Decentralized finance (DeFi) has transformed financial systems, empowering people with equal access to tools and opportunities. Meanwhile, decentralized governance has emerged as a key factor in determining the success or failure of any DeFi protocol.

Despite its revolutionary potential, this innovative approach to decision-making is not without its challenges. As the DeFi ecosystem continues to expand, the burdens of decentralized governance are becoming more apparent, with real-world incidents revealing vulnerabilities and challenges that must be addressed.

Burdens of Decentralized Governance

Yuvi, a prominent member of the Fantom community and an avid DeFi enthusiast, highlighted decentralized governance’s challenges. He stated:

“The ‘free economy’ as we know it is so heavily controlled by self-serving, centralized entities that the idea of building a financial world that is truly by the people, for the people, and where everyone has access to the same tools and opportunities, is deeply appealing to me.”

Still, some protocols encounter pitfalls due to insufficient consideration of governance models.

“I found that some protocols didn’t really understand the flaws in their governance models before they were already live, and some protocols hadn’t even considered the systemic risks they were introducing,” Yuvi explained.

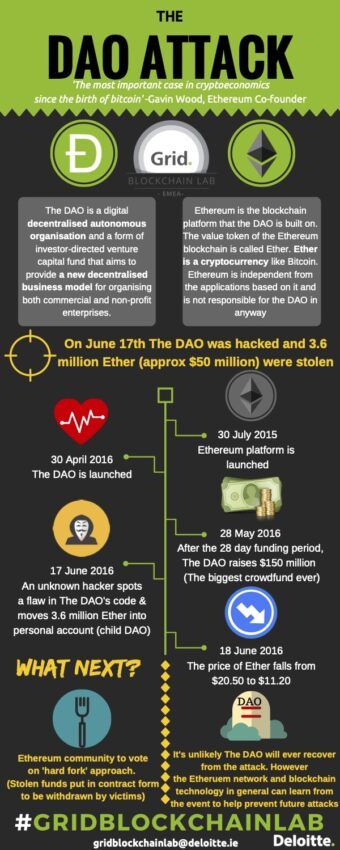

The DAO Hack in 2016 and YAM Finance in 2020 serve as early examples of governance failures. But recent incidents have further emphasized the importance of well-designed and thoroughly tested governance models.

A History of DeFi Failures

Solend, a decentralized lending platform on the Solana blockchain, faced a significant governance vulnerability in November 2022. An attacker exploited a bug in the governance contract, allowing them to pass a malicious proposal that could have drained substantial funds.

Fortunately, the Solend team and community acted promptly to mitigate the potential damage, and no funds were lost. The incident highlighted the importance of community vigilance and the need for rigorous testing and scrutiny.

Mango Markets, a decentralized exchange also built on Solana, experienced a governance issue in October 2022. A bug in the governance contract allowed users to vote multiple times on proposals. This undermined the democratic process and potentially gave bad actors the ability to manipulate decisions.

The Mango Markets team fixed the bug and implemented a new governance contract, emphasizing the need for continuous development and improvements.

Balancer, a popular DeFi protocol on Ethereum, faced a governance challenge where a sophisticated attacker exploited a vulnerability in the token distribution mechanism. The attacker manipulated the governance voting process using flash loans, causing an incorrect distribution of governance tokens.

Although the Balancer team addressed the issue, the incident underscored the importance of anticipating and mitigating potential threat vectors.

Code is DNA, Governance is RNA

Yuvi shared an insightful analogy that likens code to DNA and governance to RNA.

“Code is like DNA. It forms the building blocks of protocols and evolves over time such that only the fittest survive. But it cannot evolve on its own. In a sense, governance is the RNA that enables the chemical processes that achieve evolution. It’s the mechanism by which external influence dictates the information transfer that is most conducive to survival. No organism can survive without healthy RNA processes.”

This analogy highlights the crucial role of governance in shaping the evolution and sustainability of decentralized finance protocols.

Just as RNA helps DNA replicate and evolve, governance serves as the driving force behind the growth and adaptation of DeFi platforms. Through governance, protocols can respond to changing needs, address challenges, and remain competitive in an ever-evolving financial landscape.

Yuvi’s perspective sheds light on the importance of understanding the intricacies of decentralized governance and the need to learn from real-world examples.

By examining the experiences of protocols such as Solend, Mango Markets, and Balancer, one can identify key threat vectors and areas for improvement. These examples emphasize the potential vulnerabilities and challenges that can arise when governance models are not carefully designed and implemented.

Yuvi envisions proactive governance frameworks that inherently defend themselves from misuse in the short term. However, he acknowledges the long-term challenges and uncertainty surrounding the ideal solution.

“In the long term, I suspect crypto in its entirety will go through iterations of governance applications before a truly robust and viable solution is broadly adopted. I don’t know what that looks like, but I enjoy thinking about it,” Yuvi shared.

Understanding the burdens of decentralized governance and learning from these examples is essential so developers can work towards creating more robust and effective models that can withstand the challenges of the rapidly changing DeFi ecosystem.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.