In this article, BeInCrypto takes a look at the seven altcoins that increased the most over the past seven days (March 19 – March 26).

These altcoins are:

- Dent (DENT) – 158%

- BitTorrent (BTT) – 87%

- Ankr (ANKR) – 75%

- Pundi X (NPXS) – 70%

- Harmony (ONE) – 66%

- PancakeSwap (CAKE) – 47%

- THETA (THETA) – 44%

DENT

On March 23, DENT reached an all-time high price of $0.0149. Since then, it has been moving downwards and has decreased by 27%.

Furthermore, it has created a shooting star candlestick, known as a bearish reversal sign.

ETH bounced at the 0.382 Fib retracement level and is increasing.

However, the upward movement is completely parabolic. Therefore, a significant correction is eventually expected. If so, the 0.5 and 0.618 Fib retracement levels at $0.081 and $0.065 would be expected to act as support.

BTT

BTT was the subject of a considerable increase last week. It managed to reach a high of $0.0039. However, it dropped shortly afterward.

The drop was preceded by bearish divergence in the RSI.

The high was made nearly exactly at the 2.61 external Fib retracement, which is a potential reversal area.

Therefore, it is likely that BTT decreases in the short-term, before potentially resuming its upward movement.

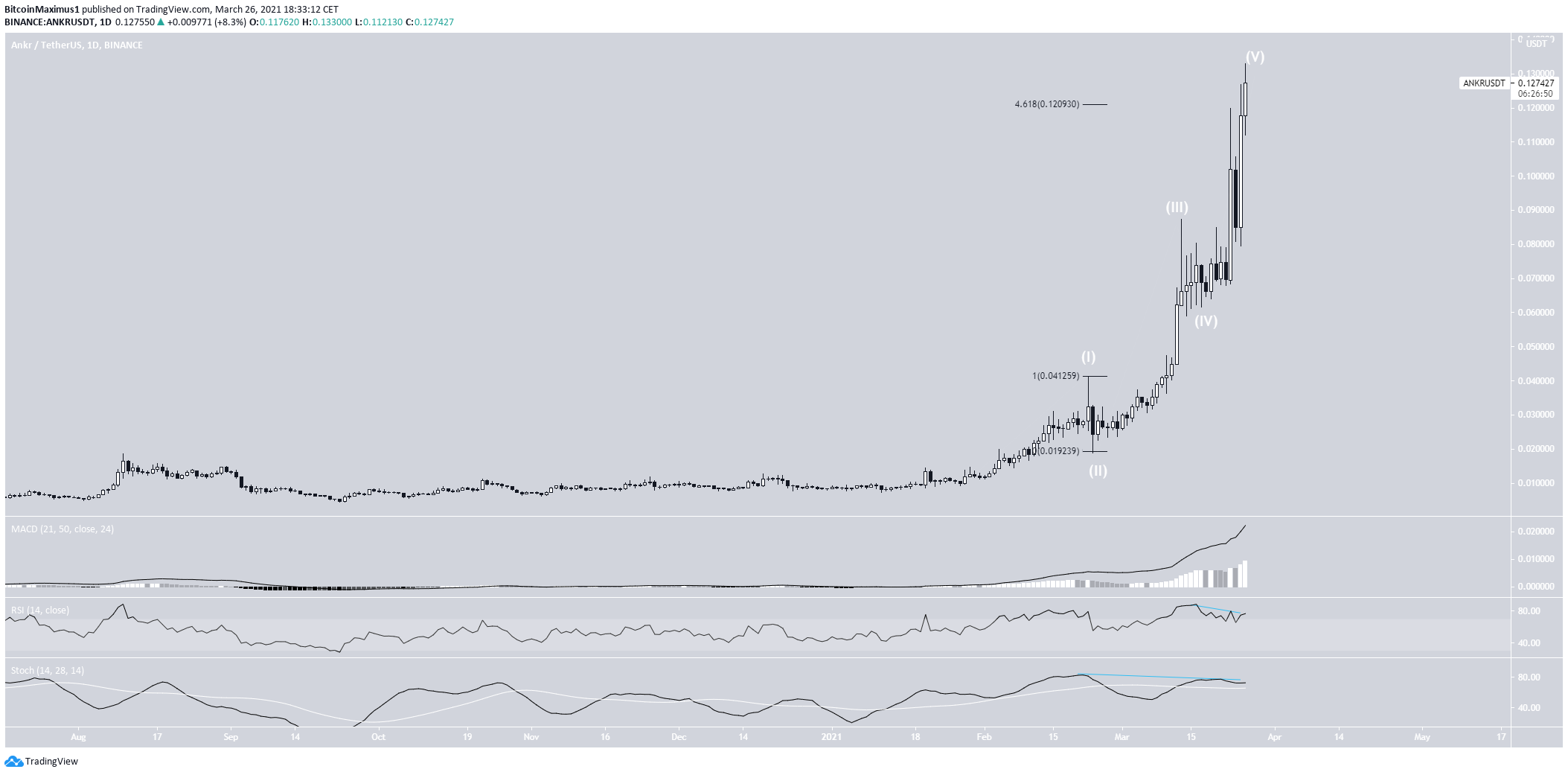

ANKR

ANKR has been on an extended upward movement since Feb 23. Today, it reached a new all-time high price of $0.133.

