ALGO price was up by a staggering 15% in the past two days, despite the bearish market conditions.

Algorand managed to make headlines in the market, with the upcoming FIFA World Cup hype generating positive gains for the coin.

Algorand is one of the few large-cap tokens posting decent short-term gains. The prices of most of the top cryptocurrencies have been down following the collapse of FTX.

However, Algorand managed to make nearly 15% gains in the last two days. According to CoinMaketCap data, ALGO was in the top five top gainers on Nov. 16.

With most of the top altcoins showing no to low gains, ALGO price seemed to offer decent short-term returns. The same could be tempting for some market participants, but can the gains continue or even sustain?

ALGO Price Recovers, What Next?

At the time of writing, ALGO price traded at $0.28, charting just over 4% gains. The last two days saw the coin recover from the lower $0.25 mark.

While ALGO price recovery from the two-year low of $0.25 presented short-term buy signals, the current situation wasn’t favorable for bulls. On a four-hour chart, ALGO price made its first red candle in two days.

RSI started to retrace back, presenting sellers taking over the market. The 50 period moving average acted as a resistance, and price action started to reverse its bullish momentum after testing the level.

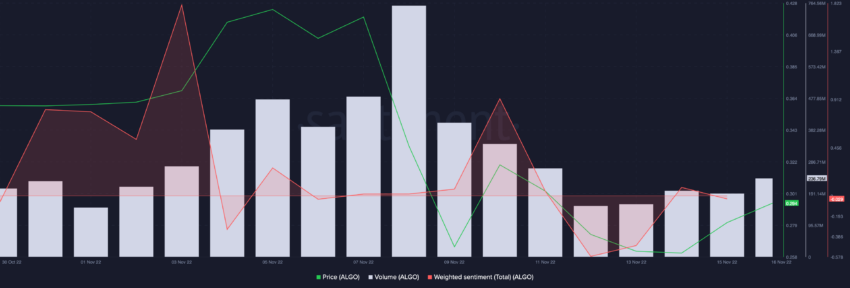

That said, Algorand still had a negative weighted sentiment despite the hype coming from the upcoming FIFA World Cup. Notably, Algorand is FIFA’s official blockchain platform for providing a blockchain-supported wallet solution.

In addition to the negative social sentiment, ALGO saw dwindling trade volumes, which further presented a lower retail interest. Seemingly, as bullish momentum wanes from ALGO price action, Algorand could witness a drop back to the $0.25 price level.

Algorand on-Chain Dynamics

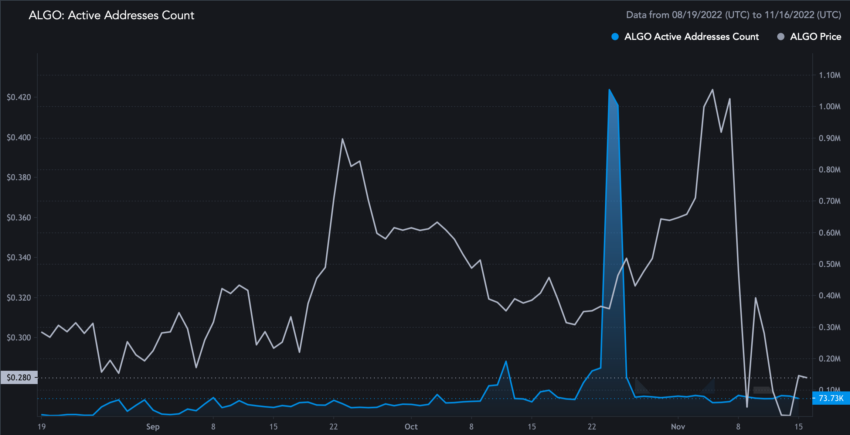

The active address count for Algorand suggested that the active address stood at 73,733, which isn’t bad. However, looking at a long-term picture, it was notable that active addresses have flat lined for the most part of last year.

Apart from the Oct. price rising above $0.40, active addresses saw no major growth. Another worrying factor was that Messari data suggested nearly 99% of ALGO supply was held in the top 100 addresses, which could spell trouble for the ALGO price.

Furthermore, Algorand also saw a dip in its total value locked, showing institutional investors losing confidence. Algorand TVL registered an almost 50% dip throughout Nov.

All in all, if you are planning to long ALGO beware that short-term prospects don’t look too bright, and a pullback to $0.25 wouldn’t be surprising.

A bullish push, however, can invalidate the bearish prediction and push price to the next resistance at $

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.