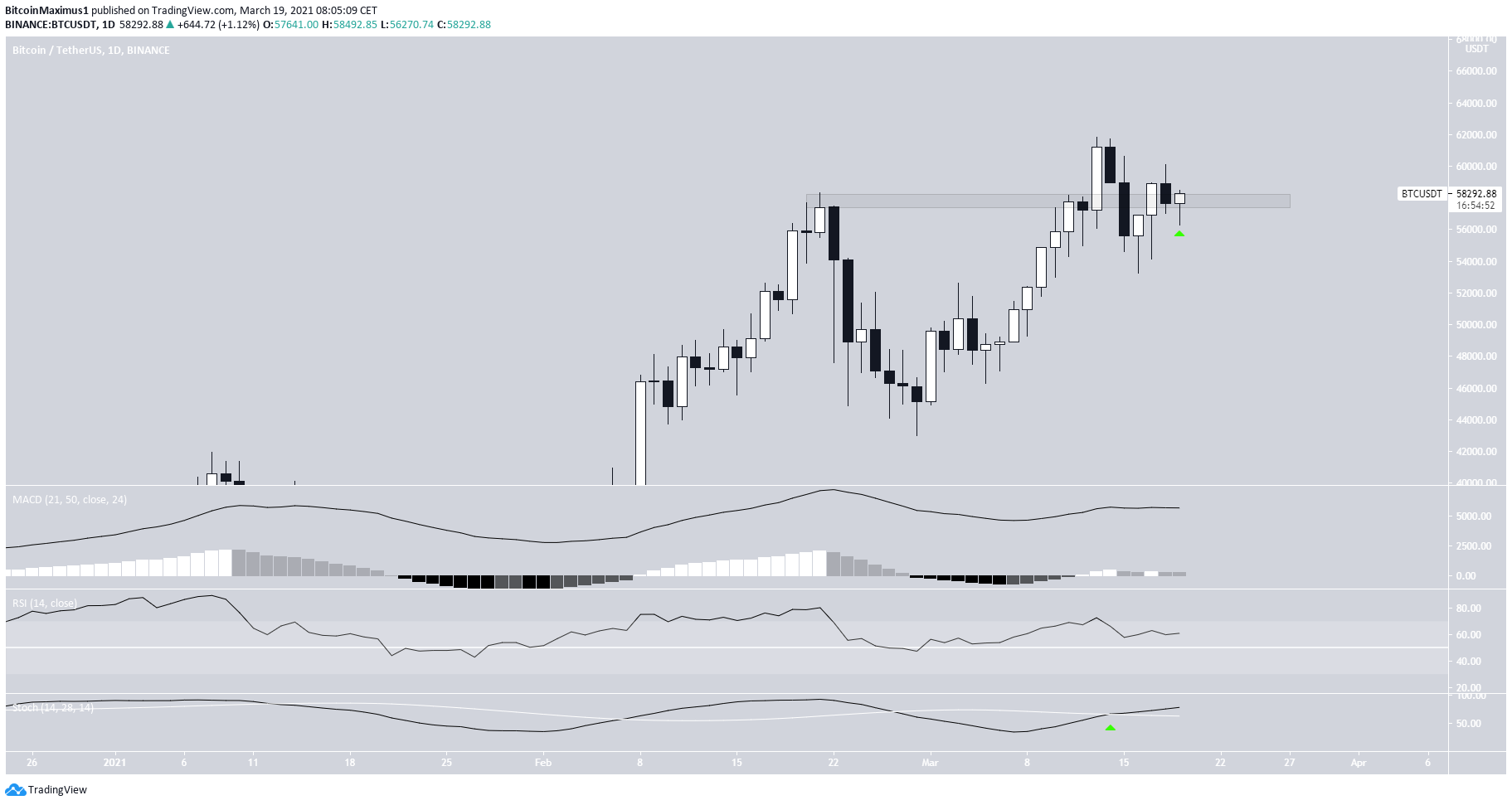

The Bitcoin (BTC) price is in the process of reclaiming the previous all-time high resistance area at $57,800.

Bitcoin is expected to be successful in reclaiming this level and gradually moving towards a new all-time high price.

Bitcoin Attempts Reclaim

BTC has been moving upwards over the past three days, more specifically since reaching a low of $53,271 on March 16.

Today’s movement is very important. Bitcoin is in the process of reclaiming the $57,800 area, which previously acted as the all-time high resistance. If the current daily candlestick closes above it, it would confirm that the area is now a support.

In addition, technical indicators are turning bullish. The Stochastic oscillator has already made a bullish cross, the MACD is positive, and the RSI is above 50.

Short-Term Breakout And Retest

The six-hour chart also supports this possibility.

Bitcoin has already broken out from and retested a descending resistance line. The retest left a long lower wick behind, which also had a bullish close.

In addition, this validated the $57,00 area as minor support.

Both the MACD and RSI support the continuation of the upward move towards a new all-time high price.

Wave Count For Bitcoin

A look at the short-term count suggests that BTC is in the fifth and final sub-wave (black) of wave five (orange).

A confluence of Fib levels provides a target between $67,000-$68,500. The latter is more likely to act as the top, due to being the target of two different Fib extensions.

A Bitcoin drop below the red line, which is the previous lower high of $54,124, would suggest that the upward movement has ended.

For the longer-term wave count, click here.

Conclusion

Bitcoin is expected to reclaim the $57,800 area. After that, it’s likely to gradually increase towards a new all-time high price.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.