THORChain (RUNE) has been increasing since April 12 in what could be a relief rally after a sharp drop.

RUNE has been falling underneath a descending resistance line since reaching an all-time high price of $22.14 on May 18. Since March 31, the line has rejected the price thrice (red icons).

Technical indicators in the weekly time frame are somewhat bullish. The RSI is increasing and is above 50, while the MACD has generated several successive higher momentum bars.

However, the MACD is right at the 0 line and the RSI is barely above 50. Therefore, while they are bullish, these indicators fail to confirm the strength of the bullish trend.

As a result, the trend cannot be considered bullish until the price breaks out from the descending resistance line.

RUNE pumps in March

Similarly to the weekly time frame, the daily one provides mixed signs.

The 300% upward movement that transpired between Feb. 24 and Mar. 31 was preceded by significant bullish divergences in both the RSI and MACD (green lines) – both considered bullish signs.

However, both indicators has been falling since March 31. Furthermore, while the bullish divergence trendline is still intact in the MACD, the RSI has already broken down from its trendline.

Therefore, daily time frame indicators for RUNE are also mixed.

Wave count analysis

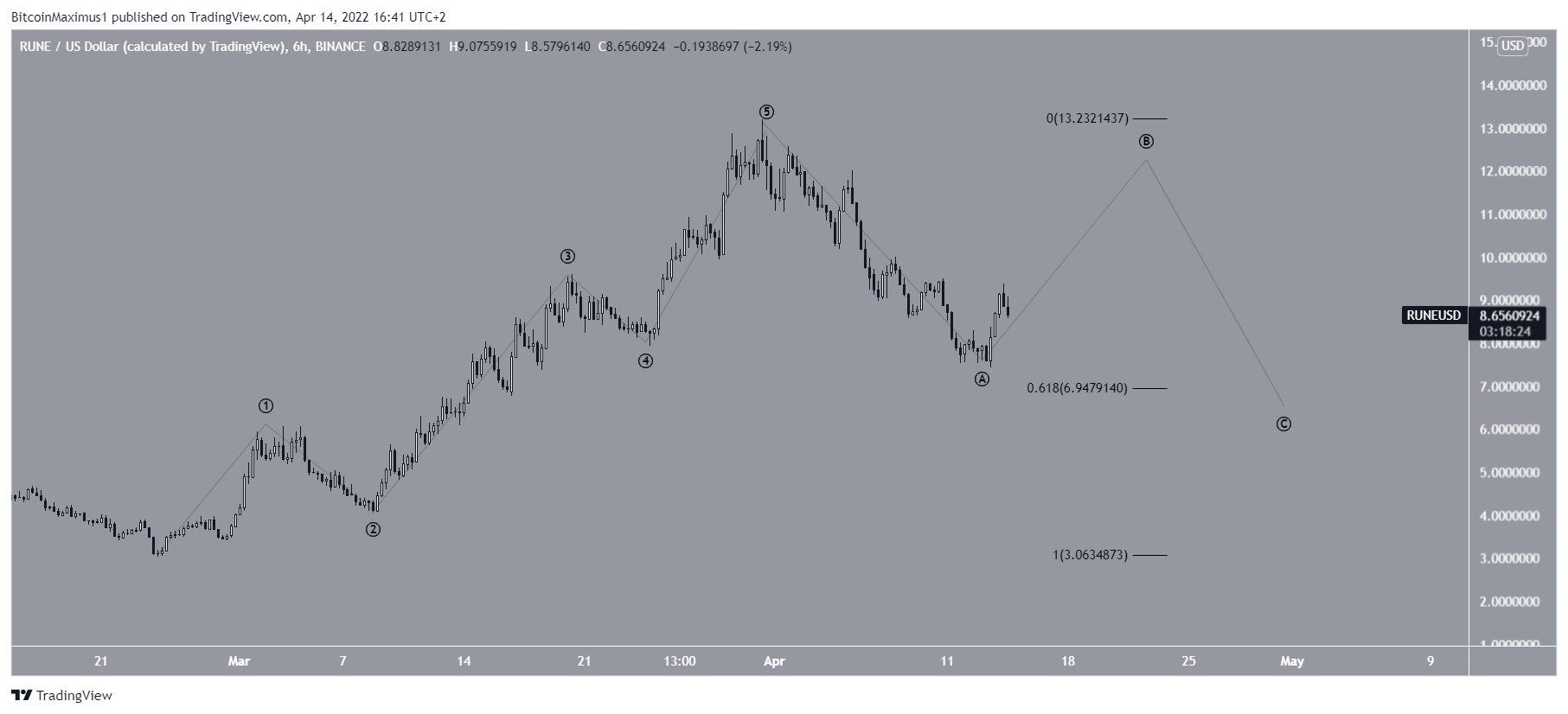

Cryptocurrency trader @JacobEmmerton tweeted a chart of RUNE, stating that after a relief rally, another drop will follow.

The most likely scenario suggests that the aforementioned Feb. 24 – March 31 increase was a five wave upward movement.

Therefore, it seems that RUNE has completed wave A, and is now in wave B of an A-B-C corrective structure (black).

So, after the current relief rally is complete, another drop could occur.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.