Bitcoin miners are coming under increasing pressure to offload some of their BTC, which could put more downward pressure on prices. The move comes amid soaring hash rates and persistently high energy costs.

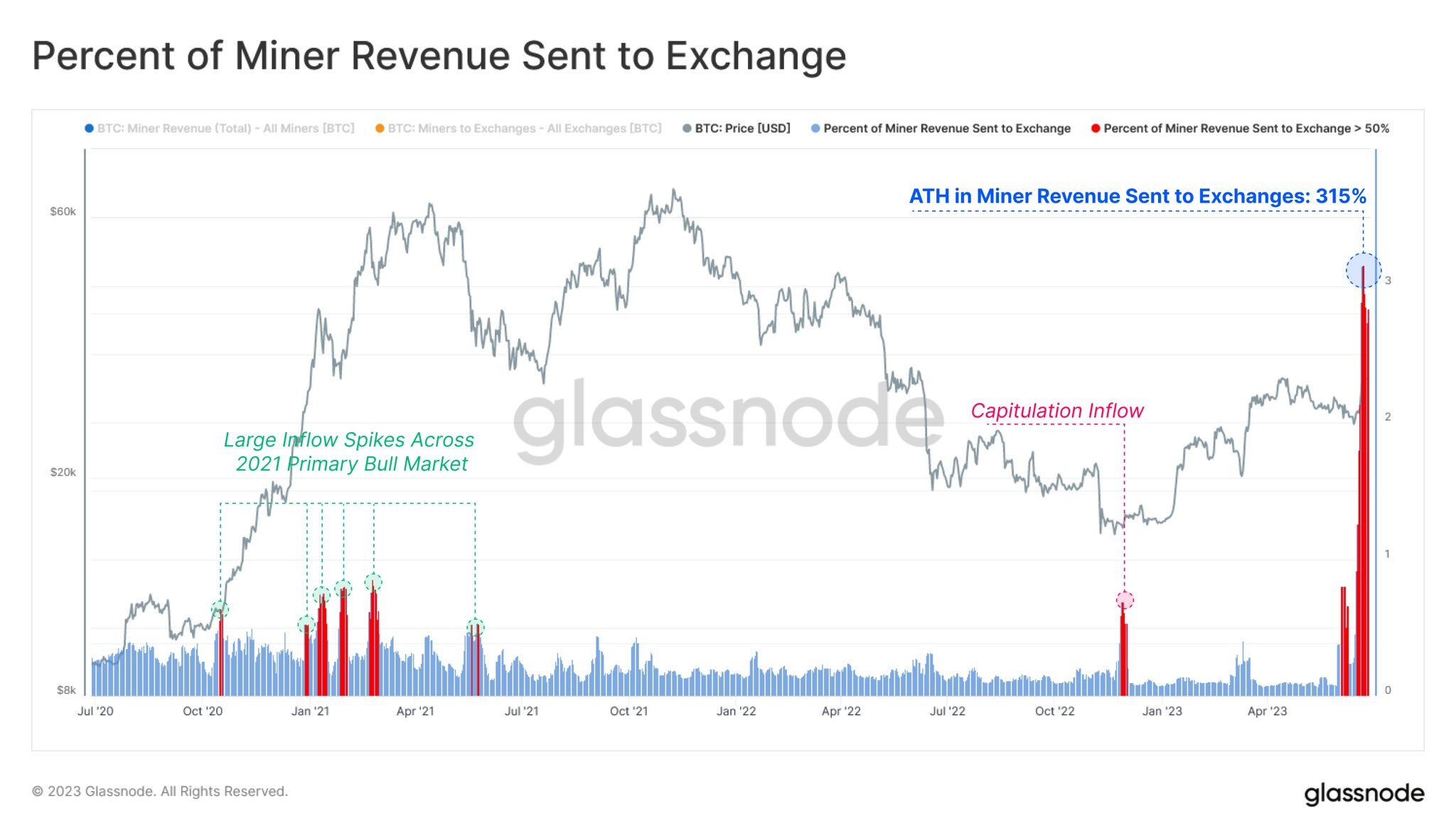

Bitcoin miners are sending more BTC to centralized exchanges, which could be a precursor to offloading the assets to cover escalating expenses.

Bitcoin Miners Selling

On September 28, crypto analyst Miles Deutscher highlighted one of Bitcoin’s biggest supply headwinds – increasing miner selling pressure.

Peak hash rates and difficulty, in addition to soaring energy prices, have combined to heavily affect mining profitability, he noted.

“With rewards set to be cut in half via the halving, miners may be forced to sell to shore up capital.”

This is already starting to happen with record amounts of Bitcoin being sent to exchanges from miners, according to Glassnode.

The total hash rate hit an all-time high of 425 EH/s (exahashes per second) last week, according to Blockchain.com. Moreover, the metric has risen by 68% since the beginning of the year.

Network difficulty is also at an all-time high of 57T, having increased 63% so far this year.

Both metrics make mining Bitcoin more competitive and intensive which results in decreasing profitability.

Hash price, which is measured in dollars per terahash per second per day, has slumped to $0.06, according to the Hashrate Index. Moreover, mining profitability has slumped 85% since the bull market peak when it was $0.40/TH/s/day.

Bitcoin ordinal inscriptions have provided some reprieve for distressed miners this year. However, it is not enough to offset the need to sell.

Earlier this week, Glassnode noted that it is likely that miners are “on the edge of income stress, with their profitability to be tested unless BTC prices increase in the near term.”

BTC Mining ESG Improvements

Depressed BTC prices are also not helping miners. The asset has failed to breach resistance above $30K three times this year, falling back to the $26,000 zone.

On the bright side, Bitcoin’s ESG (environmental, social, and governance) properties are improving as mining uses more renewable energy than ever before.

On September 26, mainstream media picked up the recent KPMG report on Bitcoin’s potential contributions to global ESG frameworks. It concluded:

“The recent KPMG report serves as a powerful testament to the positive contributions of Bitcoin in terms of ESG factors, further bolstering the perception of cryptocurrencies in the mainstream.”

Bitcoin’s pivot to renewables and recent research counters the mainstream concern about mining energy usage patterns. However, this is of little comfort to Bitcoin miners who are poised to offload some of their holdings.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.