On Monday, June 5, 2023, Bitcoin (BTC) price had its third worst 24-hour outing of 2023 behind the USDC-depeg event on March 8 and April 19, when the US Fed mulled rate hikes. On-chain data shows that critical Bitcoin metrics remain solid. What are the chances the BTC price will rebound over the coming days?

Bitcoin (BTC) price crashed 5% on Monday, largely because the crypto markets reacted negatively to the recent SEC lawsuit involving Binance exchange and CEO Chanpeng Zhao.

Within 24 hours, the crypto industry recorded over $313 million in liquidations as the price briefly dropped below $25,500 for the first time since March 17, 2023.

With BTC holders looking to avoid more liquidations, will the bullish support around the $25,000 mark be enough to trigger an early price rebound?

Long-term Bitcoin Investors are Holding Firm

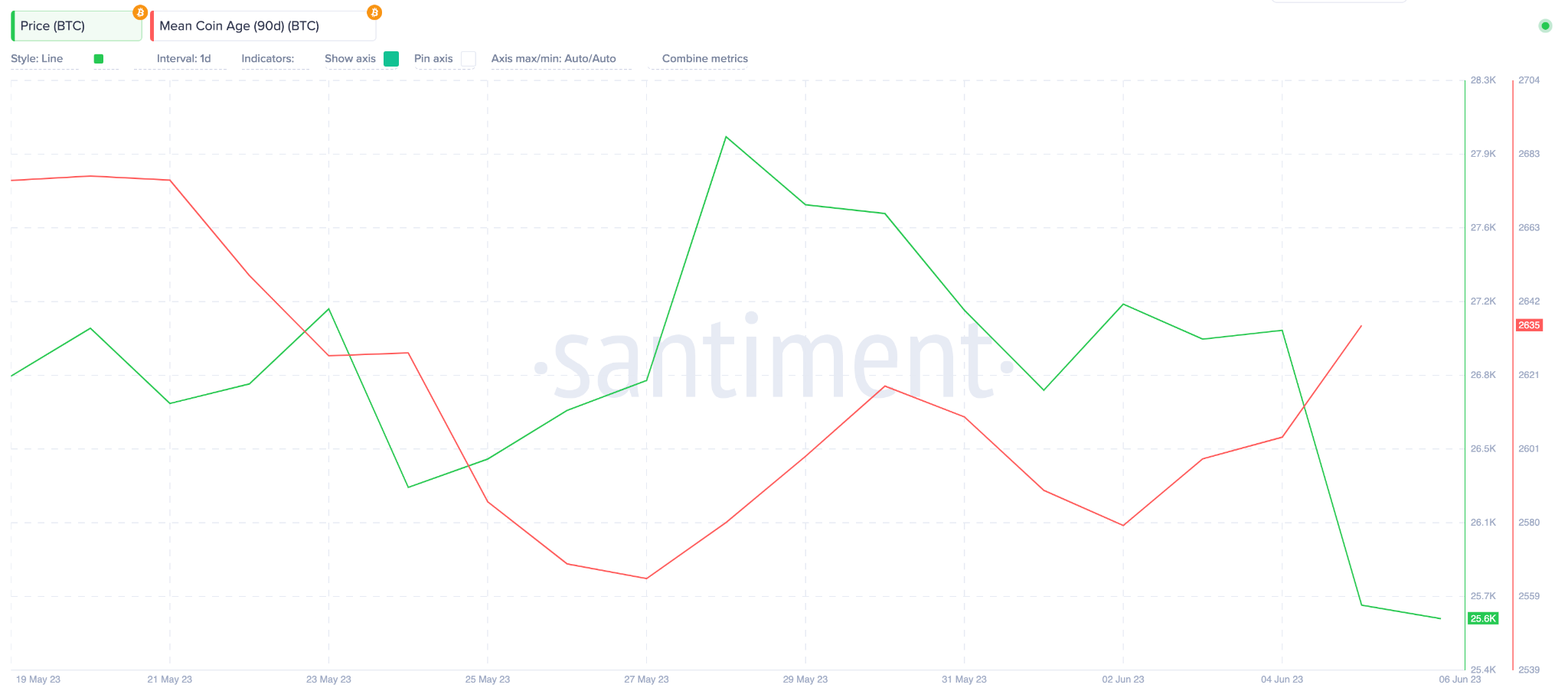

According to on-chain data, most Bitcoin holders that sold off their coins on Monday were short-term traders. The Santiment chart below shows that while massive sell-offs triggered a 5% BTC price drop, Mean Coin Age across the Bitcoin ecosystem actually trended upward.

