KPMG has released a new report highlighting some of the major trends in the fintech space and has revealed that investments in the crypto market have grown significantly.

KPMG, one of the world’s largest professional services firms, has published a new report that details the trends and activity in the fintech market. The report is in line with what other incumbents are saying about the cryptocurrency market, namely that it’s seeing an influx of interest and funds from businesses and governments.

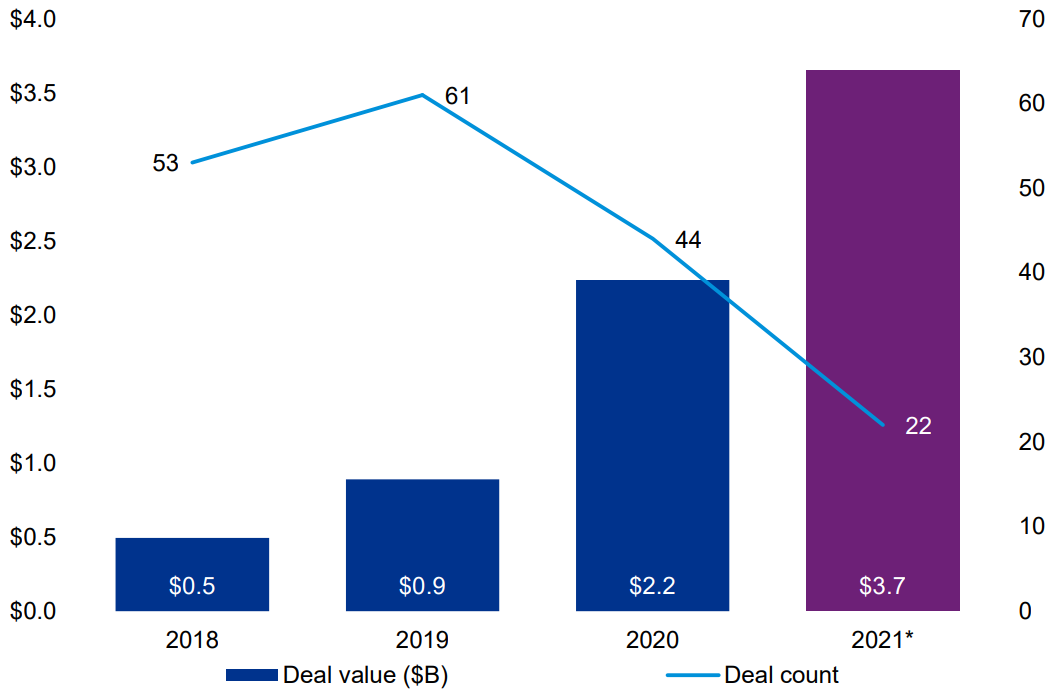

This edition of the Pulse of Fintech report covers developments in the first half of 2021. The keyword that is used to describe this period was ‘diversity,’ saying that the pandemic continues to affect the way consumers behave. The total investment in blockchain and cryptocurrency so far is nearly double that of 2020, at $3.7 billion compared to $2.2 billion.

Among other things, it notes that there has been a rise in interest in cryptocurrencies from startups and investors, but also from government and regulators. This has never been more apparent than in El Salvador’s decision to make bitcoin legal tender. Companies, too, have been accumulating bitcoin at astonishing levels.

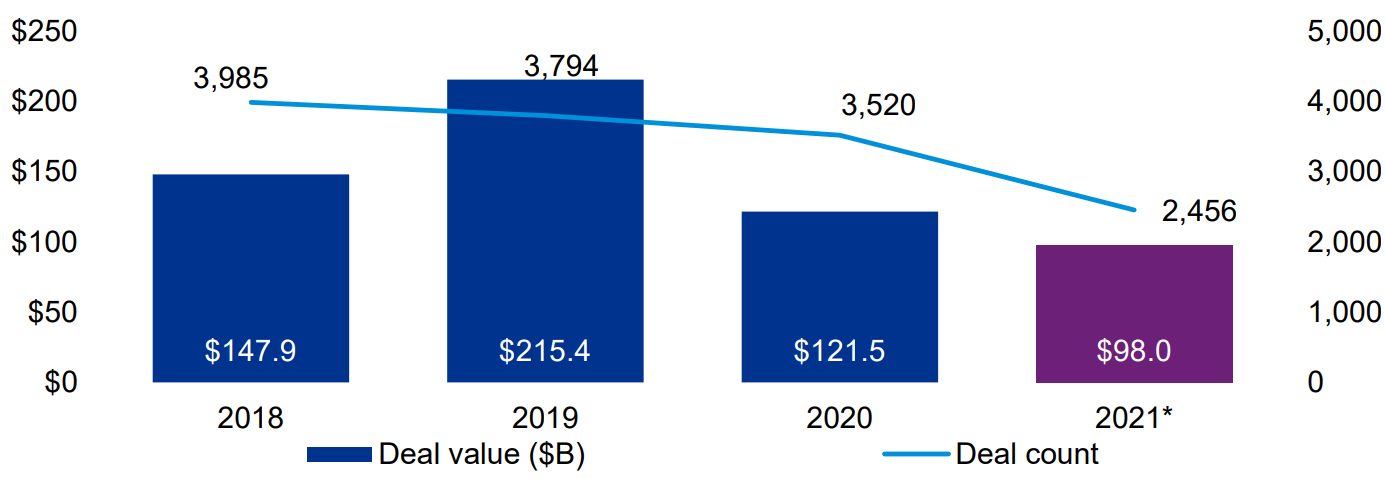

As for the fintech market overall, the first half of 2021 saw total investments of $98 billion coming from 2,456 deals. Two of the largest deals in this time were two companies associated closely with pioneering fintech platforms: Robinhood and Nubank. The former saw a VC round of $3.4 billion, while the latter saw one worth $1.5 billion.

However, the report does state mention the role that regulations will have going forward. Consequently, it says that regulation will be something to keep an eye on in H2 2021. This is already something that is moving at a breakneck pace, with the U.S. in particular now accelerating efforts.

KPMG predicts crypto trend

The report may come as a surprise to those who haven’t been paying close attention to the market. Recent bearish market conditions may have given some the impression that the crypto market was overbought in general. However, bitcoin’s recent jump to the $47,000 level might prove that there is still life in the market.

KPMG notes that the crypto market will be a hot focus of investors, putting it as one of the top fintech trends for 2021. The analysts believe that the future will bring a greater diversity of retail investors. They also state interest and developments will grow to cover trading, NFTs, and support structures.

The market is showing signs of attaining a new support level as bitcoin hovers slightly under the $50,000 barrier. Still, interest in the market remains as strong as ever, with both retail and institutional investor numbers improving.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.