The movement since Feb. 23 looks like a bullish impulse, in which ANKR is currently in wave five.

While the MACD is still increasing, there is considerable bearish divergence in both the RSI & Stochastic oscillator.

Furthermore, ANKR has already reached the 4.618 external Fib retracement of the previous drop.

When combined with the potentially completed count and bearish divergences, ANKR may have reached its top.

NPXS

Since March 17, NPXS has increased by slightly more than 150%. On March 24, it reached an all-time high price of $0.0087.

Despite the parabolic increase, indicators do not yet show weakness. Furthermore, NPXS has yet to reach the 4.618 external Fib retracement level when measuring from the most recent downward movement. The level often acts as the top of such movements. It is found at $0.0096.

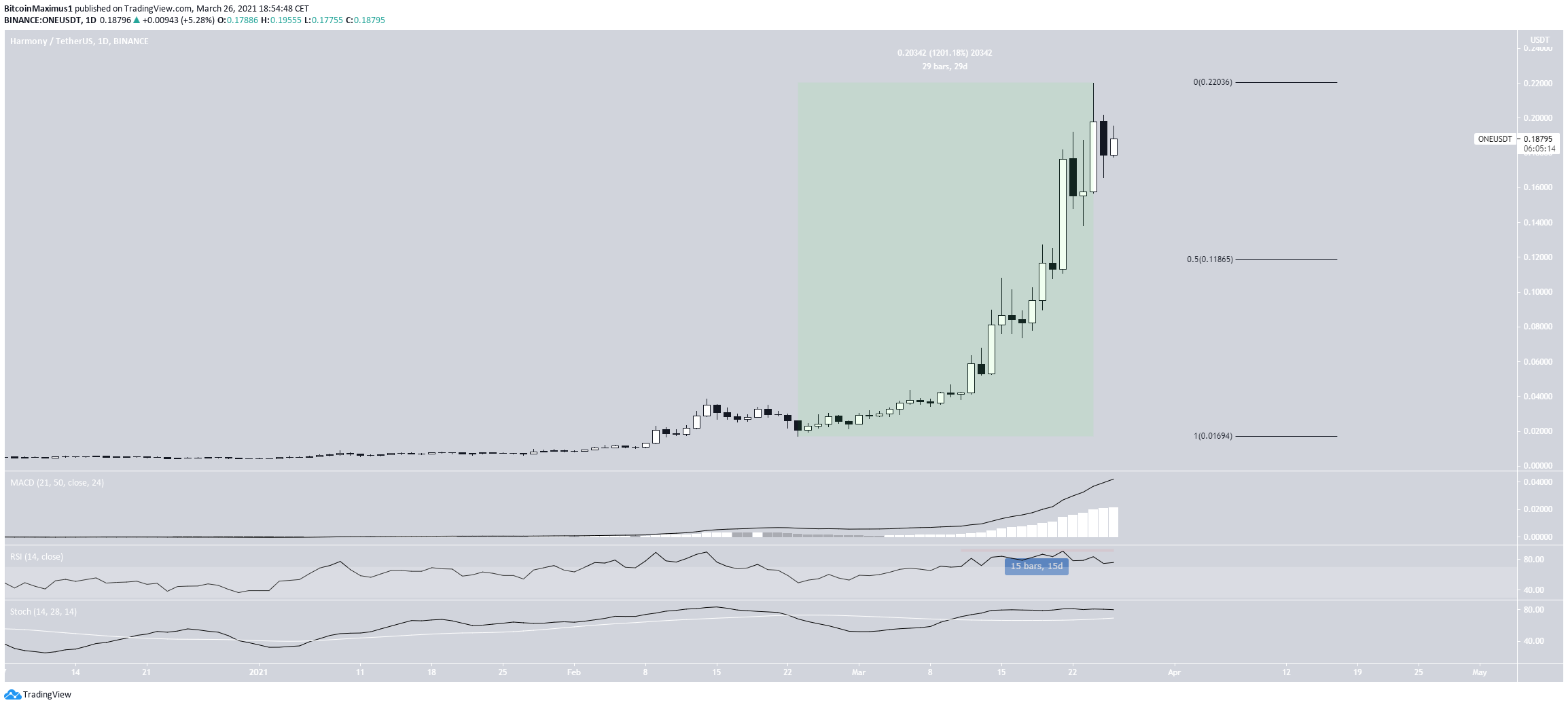

ONE

Since Feb. 23, ONE has increased by a massive 1200%. This led to an all-time high price of $0.22 being reached on March 24.