Between June 2 and June 6, BTC Mean Coin Age is now up 2% from 2,579 to 2,635

In simple terms, Mean Coin Age tracks long-term holders’ trading activity by evaluating how long coins in circulation have stayed in their current addresses.

When Mean Coin Age increases marginally during a price retracement, as seen above, it signals confidence among long-term holders.

More From BeInCrypto:

Currently, 68.15% of the total BTC in circulation is in the hands of long-term investors that have held for more than one year. So, logically, if most of them continue to HODL, the BTC price will likely bounce back above $26,000 in the coming days.

Rising Demand Could Prevent BTC From Dropping Below $25,000

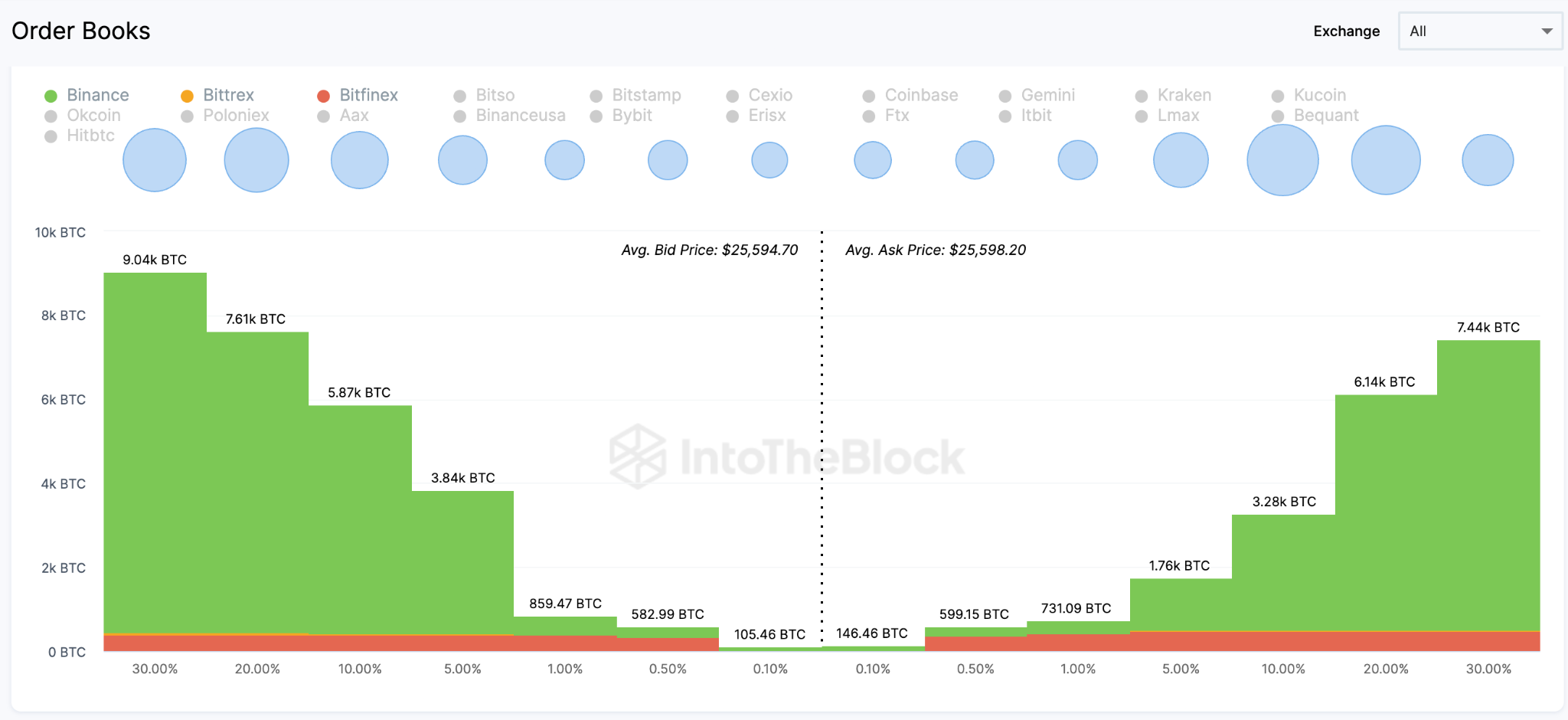

In further confirmation of the bullish outlook, the order books of exchanges suggest that investors are looking to scoop the dip around the $25,000 mark

The Exchange on-chain Market depth chart shows an aggregate of BTC holders’ total buy/sell orders across different crypto exchanges.

