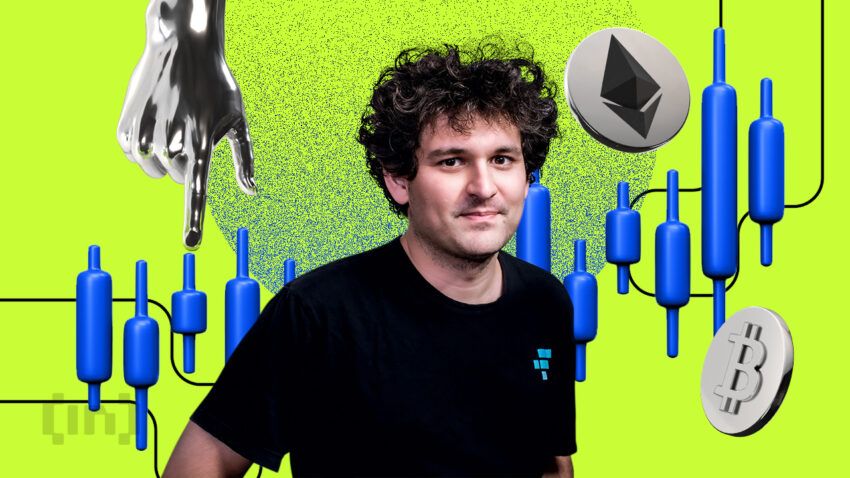

The hedge fund manager Bill Ackman believes that Sam Bankman-Fried is not a crook. The FTX failed because SBF was trying to avoid embarrassment.

The American billionaire investor and the CEO of the hedge fund Pershing Square Capital Management has a theory for the failure of the FTX exchange. Bill Ackman-led hedge fund manages over $18.5 billion in assets under management.

Sam Bankman-Fried Did Stupid Sh-t to Avoid Embarrassment: Bill Ackman

Bill Ackman has compared Sam Bankman-Fried to Bernie Madoff, an American fraudster who ran a Ponzi scheme worth $64.8 billion. He says neither Sam Bankman-Fried nor Bernie Madoff had the “typical profile of a crook.”

In his theory, he mentions that FTX was profitable, and there was no reason for Sam Bankman-Fried to commit fraud. SBF was embarrassed after making losses, and he assumed that he could “borrow” customer funds to cover up the losses.

As the market crashed, the losses were too large to recover from. Bill Ackman believes that for MIT grads, “Failure is so frightening that they can’t acknowledge it, and they do stupid sh-t to avoid the embarrassment.”

Community Calls Out The Irony

Earlier, when Sam Bankman-Fried apologized on Twitter, Bill Ackman defended him, stating SBF should be given credit for accountability. He later deleted the tweet upon receiving backlash from community members.

Alex Svanevik, the CEO of the blockchain analytic platform – Nansen, called out the irony of Bill Ackman.

On the other hand, Bill Ackman tweeted that the $250 million bill from Sam Bankman-Fried is a criminal indictment.

The Authorities Face Allegations

Post the collapse of FTX, allegations started brewing because the disgraced founder Sam Bankman-Fried was roaming free. Even after the arrest by Bahamian authorities, SBF enjoyed luxurious treatment in prison. Further, with the $250 million bail, the crypto influencer believes that SBF made a mockery of the American judicial system.

The most recent allegation comes from Congressman Tom Emmer. He alleges that the Securities and Exchange Commission made backroom regulatory deals with FTX.

Bruce Fenton, the SEC-registered stockbroker, agrees with the Congressman. He says, “I can’t get questions answered by the SEC- let alone get meetings with the Chair.” Further, the community draws some more conspiracy theories with Sam Bankman-Fried’s criminal trial judge.

Got something to say about Sam Bankman-Fried’s bail, Bill Ackman, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.