It appears that the crypto bull euphoria is coming to an end as the entire market sees deep red for the first time in a while.

Prices have fallen sharply for crypto, with ether dropping almost 20%. Meanwhile, bitcoin dropped almost 15%, with some altcoins being hit even harder.

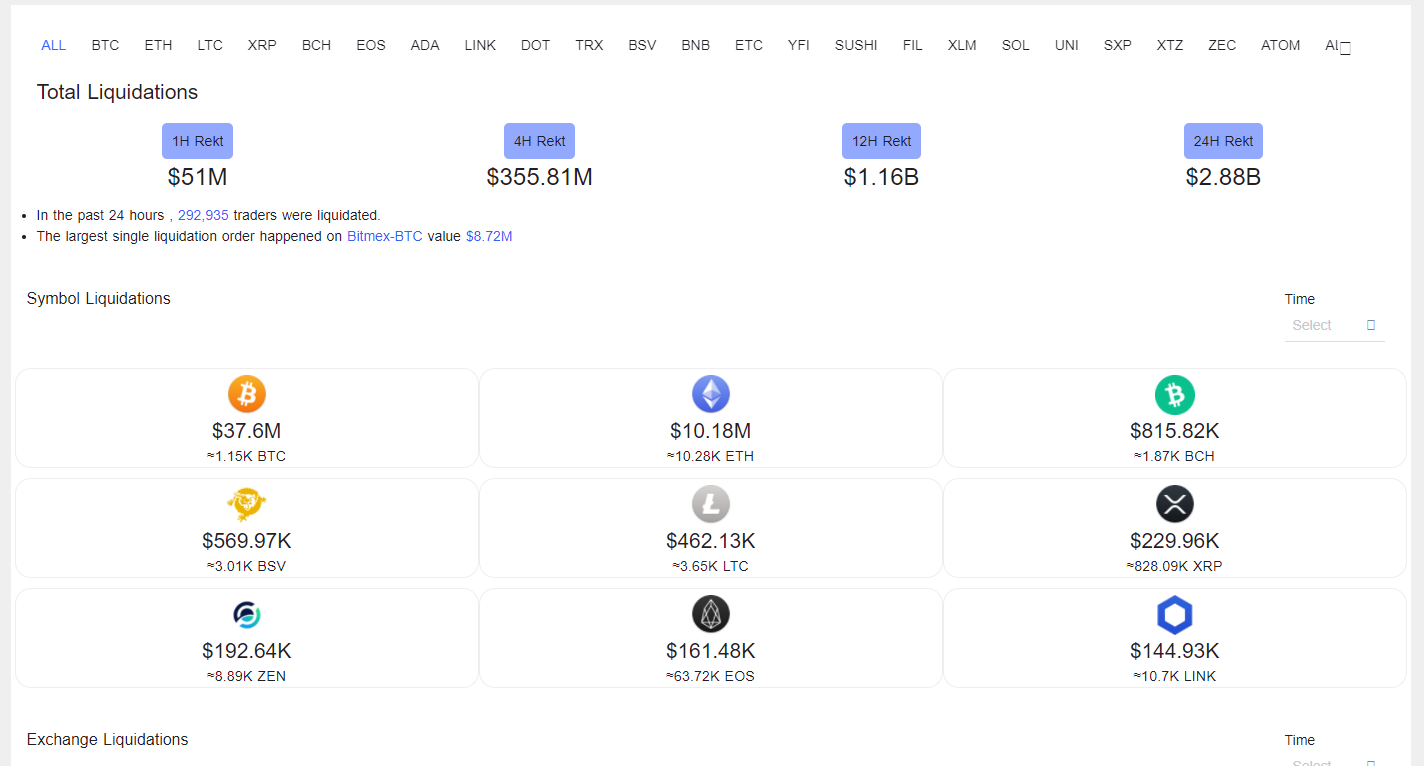

According to Bybt, a cryptocurrency derivatives data analytics platform, $2.87 billion has been liquidated across the entire cryptocurrency ecosystem in the last 24 hours. That includes $1.77 billion worth of bitcoin and $629.5 million’s worth of ether.

The majority of the liquidations took place on Binance, then Huobi, and finally BitMEX. The largest single liquidation occurred on BitMEX in BTC, where a trader lost a staggering $8.72 million.

Have We Topped Out In Price?

Since bitcoin broke its previous 2017 all-time high price records, it has barely seen any downside selling. This is the first +15% drop since the latest crypto bull run began.

Breaking all-time highs daily, bitcoin was almost perpetually in price discovery. In other words, the market was constantly trying to determine a fair value spot price.

Since bitcoin moved over twice its previous all-time high, a pullback is expected. Many users are uncertain whether the asset will continue to drop, find support, or bounce back and continue to move into price discovery.

What to Expect in Crypto Moving Forward

Some retail users that are more conspiratorially minded claim that ‘market manipulation’ is the cause for the recent price rise. But bitcoin is an inherently volatile asset that just experienced one of the biggest bull runs ever seen.

With such rapid growth across the entire space in such a short time, it’s only natural to see such price volatility as speculators take profits.

Ethereum is being hit hard as well. Though it accounts for about 35% of bitcoin’s total monetary losses, it only has a market cap of around one-fifth.

Cryptocurrency traders with years of experience know well that massive volatility throughout the space will likely remain until crypto moves into the mainstream.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.