The Dogecoin price has managed to keep investors’ attention on its amid larger bearish blues. As the DOGE price starts to continue on a downward trend, assessing its fall becomes crucial.

Dogecoin charted an incredible run during the month of October, gaining over 140% to reach a multimonth high of $0.158. However, DOGE is now down nearly 40% from that local high.

Dogecoin Futures Market Turns Red

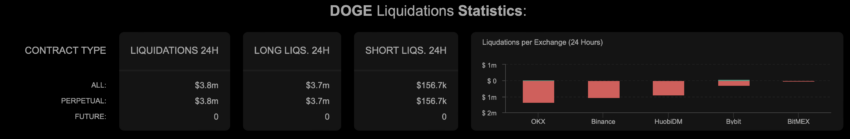

Around $3.7 million worth of DOGE long liquidations took place in the last 24 hours, showing that bears currently have the upper hand.

The futures market presented an overall bearish tone. Open interest fell by 7.80% to $367 million at press time. In addition to that, the funding rate on Binance turned negative.

DOGE is now trading at $0.0964, down 3.3% in the past 24 hours and 10.1% in the past week.

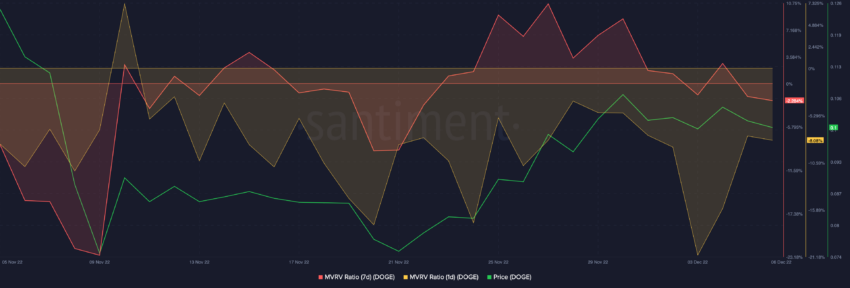

The Dogecoin 1-day and 7-day MVRV metrics suggest that short-term DOGE holders have started to realize losses.

With short-term holders at a loss, selling pressure could begin to pile on and pull the price down further.

DOGE Retail Traders Lead the Way

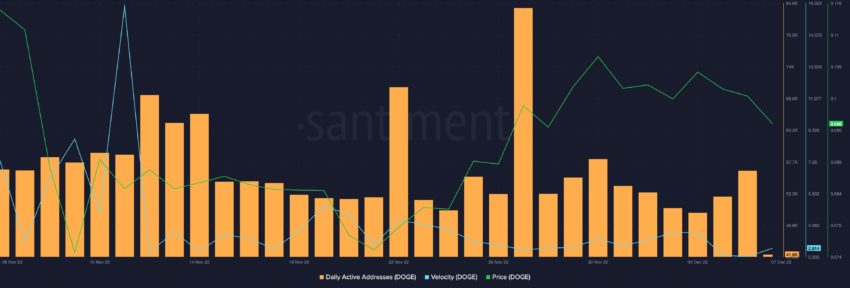

Daily active addresses for DOGE have been climbing. This could be mostly attributed to market participants selling. However, Dogecoin’s velocity (how fast the price moves) recently fell to local lows.

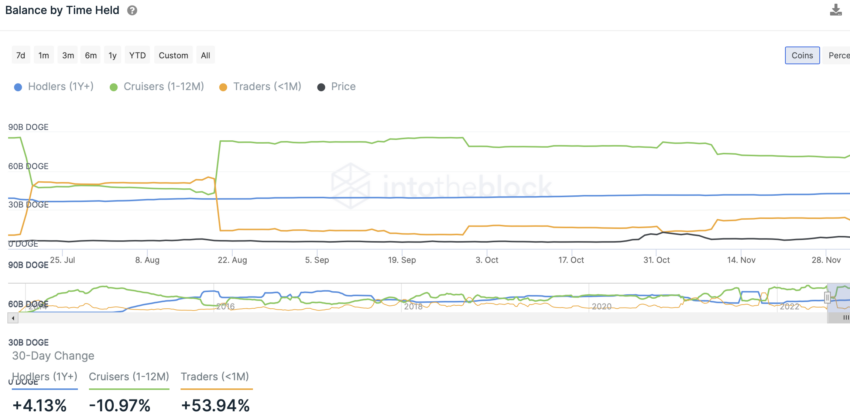

A chart of Dogecoin balances by time held highlighted that ‘trader’ balances (less than one month) had increased by 53.94% while ‘cruiser’ holdings (between one month and one year) saw a 10.97% drop.

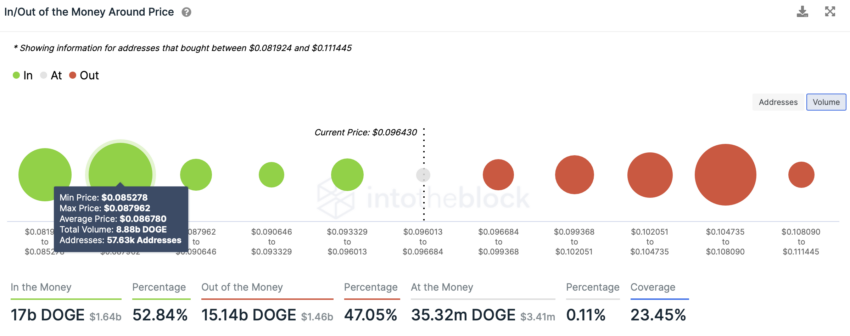

Traders increasing their balances suggests that the DOGE market is likely to largely be retail-driven in the coming days. For DOGE, the In/Out of Money Around Price Indicator from IntoTheBlock showed the next support at the $0.086 mark, where 757,630 addresses hold 8.88 billion DOGE.

A fall below the $0.086 level could spell trouble for DOGE holders and further liquidations could lead to a bearish close for the DOGE price in December.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.