Binance said it is abandoning early plans to acquire embattled rival FTX after going through the company’s financials and structure.

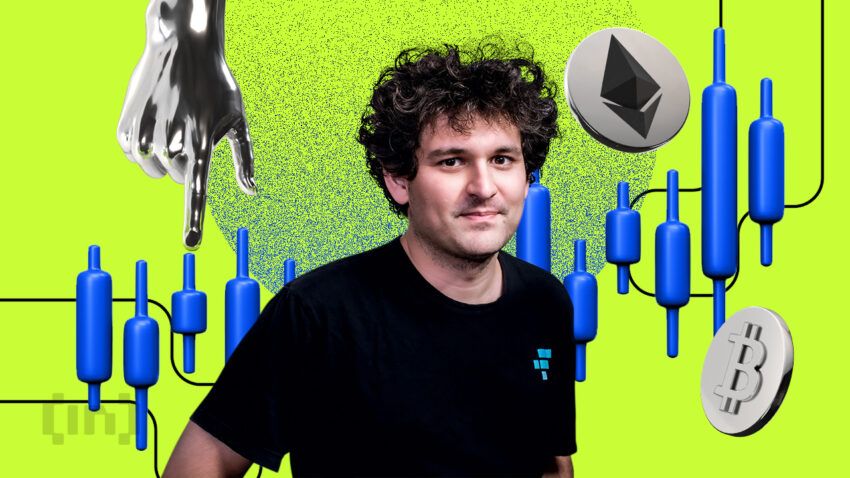

Updated 14:30UTC, Nov. 10: Sam Bankman-Fried issued a mea culpa on Twitter saying he “should have done better.”

The FTX chief added: “Anyway: right now, my #1 priority–by far–is doing right by users. And I’m going to do everything I can to do that. To take responsibility, and do what I can.

“Because at the end of the day, I was CEO, which means that *I* was responsible for making sure that things went well. *I*, ultimately, should have been on top of everything. I clearly failed in that. I’m sorry.”

The exchange said, “Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.”

Yesterday, Binance CEO Changpeng Zhao announced that his company had signed a non-binding agreement to acquire the exchange after the Bahamian exchange experienced a severe liquidity crunch.

Barely a day later, it pulled out, which could trigger a cascade of crypto collapses in the coming days.

Binance says collapse will make industry stronger

While conducting due diligence, Bloomberg reported that Binance found an eyebrow-raising potential $6 billion hole between FTX’s assets and liabilities.

Recent announcements of investigations by key U.S. agencies into FTX’s handling of customer funds eventually prompted Binance to halt acquisition proceedings.

The Securities and Exchange commission reportedly began its probe into FTX and its lending products a few months ago.

Binance also sympathized with consumers who will undoubtedly be affected by the collapse of FTX, and said that incidents like this make the crypto industry stronger. It also highlighted the development of regulatory frameworks and crypto’s push toward greater decentralization as key driver’s of the industry’s growth from this point on.

Since the announcement, FTX CEO Sam Bankman-Fried, known by his initials SBF, has reportedly filed for bankruptcy.

Just a few months ago, SBF became the savior of floundering crypto firms Voyager Digital and BlockFi.

FTX’s death spiral (Luna anyone?)

The unwinding of FTX started with a damning financial report on Alameda Research, a quant trading firm with close ties to SBF and FTX. The report revealed that a large portion of Alameda’s assets were in the form of FTX’s native token FTT, a relatively illiquid token with a market cap of around $3 billion on Nov. 7, 2022.

In response to the report, Binance CEO Changpeng ‘CZ’ Zhao said that Binance would be liquidating $580 million of FTT received after it exited an equity position in FTX Trading Ltd., FTX’s parent company.

After CZ’s announcement, FTX experienced a huge surge in FTT withdrawals that saw it stop processing transactions from about 6:37 a.m. ET to approximately 12 p.m ET. SBF later announced that Binance would help it with its transaction backlog as part of a non-binding agreement in which Binance could acquire FTX.

A little over 24 hours later, Binance pulled out of the deal. CZ expressed regret at being unable to help.

There has been no official comment from SBF or FTX regarding the latest developments.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.