Technical indicators do not yet show any weakness. However, the move is overextended, as evidenced by the fact that the RSI has been overbought for 15 days.

If a correction transpires, the closest support area would be found at $0.118.

CAKE

On Feb. 19, CAKE reached an all-time high price of $21.45. It began a correction immediately afterward, which took it to the 0.618 Fib retracement support at $8.42. This occurred on Feb. 28.

Since then, CAKE has been moving upwards. Technical indicators support the continuation of the upward movement.

The MACD has given a bullish reversal signal. The RSI has crossed above 50. The Stochastic oscillator has made a bullish cross.

If CAKE manages to close above the $14.40 resistance area, it would be likely to make another attempt at reaching a new all-time high.

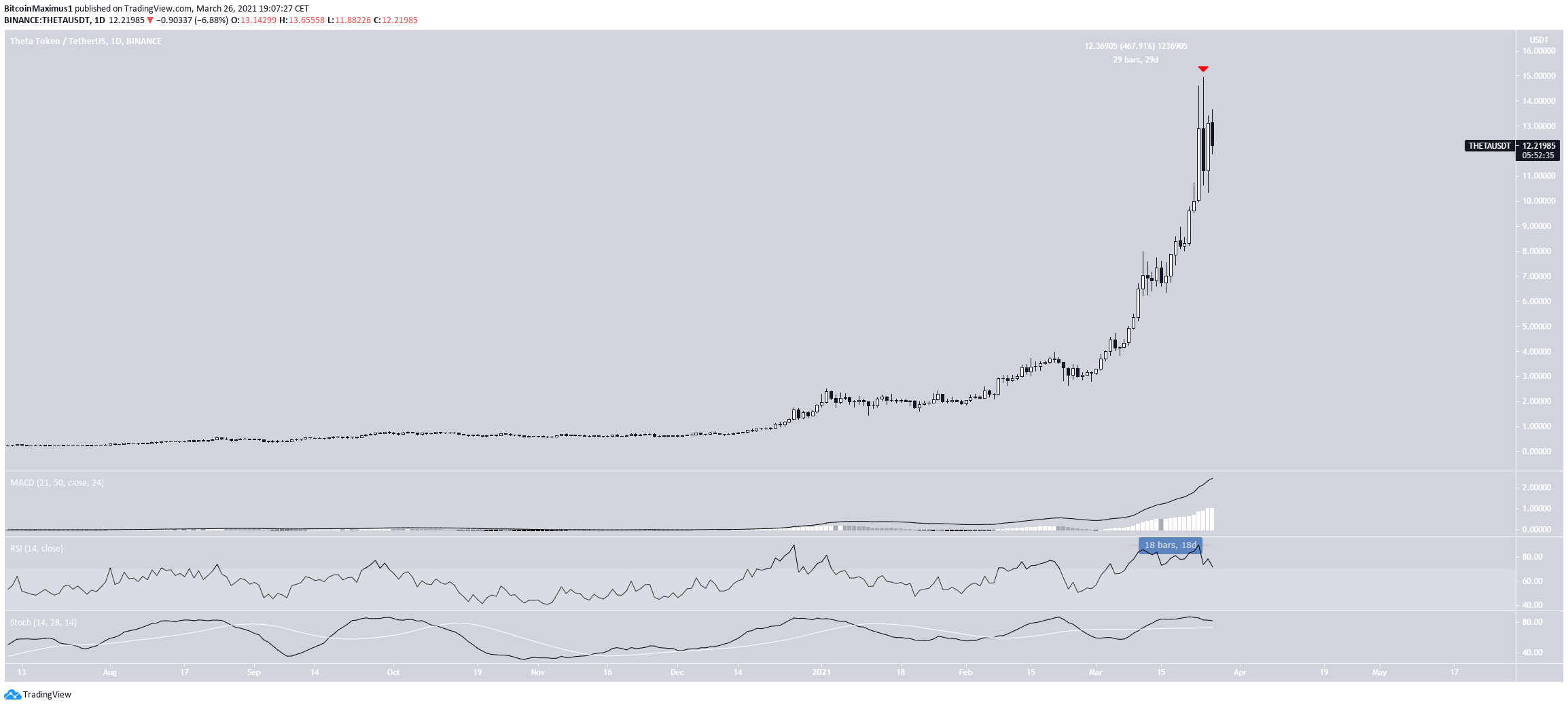

THETA

Since Feb. 23, THETA has increased by 467%. This led to an all-time high price of $14.96 on March 24.

While THETA initially created two long upper wicks, it followed them up with a bullish engulfing candlestick.

Similar to ONE, the RSI for THETA has been overbought for 18 days. However, there are no definite bearish reversal signs.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.