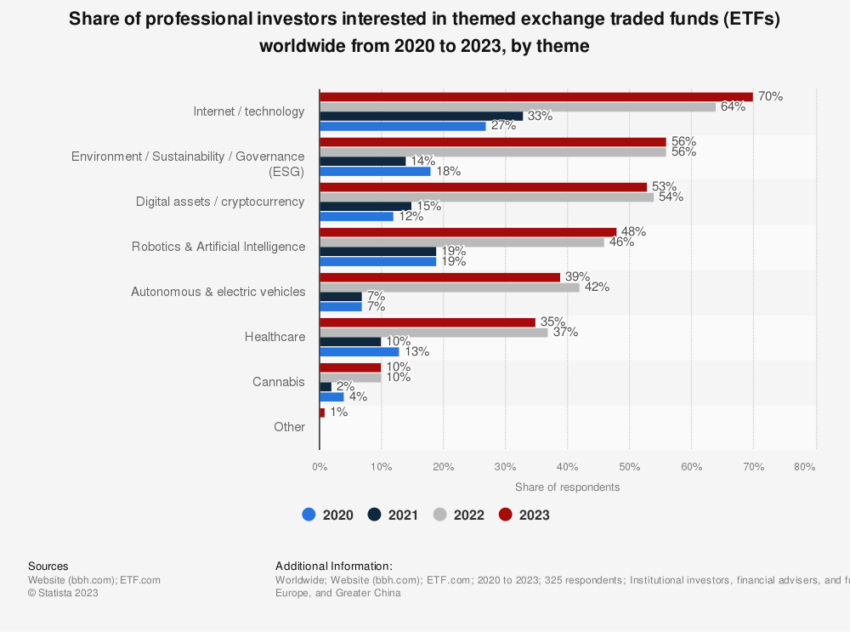

Yet where BlackRock is concerned, the company has stirred up significant fear, uncertainty, and doubt (FUD) in the market. Namely through a series of severe missteps on issues ranging from ESG investing at the expense of maximizing profits, to investments in firms with ties to China’s brutal regime.

Whether BlackRock can overcome this FUD and successfully market its ETFs to a skeptical public is an intriguing question. And one certain to come to a head in coming months.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.