Cardano, one of the biggest competitors of Ethereum (ETH) in the blockchain ecosystem industry, reached the new all-time (ATH) at $1.70 yesterday. The new record follows a long consolidation, so we can expect a continuation of long-term upward trend.

The ADA/BTC pair is also showing bullish perspectives and is currently facing short-term resistance at 3000 satoshi. After a potential breakout, Cardano will be able to continue the upward trend initiated in 2021.

Cardano reaches the new ATH

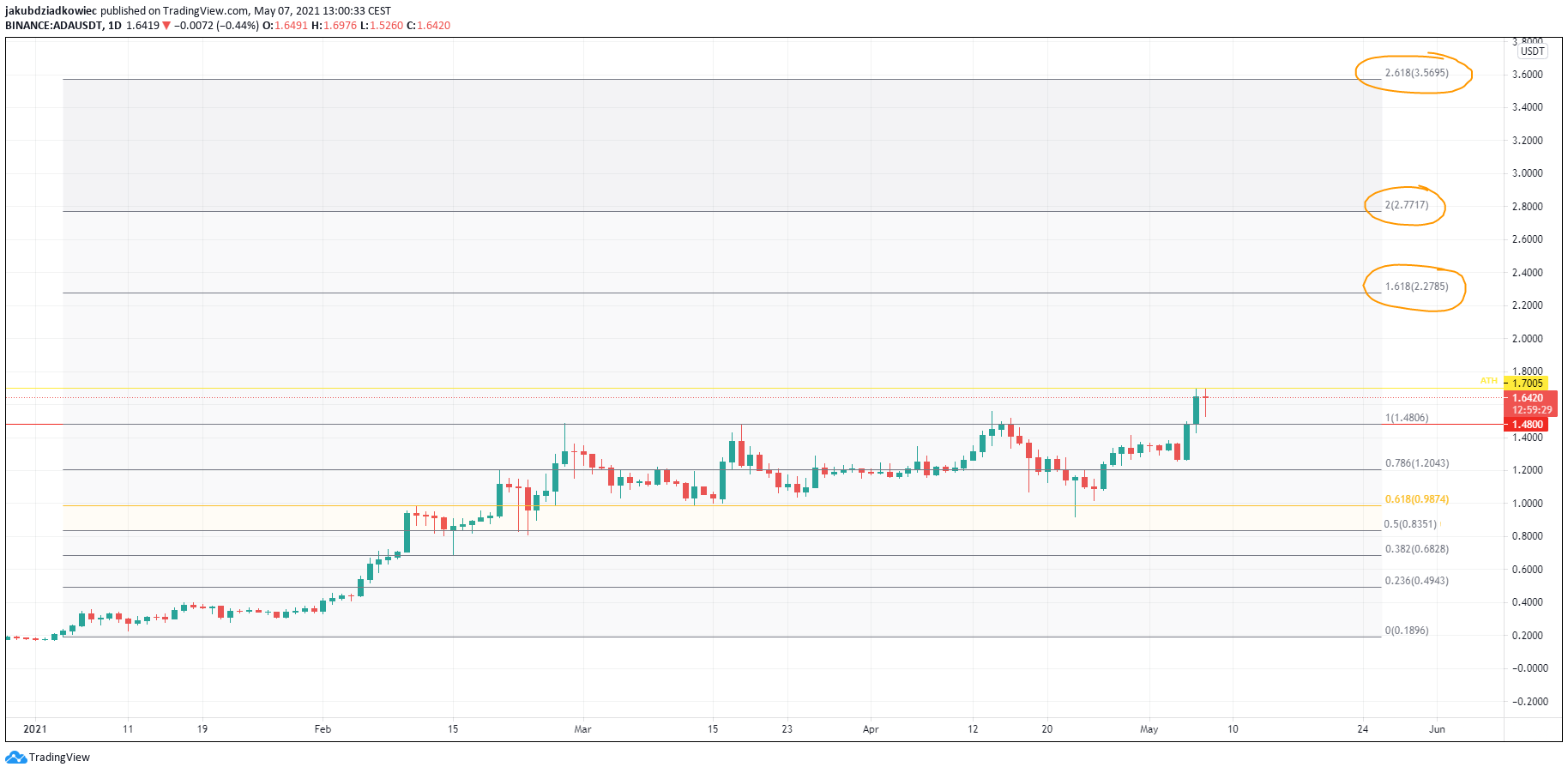

With the beginning of 2021, Cardano (ADA) initiated its bullish impulse. The price increased from the area of long-term consolidation in the $0.10-0.20 range to the historic ATH at $1.55 in just 56 days. Altcoin increased by 777%.

The record was set on February 27, and ADA has been trading in a long-term consolidation since then. For the next 67 days, the price respected the parallel channel in the range of $1-1.50 and with the median of $1.25 that was verified many times.

Yesterday there was a clear breakout from this channel and ADA reached the new ATH at $1.70. From the bottom of the channel to the new peak, Cardano has increased by 65% in just over a week. Breaking the $1.50 resistance was confirmed by an increase in volume (blue arrow).

Technical indicators are bullish and suggest the continuation of another wave of the uptrend. The RSI has just broken out from the long-term downward resistance line that has been in place since February 10 (orange circle). We can expect to retest it before continuing the bullish momentum.

MACD generates more green bars of positive dynamics. The stochastic oscillator heads north even though it is already high in the bullish territory above 80.

ADA future movement

Cardano broke out after more than two months of consolidation, which took place after an impulsive increase. Usually, after such a move, a continuation of the long-term trend can be expected.

Cryptocurrency trader @CryptoRgreen posted a weekly ADA/USD chart on Twitter, which suggests that the re-accumulation could be interpreted as a bullish flag, which is now breaking out. Continuing the pattern predicts a target at $2.78.

This is in line with the goals of the external Fib retracement of this year’s entire upward movement. Thus, we find 3 more targets for Cardano: $2.27 at 1.618 Fib, $2.77 at 2 Fib and $3.57 at 2.618 Fib.

The price is also likely to re-test the $1.50 level and validate it as support.

ADA/BTC

The price action of the ADA/BTC pair is interesting as we see a breakout from the smaller resistance area around 2400 satoshi (orange rectangle). Still, Cardano has to break the resistance of the previous peak at 3000 satoshi in which it is currently trading (red dashed line).

If this is successful, we find another area of resistance at 3610 satoshi. This is a long-term resistance / support area, set at 0.618 Fib of the entire downtrend from the historic ATH at 8788 satoshi on January 4, 2018.

Technical indicators are bullish and support continued growth. As in pair against the USD, the RSI has broken out from the downward resistance line and is rising (orange circle). MACD generates higher bars of positive dynamics. The stochastic oscillator is above 80 and shows no signs of weakening.

Moreover, the cryptocurrency trader @CryptoMichNL predicts that after breaking the 3000 satoshi resistance, ADA can expect significant increase:

Conclusion

Cardano reached the new ATH at $1.70 yesterday. The ADA/BTC pair is now breaking out from the 3000 satoshi resistance area. Technical indicators suggest a continuation of the long-term uptrend.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.