The BNB Foundation announced the completion of the 28th quarterly BNB token burn. It comes only two weeks after the ecosystem celebrated its seventh anniversary.

Amid talk of an altcoin season, token burning is among the many catalysts that could steer a value surge for altcoins.

BNB Chain Completes Quarterly Burn

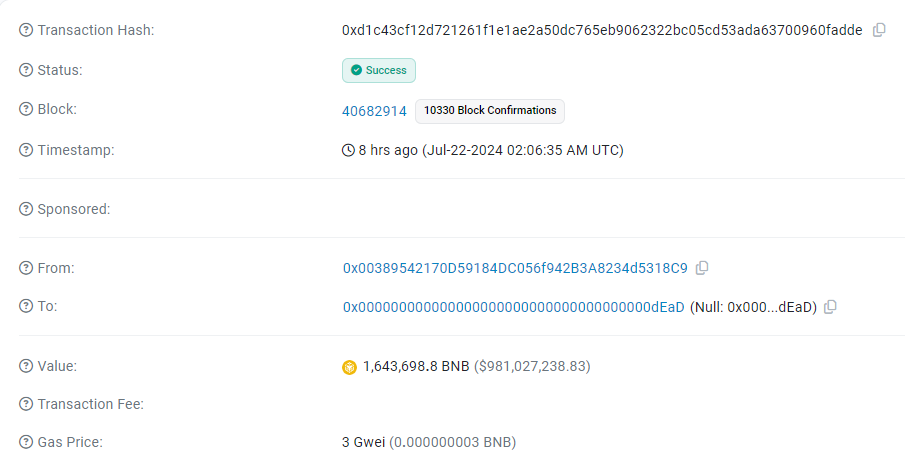

In the latest event, the BNB Chain ecosystem burned 1,643,698.8 Binance Coin (BNB) tokens worth approximately $971 million. This was part of the BNB auto-burn mechanism, independent of the Binance centralized exchange, whose figures are reported quarterly.

The company’s quarterly burn program has been running since October 2017. The introduction of the BNB auto-burn mechanism aims to eliminate 100 million BNB tokens, equating to half of its total supply, from circulation.

Read more: What Is BSCScan? A Guide to Using The Blockchain Explorer

The previous quarterly burn happened in April, where 1,944,452.51 BNB tokens worth $1.17 billion were burned, sending BNB up 5%. This one, however, was different.

It occurred directly on the Binance Smart Chain (BSC) amid ongoing BNB Chain Fusion. It marks the first of many, with the corresponding BNB amount sent to this “blackhole” address.

“The price of BNB did not show much reaction after this news. BNB Burn is an activity carried out periodically by Binance every three months since the platform was established. The exchange proactively burns BNB until the total supply is reduced to 100 million from 200 million tokens,” a popular X account noted.

Alongside the auto-burn, the BNB ecosystem also has a real-time burn mechanism, introduced with the BEP95 update. It is based on gas fees, and nearly 234,000 BNB tokens have been burned under this mechanism since its inception.

On this report, BNB trading volume soared 28% alongside a small value surge, suggesting increased attention on the token. This is because token burning increases the scarcity of the remaining tokens, potentially increasing their value.

BNB Community Hopes for Positive Price Action

Token burning is a common practice in the cryptocurrency space. In this practice, a certain number of coins are removed from circulation. The network sends them to an inaccessible wallet address or burn address, effectively reducing the token’s total supply.

Accordingly, BNB community members anticipate an increase in the BNB token’s price. However, the BNB price remains subdued below $600 after a brief test of the psychological level.

“BNB quarterly burn, based on data from previous years, the annual amount of destruction is gradually declining.The recent destruction has had no obvious positive effect on the market. One important reason is that the smaller the Token burned, the smaller the deflationary effect, thus there is less force to push prices up. At the same time, the steady pace of destruction has helped foster long-term trust in BNB,” Edward Wu, Analyst at BloFin Research & Options, told BeInCrypto.

On the daily timeframe, the odds lean toward the upside, with the Relative Strength Index (RSI) well above the mean threshold of 50. The Moving Average Convergence Divergence (MACD) is also above the signal line and in positive territory. This shows buying pressure exceeds seller momentum.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Nevertheless, given the RSI is inclined south, momentum is falling, and the BNB price could record a subsequent red candlestick.