The Bitcoin dominance rate has been moving in a tight range since the beginning of February but is expected to eventually break down.

Both the altcoin market cap and ETH/BTC are expected to move upwards.

Bitcoin Dominance Movement

The BTCD has been moving downwards since reaching a local high of 73.63% in December 2020. The movement up to that point was a failed breakout attempt above the 71% resistance area. This is a resistance that has been in place since December 2017. The rejection left a long upper wick in its wake.

Technical indicators are bearish. The MACD has just crossed into negative territory, the Stochastic oscillator is close to making a bearish cross, and the RSI is below 50.

If the BTCD continues to decrease, the next closest support area would be found at 57.50%. Below that, and the next likeliest support would be at 49.82% if a breakdown occurs.

The daily chart provides a more mixed outlook but does nothing to dissuade the readings on the weekly.

BTCD has been consolidating between 60-64% since the beginning of February, but has failed to reach a close above the latter.

Technical indicators are relatively neutral but are showing decreasing momentum. This is evidenced by the potential bearish cross in the Stochastic oscillator.

Altcoin Market Cap

The altcoin market cap (ALTCAP) also suggests that altcoins are expected to increase.

The altcoin market cap decreased considerably last week, creating a bearish engulfing candlestick. However, this only served to validate the previous all-time high area of $450 billion as support.

Technical indicators are bullish, and the RSI has even generated a hidden bullish divergence — a strong sign of trend continuation.

ETH/BTC

Since Ethereum (ETH) is the largest altcoin based on its market cap, its price movement relative to Bitcoin has a significant effect on the BTCD.

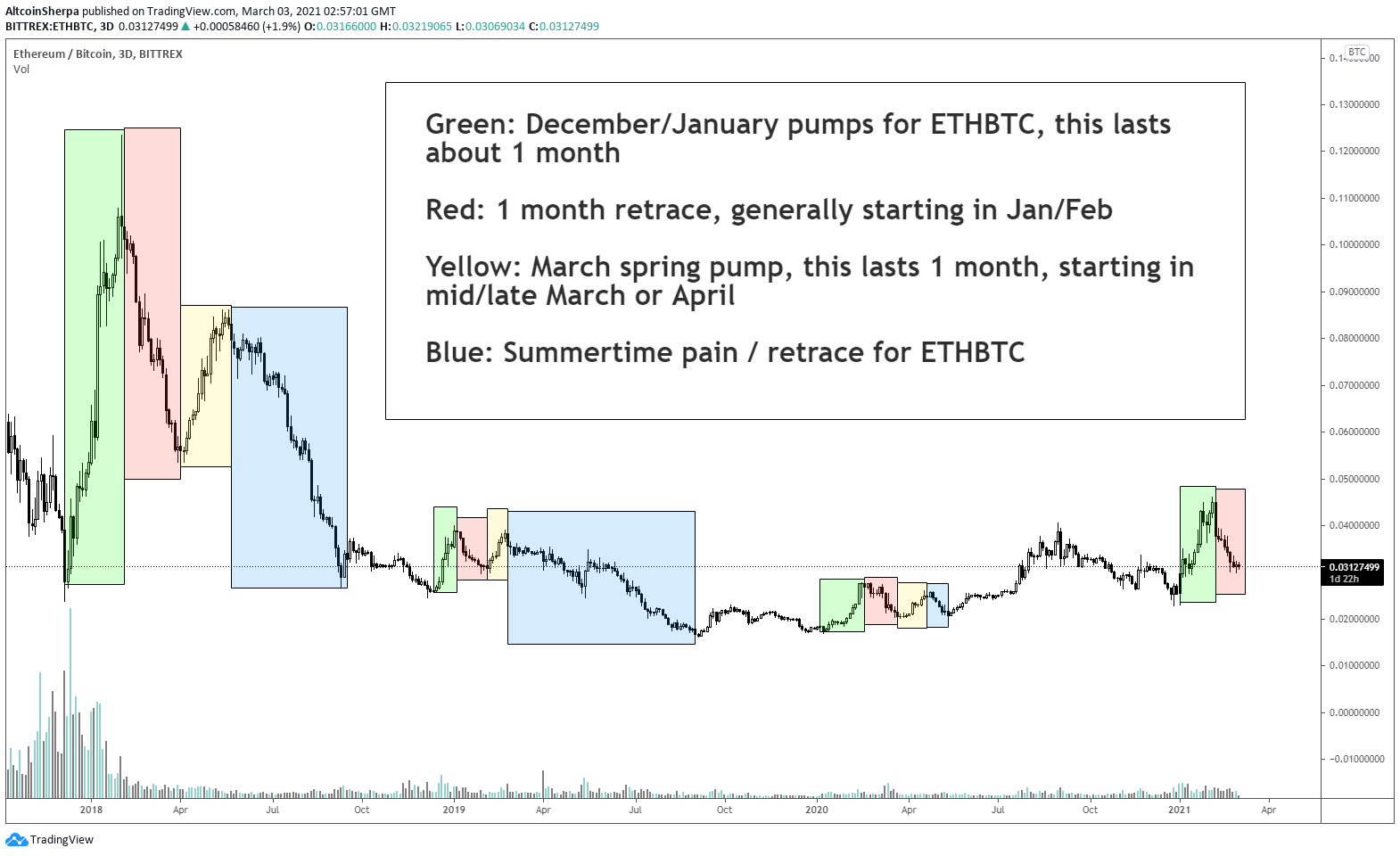

Cryptocurrency trader @Altoinsherpa outlined an ETH/BTC chart, stating that historically the pair has pumped in March/April, and is likely to do the same this time.

ETH is currently trading right at the 0.618 Fib retracement level of the most recent upward move at ₿0.03.

The movement looks like a completed bullish impulse and an A-B-C irregular flat afterward. This pattern could lead to an upward movement.

While technical indicators are still bearish, they are gradually showing a momentum reversal, suggesting that ETH/BTC could be close to a bottom.

Conclusion

The potential BTCD decrease and ALTCAP increase suggest that altcoins are expected to move upwards at a quicker rate than BTC.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.