Despite a 15% decline in total value locked across the entire decentralized finance space in 2022, Cardano Protocol has seen massive growth in liquidity locked into its crypto project.

Cardano has been a great part of smart contracts-backed blockchain technologies ever since the project was launched in 2017.

Cardano has been a vital part of the decentralized finance market ever since it launched the Alonzo Hard Fork in September 2021 that finally saw the triggering of smart contract functionality.

This has contributed to the changing of the fortunes of the entire project in 2022.

According to BeInCrypto Research, Cardano has gained approximately 25,259.3% in total value locked (TVL) since the opening day of 2022. On Jan. 1, Cardano had a TVL of $822,261, and this rallied to approximately $208,520,000 on March 16, 2022.

As the first blockchain platform to be founded on peer-reviewed research, Cardano is a proof-of-stake protocol that was developed through evidence-based methods. It thrives on a combination of technologies that provide unparalleled sustainability and security to societies, systems, and decentralized applications (DAPPS). As one of the technologies that continue to increase substantially in TVL daily, Cardano has several use cases under the banners of education, retail agriculture, government, healthcare, and finance.

What contributed to the spike in Cardano total value locked?

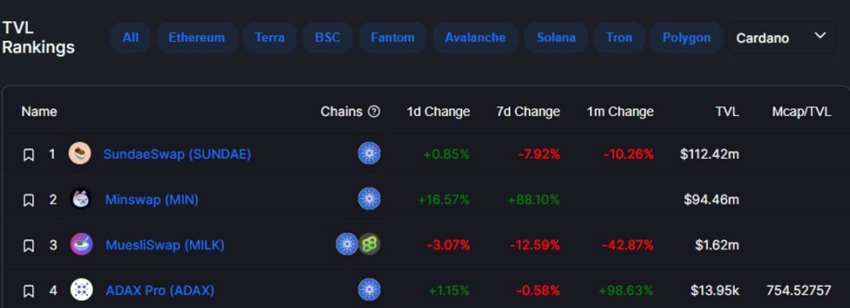

Although several sources say Cardano has several DAPPS under the lending, payment/wallets, trading, interest accounts, derivatives/options, asset management, insurance, financial analytics, and identity/Know Your Customer banner, a reputable source such as DefiLlama list only six decentralized protocols. Protocols that continue to contribute to the changing fortunes of Cardano’s TVL include decentralized exchanges SundaeSwap (approximately $112.28 million), MiniSwap (approximately $95.36 million), MuesliSwap (approximately $1.6 million), and ADAX Pro (approximately $14,060).

Others that would be contributing to the total value locked in the future include but are not limited to lending protocols VyFinance (VYFI) and Meld (MELD).

After surpassing more than $200 million in TVL in March, which can be attributed to the massive percentage gains in the aforementioned decentralized exchanges, Cardano has fallen into the top 30 chains with the most value locked.

Latest project developments on Cardano

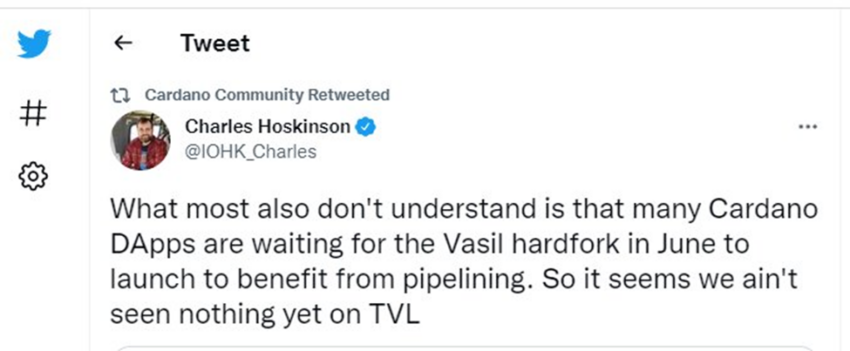

On Saturday, March 12, 2022, Input Output Hong Kong (IOHK) Chief Executive Officer (CEO) and Cardano founder Charles Hoskinson announced via a tweet that fans of the protocol should expect more DAPPS in the future once the Vasil Hard Fork is launched in June 2022.

Per the roadmap of Cardano, the Vasil Hard Fork will be focused solely on an array of scaling enhancements. This will bring several changes to the Cardano ecosystem, especially, the development of smart contracts. With the opening of the first Hydra Heads (layer 2 scaling solution aimed at improving the scalability and security of the blockchain) in March, Cardano could be handling at least 2 million transactions per second from June 2022.

As of writing, Cardano continues to see increased development activity. Cardano trails Solana (SOL) and Uniswap (UNI) but has surpassed Polkadot (DOT), Kusama (KSM), Ethereum (ETH), and Flow (FLOW) in current development activity rankings.

Unfortunately, the boom in total value locked has not reflected positively in the price of Cardano’s novel token, ADA. The crypto trading asset opened on Jan. 1, 2022, with a trading price of $1.31 and spiked by 24% to a yearly high of $1.63 on Jan. 18.

As of writing, ADA has shed 49% of its yearly high and trades in the region of $0.7819 and $0.8614.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.