The majority of altcoins have been trending downward when looking at their BTC pairs. The recent upward movement of some major coins has led some to believe that a bullish cycle for altcoins is right around the corner.

Trader, entrepreneur, and investor @BobLoukas pointed out that relative to Bitcoin, the majority of altcoins have been trading downward since early 2018 when the BTC price was at an all-time high. However, some major coins have broken out above long-term resistance lines that have been measuring this downward trend.

Relative to #Bitcoin, the Alt's have been in almost 2 year bear market since early 2018, soon after the Bitcoin/USD bubble top.

Early Days yet to call, but seeing some signs of possible end in bear market for Alt's. Weekly charts.$EOS $ETC $XMR $ZEC $LTC pic.twitter.com/mJFmHdvxFV

— Bob Loukas 🗽 (@BobLoukas) January 27, 2020

The coins are:

- EOS (EOS)

- Ethereum Classic (ETC)

- Monero (XMR)

- Zcash (ZEC)

Below, we will take a look at each of them individually and measure their potential for future price increases.

EOS

Out of the four coins, EOS is the only one that has not moved above a descending resistance line, since it has not been clearly following one.

The most critical resistance area for EOS is found at 5200 satoshis. Since reaching its all-time high price in April 2018, the EOS price decreased but stayed above this level, bouncing strongly in December 2018. However, the price fell below this area in July 2019, 644 days after the all-time high.

Afterward, the price continued to decrease until it found support at 3000 satoshis. This movement is important for the future price prospects since the weekly RSI fell into oversold territory and generated bullish divergence, the only time it has done so throughout EOS’ price history. This was combined with a double bottom, a bullish reversal pattern. As we will see in the other coins, this is a sign that very often precedes price increases.

Since then, the price has been increasing, and the RSI has moved above the 50 line. The price is very close to reaching the resistance area at 5200 satoshis.

The daily time-frame reveals a breakout, confirming the prospect of continued upward movement. The price successfully broke out of 4000 satoshis before validating it as support afterward.

Also, the 100- and 200-day moving averages (MA) have made a bullish cross. This is another strong bullish development, especially since the price is trading above both MAs. Thus, it is very likely that the price will reach 5200 soon.

EOS has shown solid signs of an uptrend, but we cannot state with certainty that it is in a bullish market until it breaks out above 5200 satoshis. If so, we think it can reach highs of 12,000 satoshis rapidly.

We discussed EOS in detail here.

