A new meme token called DIE, born out of a Vitalik Buterin tweet, is up by more than 5,500%. However, some see the token as being a bubble.

Vitalik Buterin’s have led to the creation of yet another meme coin. Just a few days after jokingly suggesting that there could be a project called “The Protocol,” intended as satire, the crypto community has created a token called DIE because of another tweet.

DIE is the German equivalent of “The.” It did not take long for developers to create the asset and launch social media accounts for Die Protocol. Unsurprisingly, this token has shot up in value, with the price up by over 5,500% in the last 24 hours, according to DEXTools. It is currently priced at $0.0000019.

One of the reasons that the token is rising so much is the fact that, besides being a meme coin, it has been listed on several notable exchanges, including Huobi and MEXC. It is also available on smaller exchanges.

2022 is turning out to be a year for meme coins, with these tokens that have been inspired by Buterin outperforming other assets significantly. Investors may be caging with distributing their capital in the market during the crypto winter, but evidently, that does not apply to meme coins.

DIE continues to go up

There is a lot of talk in the crypto community about DIE flipping the first meme coin, THE. DIE currently has a market cap of $8.6 million, with significantly more buys than sells. Liquidity is currently over $400,000, and so far, it does not appear to be a honey pot.

Some in the crypto community do not seem to think that there will be any risks, saying that the token will reach tens of millions in market cap in the weeks to come. They all seem to be shilling the token, though investors will want to be wary of any tokens that are of this nature.

DIE could be a bubble

Tokens that make a quick buck are always a risk. In the worst cases, they can be traps with code that results in capital being stolen. In the average case, they can lead to the token losing value quickly because interest in the meme has fizzled out, bursting the bubble.

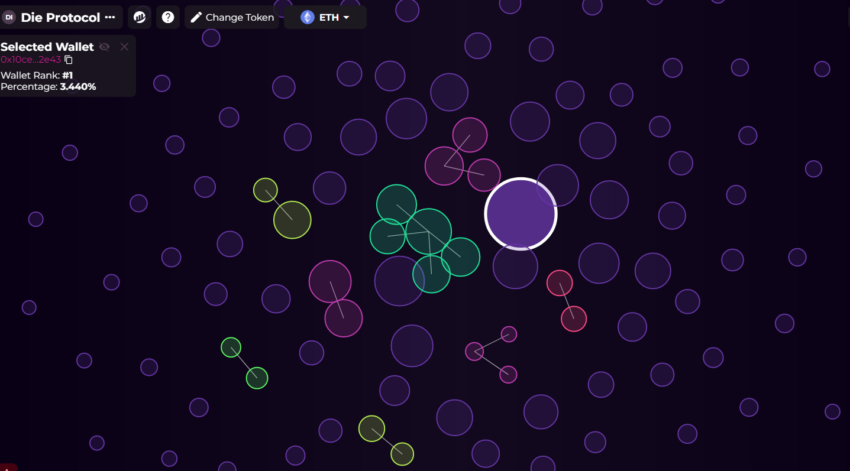

There’s also a clear case of only a small amount of wallets holding most of the DIE tokens. Bubblemaps shows the top 15 wallets holding approximately 20% of all tokens. As such, investors will want to be careful lest they get caught in quick dumping.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.