Litecoin (LTC) price gained 16% this week to become the best-performing asset in the top 10 cryptocurrency rankings. The recent launch of the LTC-20 token standard appears to have sparked new life into the Litecoin ecosystem. Will $120 LTC price predictions be validated?

Litecoin is one of the oldest cryptocurrencies created as a lightweight alternative to Bitcoin with its efficient and low-cost peer-to-peer payments.

LTC-20 Adding Interest to the Ecosystem

On May 1, Litecoin debuted the LTC Ordinals Protocol (LTC-20) token standard, its own response to the BRC-20 Ordinals that enable memes and NFTs to be attached to the Bitcoin base chain.

Quite remarkably, the LTC-20 token standard has been widely accepted across the global Litecoin community. Since May 1, new wallet addresses created on the LTC network have spiked to unprecedented numbers.

Interestingly, the rally initially started with many retail investors creating less than 1 LTC wallet. However, on-chain data shows that crypto whales are now getting involved.

Here’s an on-chain analysis of the current Litecoin resurgence and a data-driven prediction of how far the LTC price rally could get.

Litecoin is Attracting New Users at an Unprecedented Rate

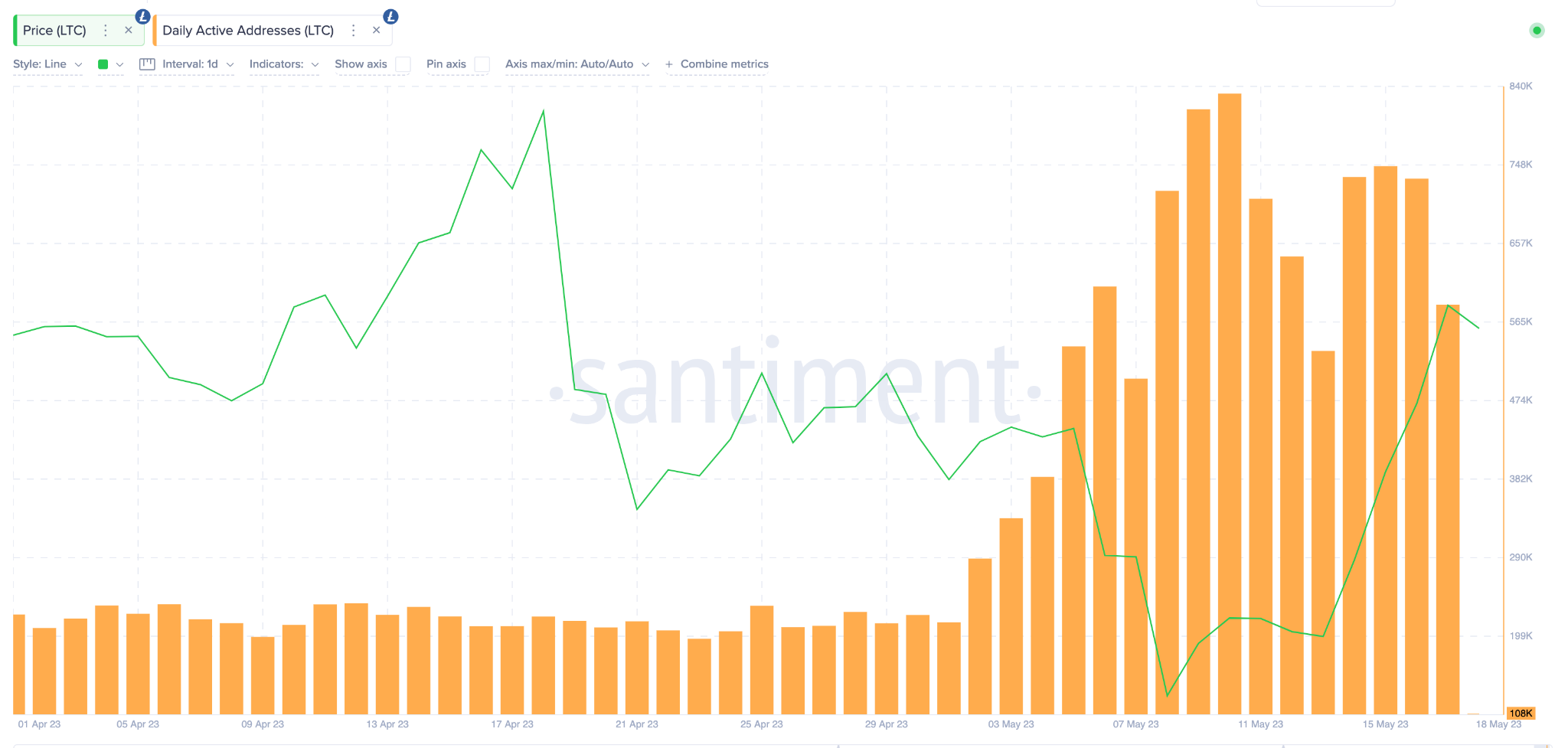

Notably, thousands of new users are hopping on the LTC-20 bandwagon, driving Litecoin network activity to unprecedented levels. Litecoin Daily Active Addresses (DAA) spiked by over 200% in May, according to on-chain data from Santiment.