Currently, Bitcoin holders have placed orders to purchase 28,000 coins. Meanwhile, sellers have placed just 20,000 BTC up for sale.

When demand exceeds the supply available on exchanges, competition increases and inevitably puts some upward pressure on the price.

Currently, there is a supply shortage of 8,000 BTC shortage across exchanges. This means BTC price is likely to rebound once buyers begin to compete by increasing their bids to get their orders filled quickly

In conclusion, long-term holders’ supply shortage and confidence are two critical factors that could trigger an early BTC price recovery.

BTC Price Prediction: A Rebound Toward $26,500 Could Be Imminent

Considering the whale investors’ bullish activity, BTC’s price might rebound above $27,500 in the coming weeks.

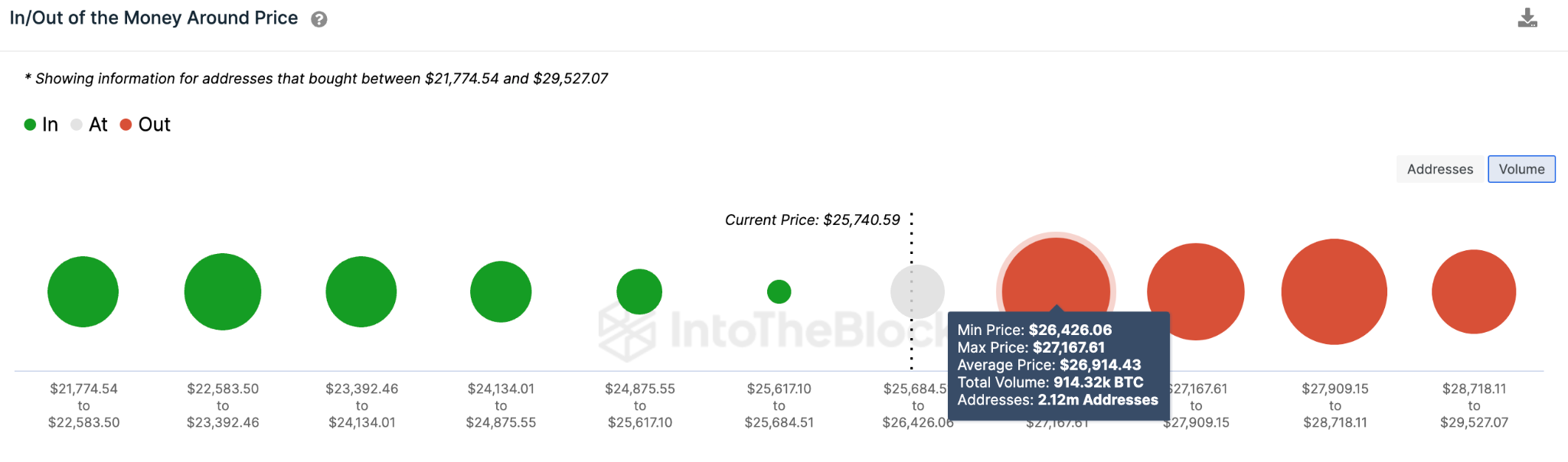

However, IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data suggests that BTC will face its initial major resistance of around $26,900.

At that zone, 2.12 million investors that bought 914,000 BTC at the average price of $26,900 could cause a pullback.

But if BTC can manage to scale that resistance zone, it could head toward $29,000 once again.

On the other hand, the bears could invalidate the bullish BTC price recovery if it unexpectedly drops below the critical $25,200 support zone.

But, the 82,500 investors that purchased 62,000 at an average price of $25,270 will likely prevent the drop.

Although unlikely, BTC could retrace further toward $23,600 if that support level is breached.

It is important to note that historically, strategic investors often seek succor in Layer-1 coins like Bitcoin and ETH when there is a systemic scare in the crypto markets. Hence, as BNB and other altcoins tumble, the demand for BTC will likely increase over the coming days.

Read More:

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.