Ethereum Classic

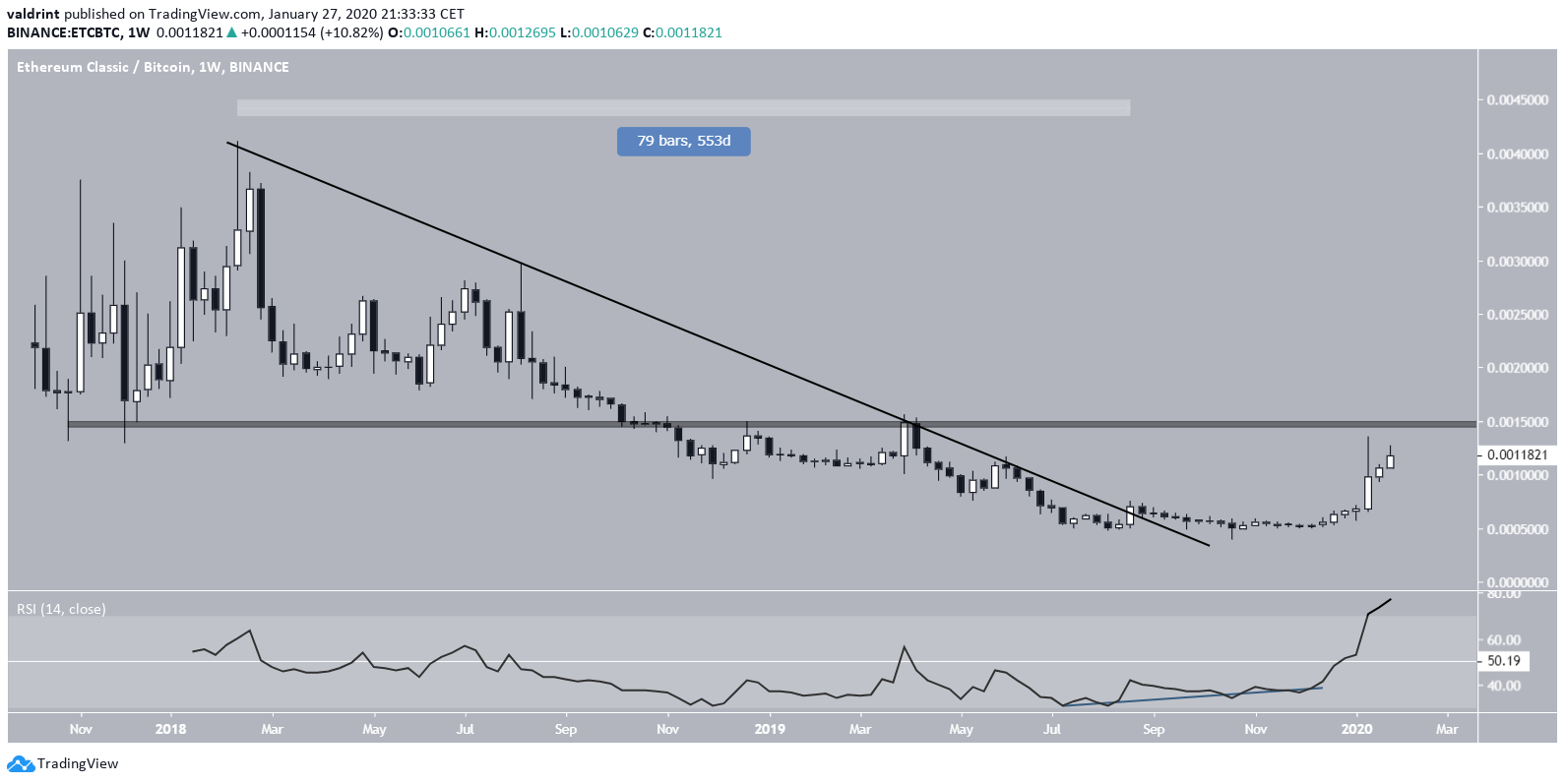

Since reaching the all-time high in February 2018, the ETC price followed a descending resistance line for 553 days. The most important level is found at 15,000 satoshis. Unlike EOS, the price broke down from this area less than a year after reaching the all-time high, validated it twice, and continued to decrease, reaching new all-time lows in the process.

Once it reached values around 5000 satoshis, on August-November 2019, the weekly RSI generated bullish divergence inside the oversold region, the first time it has done so. A rapid upward movement followed afterward. As we stated before, this is a development that very often precedes price increases.

There was another shorter-term descending resistance line, present almost from the exact same time that the breakout from the longer-term one occurred. The price broke out from this one after 119 days, and the rate of increase significantly accelerated afterward.

Similarly, the 100- and 200-day MAs have made a bullish cross, and the price is trading above them. This suggests continued price increases towards at least 15,000 satoshis and possibly higher.

The ETC price has been increasing rapidly since the beginning of 2019. It needs to break out above 15,000 satoshis to confirm the upward trend. If so, the price can reach highs around 30,000 satoshis.

XMR

Similar to the other two altcoins, the XMR price reached a high sometime around March 2018. It followed a descending resistance line since July of the same year, doing so for 546 days before breaking out.

What preceded the breakout was very similar to EOS and ETC. A double bottom combined with a bullish divergence in the weekly RSI, which was in the oversold region.

The most important level is found at ₿0.012. A breakout above this level could take the price to the top of the descending resistance line at ₿0.02.

The 100- and 200-day MAs have yet to make a bullish cross, and the price is trading above them. If the price continues to do so, the MAs will soon make the cross. This suggests that relative to EOS and ETC, XMR is at a more preliminary phase of its upward trend.

In the short-term, there is resistance at ₿0.008. As long as the price stays above the aforementioned MAs, it will continue moving towards this area and possibly ₿0.012.

The XMR price has broken out above a significant descending resistance line, but a bullish cross between long-term averages has yet to occur. Therefore, XMR is possibly at an earlier stage of its upward trend.

We discussed Monero in detail here.

ZEC

Unlike the other three altcoins, ZEC reached its all-time high earlier in June 2017. Thus, the descending resistance line that followed lasted for 776 days, until the price finally broke out in September 2019.

Afterward, the weekly RSI fell into the oversold region and generated bullish divergence. What followed was an upward move, similar to the other coins.

Akin to XMR, a bullish cross is very close to transpiring between the 100- and 200-day MAs. Also, the price is trading above them.

The closest resistance area is at ₿0.0085, while the most important one, the previous breakdown level is found at ₿0.017. If the price breaks out above this area, it could go all the way to ₿0.03.

The ZEC price has broken out above a long-term descending resistance line, the longest out of the four coins we have analyzed. But a bullish cross between long-term averages has yet to occur, indicating that ZEC is possibly at an earlier stage of its upward trend.

Altcoins Analysis Conclusion

All four altcoins – EOS, ETC, XMR, and ZEC – have shown some signs of strength, indicating that they want to move upward. As it stands, EOS and ETC seem more matured in their upward trends, likely being at a more advanced stage. However, neither of the coins have moved above their previous breakdown levels. While this suggests that confirmation of the upward trend has yet to occur, it also allows for a higher magnitude of price increases in the future.

A list of reversal signs which suggest that the price has/is close to reaching a bottom is given below:

Altcoins Reversal Signs

- Bullish reversal pattern near significant support or all-time lows.

- Weekly RSI oversold and generates bullish divergence.

- Bullish cross of long-term MAs combined with movement above resistance.

- A price increase above the previous breakdown level confirms the upward movement (has not occurred yet.)