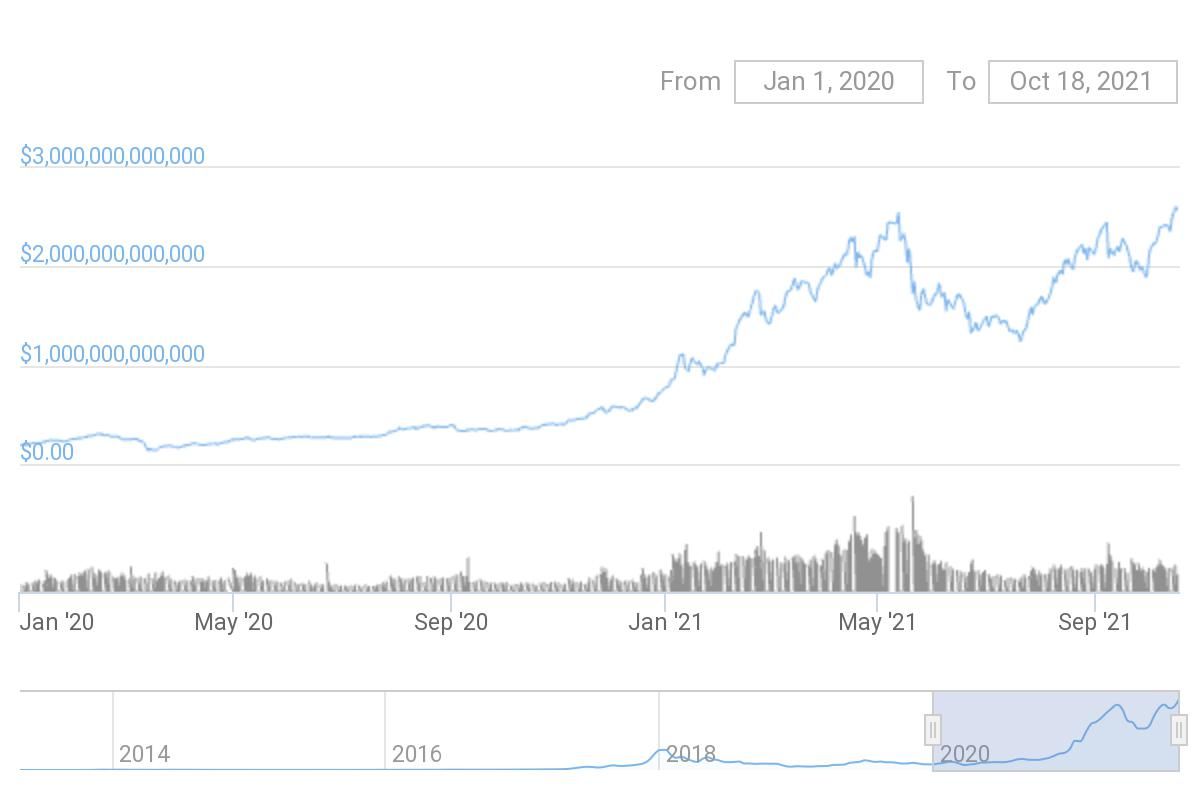

Cryptocurrency markets have been climbing again to kick off the week and the total market capitalization has reached a record high. The market capitalization for all cryptocurrencies has reached an all-time high of $2.6 trillion according to CoinGecko.

This has just surpassed the previous high of $2.55 trillion that was made on May 12 when many altcoins were notching up their own record highs.

Rival token analytics platform CoinMarketCap is reporting a total crypto market cap of around $2.5 trillion which is about the same as the previous peak five months ago.

The total market cap has surged 233% since the beginning of this year when it was around $780 billion. During the last cycle peak in January 2018, the total market cap reached a high of $830 billion.

Crypto now larger than world’s biggest company

The entire crypto market cap is now larger than the world’s largest company. According to CompaniesMarketcap, Apple has a market cap of around $2.39 trillion topping the chart. The second-largest firm is software giant Microsoft with $2.28 trillion.

Bitcoin is currently driving all of the momenta with a gain of 2.7% on the day, 14% on the past week, and 32% over the past month. BTC usually peaks before altcoins so their turn could come when bitcoin prices take a breather.

Bitcoin is now just 3.4% away from its April 14 all-time high of $64,800 according to CoinGecko. In terms of market cap, Bitcoin is now worth around $1.18 trillion which is approximately 45% of the total.

Compared to companies, Bitcoin is ranked sixth in the world, larger than Facebook with $915 billion, but smaller than Amazon with $1.7 trillion.

Ethereum represents 17% of the entire market with a capitalization of $458 billion, or about the same size as Chinese e-commerce giant Alibaba.

Billion-dollar altcoins growing

The number of altcoins with a market cap over $1 billion is 108 according to CoinGecko. The top-20 altcoins all have more than $10 billion market caps and those in the top ten are all over $30 billion.

Binance Coin (BNB) is the third-largest cryptocurrency with $79 billion and Tether is fourth with around $70 billion. Cardano’s ADA is currently the fifth largest with $69 billion, followed by XRP with $51 billion.

Altcoins have not seen much price action over the past 24 hours as Bitcoin has been making all the moves, gaining a further 2.6% on the day to trade at $62,350 at the time of press.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.