A large chunk of Bitcoin options contracts are about to expire, and the outlook is looking increasingly bullish for derivatives traders.

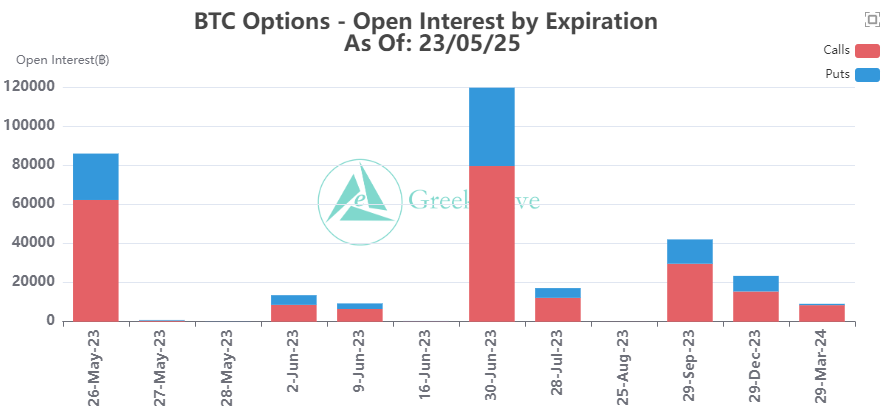

Around 86,000 Bitcoin options contracts will expire on May 26. They have a notional value of $2.26 billion and a max pain point of $27,000.

The max pain point is the strike price with the most open Bitcoin options contracts. This is the price at which the most losses would be incurred for the highest number of contract holders at expiration.

Bullish Bitcoin Options Ratios

The put/call ratio (PCR) for this batch of Bitcoin options is 0.38. This ratio is calculated by dividing the number of traded put (short) contracts by the number of call (long) contracts.

Values below 1 are generally considered bullish, as more speculators are purchasing more call options than put options. This signals that investors have speculated a bullish trend going forward. The number of expiring call contracts heavily outweighs the expiring put contracts.

Total open interest, the number of unsettled open contracts is 325,311, according to Deribit. It reported that the put/call ratio is 0.44. This is also indicative of bullish sentiment among derivatives traders.

There are also 695,000 Ethereum options contracts about to expire. These have a notional value of $1.25 billion and a max pain point of $1,800.

Furthermore, the PCR for Ethereum options is 0.49, which is also heavily in favor of call (long) contracts. GreeksLive observed:

“Looking at the distribution of options coming to expiration, the proportion of call positions is huge and the prices are currently near the max pain point.”

“This month was a big win for the option sellers,” it noted before adding:

“Especially in the context of the current market downturn and lack of hot areas, option sellers are probably the most profitable traders.”

BTC Price Outlook

Bitcoin prices hit a ten-week low just below $26,000 in late trading on Thursday. However, they returned to $26,423 during the Friday morning Asian trading session.

The asset has fallen to a key long-term Fibonacci level of support at -61.8%, which correlates to $26,200, according to Glassnode.

A breakdown from here could get ugly, however. Analysts have also predicted that BTC may drop to lower support at $24,400 should the selling pressure continue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.