The DAA metric tracks the daily number of unique wallet addresses carrying out transactions on a blockchain network.

The chart below shows how it has increased from the April maximum of 237,000 addresses to over 832,000 recorded on May 10.

Notably, a spike in the number of users interacting on a network signals growing demand for the underlying coin.

If Litecoin network participants continue this trajectory, the recent LTC price rally could break into new highs.

Whale Investors are Getting in on the Act

The rally initially started with a flurry of new retail users creating wallets with less than 1 LTC. However, on-chain data shows that crypto whales have also gotten in on the action.

Single LTC transactions exceeding $1 million spiked from 9 transactions on May 12 to over 600 in the last four trading days.

Although they were late to the LTC-20 ordinals party, it appears that Litecoin whales are now carrying out more transactions than they did in the first week of May 2023.

In summary, if the LTC-20 wave sustains current momentum and whales continue buying in, the bullish Litecoin price prediction could be validated.

LTC Price Prediction: Road to $120

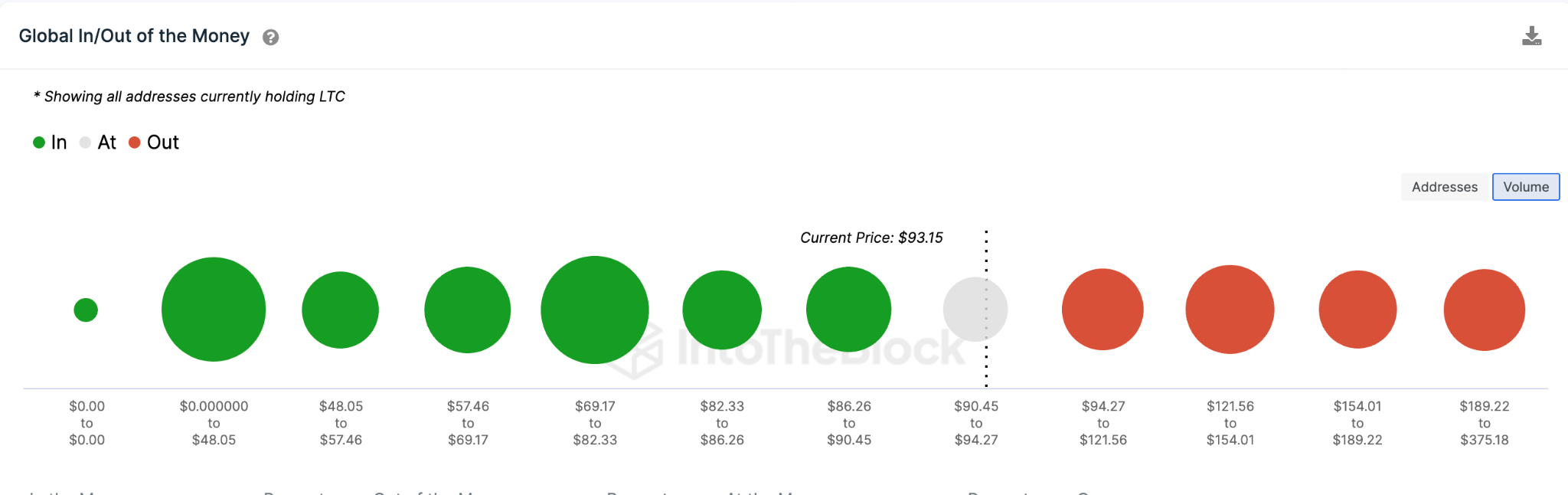

IntoTheBlock’s Global In/Out of Money (GIOM) data suggests Litecoin price could reach $120 ahead of the upcoming halving event.

However, for the bulls to be confident of the bullish Litecoin price prediction, LTC must first clear the initial resistance at $105. But, profit-taking by 101 million investors that bought 5.83 million LTC at the average of $105 may prevent it.

Nonetheless, if the positive LTC price prediction plays out as expected, the bulls can garner enough momentum to push for $121.

Yet, the bears could invalidate the positive stance if LTC retraces unexpectedly below $90.

Although 687,000 addresses that bought 6.34 million Litecoin for a maximum price of $90.45 can offer support. But, if that support level breaks, the bullish Litecoin price prediction could be invalidated and trigger a drop toward $82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.