Founders of the Ethereum-compliant Haqq blockchain will launch a new Sharia-compliant cryptocurrency called Islamic Coin (ISLM) next month.

The new cryptocurrency and blockchain will target the Muslim population after religious leaders approved the project in June 2022.

Haqq Can Host Any Sharia-Compliant Ethereum DApp

The Haqq blockchain advisory board will only allow Sharia-compliant applications. These exclude gambling, speculation, short-selling, and debts and receivables sales.

The coin received Fatwa, or a religious green light, in June 2022. Authorities liked the Haqq blockchain’s proof-of-stake consensus method, decentralized nature, and commitment to charity. The coin is reportedly the first digital asset that follows the Quran’s rules. Islamic Coin garnered 50% of private sales from non-Muslims.

Haqq’s software will limit ISLM’s supply to 100 billion tokens and reduce the token’s emission rate by 5% every two years.

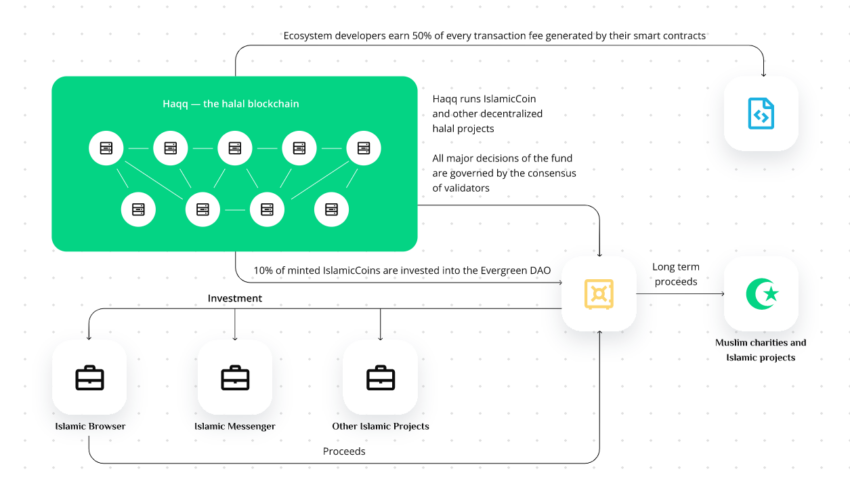

Non-profit foundation Evergreen DAO will receive 10% of each mined Islamic Coin to fund community projects. A Sharia board will decide which projects Evergreen will invest in.

Between 1% and 5% of tokens will go to a block proposer and delegators. The blockchain code will send the rest to validators and delegators based on the number of staked coins.

Between Q4 2022 and Q4 2023, the project will integrate with 20 payment firms in the Middle East and North Africa (MENA).

Is ISLM Overhyped?

Reaction to the imminent launch date was mostly positive, with several Twitter followers asking how to get the coin.

Others asked whether Islamic Coin was different or trying to attract Muslims with the Islamic language.

Last year, the project’s co-founder, Mohammed AlKaff AlHashmi, told BeInCrypto that if 3-4% of the Muslim population adopts ISLM, the crypto will become a “Bitcoin-scale asset.” A bold remark considering that Ethereum boasts a $200 billion-plus market cap.

However, according to Arabian Business, Sharia-compliant finance could fuel the growth of the Islamic finance market to $3.7 trillion by 2024.

Islamic banks make money by sharing profit and loss with depositors and grant loans through unique sale and leasing contracts. For example, in a home loan deal, the bank leases mutually owned property to a client. The client takes owns the house after paying off the bank’s share.

Traditional banks earn money by charging borrowers a higher interest rate than they pay depositors and charge fees for late payments. Sharia-compliant banking incentivizes payment by recovering a percentage of the funds for contribution to ethical causes.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.