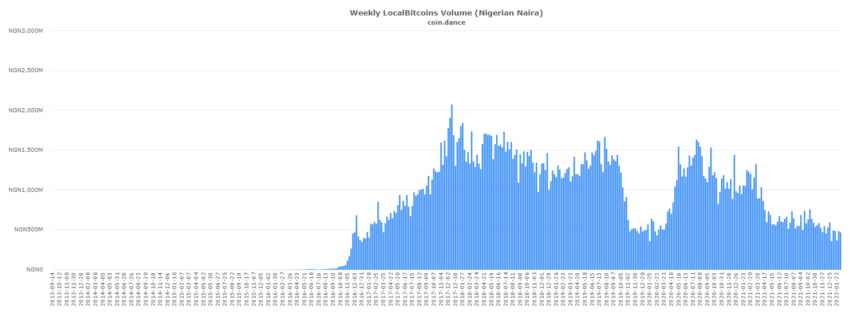

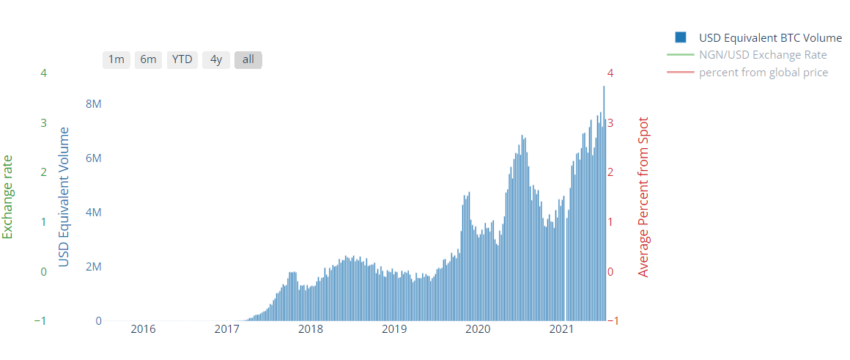

P2P trading volume of bitcoin in Nigeria has increased by 15% year-over-year, according to data from LocalBitcoins and Paxful. This is despite a ban on crypto enforced by the Nigerian Central Bank.

Data from LocalBitcoins and Paxful show that peer-to-peer trading of bitcoin in Nigeria has increased by over 15% year-over-year since the country’s central bank enforced a crypto ban. Current weekly bitcoin trading volumes are at a slight lull, probably because of the downturn in the market.

The Central Bank of Nigeria enforced a ban on crypto in Feb. 2021, though it hasn’t done much in terms of reducing trading. Crypto adoption continued to increase during the year, hitting 24% — which made it the country with the highest adoption rate, ahead of Malaysia and Australia.

P2P platforms allow buyers and sellers to directly sell between each other, avoiding any central platform. It is often used in countries where crypto trading isn’t permitted. Currently, there is over $400 million between traded using these platforms in Nigeria.

The citizens of Nigeria and other African nations are very keen on crypto, as proven by the high adoption rate. Proponents of crypto in Nigeria have begun to take the fight to the central bank, with a legal battle set to take the stage this year. Amid all of this, the Nigerian central bank has also been accused of ‘financial terrorism.’

It’s not all doom and gloom, however. The Nigerian Vice President has asked the central bank to regulate crypto instead of banning it. Whether this, along with lobbying from pro-crypto groups, will have an effect remains to be seen.

Nigeria turns to CBDC instead

Nigeria, however, has expressed a lot of interest in a central bank digital currency (CBDC) and has launched a website for the e-Naira. This appears to be its main focus with respect to blockchain and crypto developments, much like other countries.

Governments are keen on capitalizing on the benefits of distributed ledger technology. Primarily, they want to digitize economies and introduce innovations, but also to stave off any effects crypto might have on national currencies.

Almost all major economies have announced experiments with respect to CBDCs, the most recent being India. Countries like China have already conducted several major tests, while others are in the proof-of-concept stage.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.