BENQI and Yeti Finance have chosen to partner with the highly capital-efficient KyberSwap in a joint initiative to enhance liquidity and provide the best rates for sAVAX and YUSD tokens on Avalanche.

This first phase of this joint initiative is set to bring liquidity providers over $200,000 in liquidity mining rewards, with more incentives to come in the near future.

BENQI is a decentralized non-custodial liquidity market and liquid staking protocol built on Avalanche. BENQI Liquid Staked AVAX (sAVAX) is the token that users receive when staking their AVAX on the BENQI Liquid Staking (BLS) protocol. AVAX holders can get $sAVAX by staking $AVAX on BENQI here.

This is not the first time BENQI has partnered with KyberSwap for its capital efficiency benefits. Learn about BENQI’s first joint initiative with KyberSwap here.

Yeti Finance is a cross-margin lending protocol on Avalanche that allows users to borrow up to 21x against their portfolio of LP tokens, staked assets such as sAVAX, and yield-bearing stablecoins in a single debt position for 0% interest.

Borrowers receive $YUSD, an overcollateralized stablecoin that can be swapped for additional assets and subsequently re-deposited into Yeti Finance to build a leverage position.

What is KyberSwap Elastic?

KyberSwap’s newest protocol, dubbed Elastic, is a tick-based AMM that gives Liquidity Providers (LPs) the advantages of concentrated liquidity and the flexibility to achieve capital efficiency and manage risks.

With concentrated liquidity, LPs have the flexibility to supply liquidity to an Elastic pool either by “concentrating” the liquidity to a narrow price range or set to a wider price range.

Concentrated liquidity would use the pool’s liquidity more efficiently, mimicking much higher levels of liquidity and achieving better slippage, volume, and earnings for LPs while a wider range would ensure liquidity for uncorrelated token pairs such as USDC-ETH would remain active even with big price swings during high market volatility.

KyberSwap Elastic also has a Reinvestment Curve, which compounds fees by automatically reinvesting the fee earnings of LPs back into the liquidity pool so LPs earn higher APYs while saving time.

LPs on KyberSwap Elastic can also choose from multiple fee tiers to select the best-suited rates for individuals taking into consideration factors such as token volatility, individual risk appetites, etc.

In addition, KyberSwap Elastic comes with a Just-in-Time (JIT) Attack Protection feature, which protects LP earnings from snipe attacks that would reduce the earnings of other honest liquidity providers. So LPs can earn securely while enjoying peace of mind.

Starting from August 17, 2022, liquidity providers can add liquidity to the eligible sAVAX and YUSD pools on KyberSwap Elastic on Avalanche and earn KNC, QI, and YETI rewards.

With KyberSwap’s Elastic protocol, LPs can enjoy benefits such as concentrated liquidity and compounding fees, providing higher capital efficiency and optimized rewards.

KyberSwap Elastic also has JIT (Just In Time) protection, so LPs will have their earnings better protected and enjoy better peace of mind.

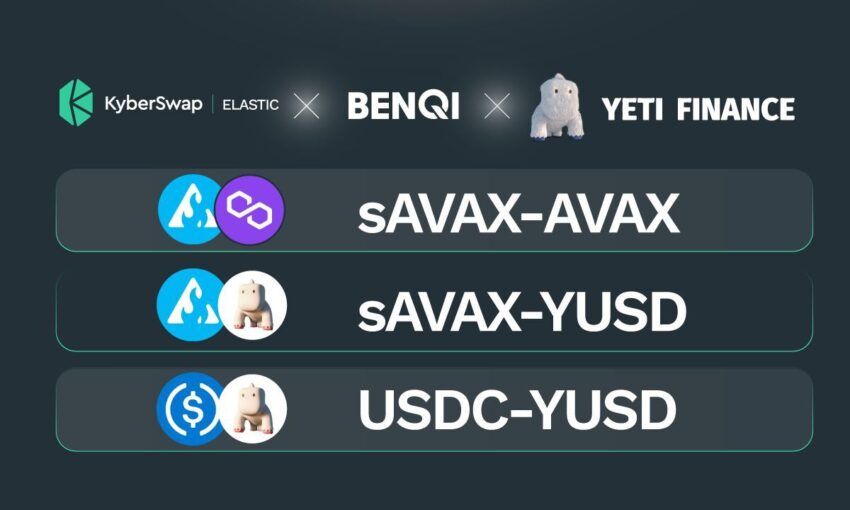

BENQI and Yeti Finance pools on KyberSwap Elastic (Avalanche)

Eligible Pools (Fee Tier):

- sAVAX-AVAX (0.01%)

- sAVAX-YUSD (0.04%)

- USDC-YUSD (0.01%)

*Full list of eligible pools for Yield Farming on Avalanche can be viewed here.

KyberSwap: Benefits for BENQI and Yeti Ecosystem

1. For Traders

- Best swap rates for sAVAX and Yeti tokens through DEX aggregation, while letting users identify other tokens even before they trend/moon via on-chain metrics

2. For Liquidity Providers

- Concentrated liquidity for sAVAX and Yeti pairs and any other token, stables, and non-stables

- Auto-compounded LP (liquidity provider) fees

- Bonus liquidity incentives through yield farming

- Sniping/Just-in-time attack protection to protect the earnings for BENQI and Yeti LPs

3. For Developers

Dapps can integrate with KyberSwap’s pools and aggregation API to provide the best rates for their own users, saving time and resources.

With these benefits in mind, KyberSwap is proud to partner with BENQI and Yeti Finance in this initiative to enhance liquidity on Avalanche for the benefit of all four ecosystems.

About Kyber Network

Kyber Network is building a world where any token is usable anywhere. KyberSwap, our flagship Decentralized Exchange (DEX) aggregator and liquidity platform, provides the best rates for traders in DeFi and maximizes returns for liquidity providers.

KyberSwap powers 100+ integrated projects and has facilitated over US$9.9 billion worth of transactions for thousands of users since its inception. Currently deployed across 12 chains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora, Oasis, BitTorrent, and Optimism.

KyberSwap | Discord | Website | Twitter | Forum | Blog | Reddit | Github | KyberSwap Docs

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.