Canadian digital asset manager, 3iQ, will be launching its Ethereum based fund on the Toronto Stock Exchange on December 10.

The firm has already launched a public BTC fund on the Toronto Stock Exchange and is now expanding its offering with the Ether Fund.

The Ether Fund IPO

According to Tyler Winklevoss, Bitcoin billionaire and co-founder of Gemini, a cryptocurrency exchange and custodial platform, 3iQ’s Ether fund has raised approximately $75 million before the IPO.

Winklevoss explains that all of the Ether from this fund will be stored and protected by Gemini Custody, one of the major institutional custodial players in the space.

As more institutional investors look to invest in cryptocurrency, many also require the necessary legal and custodial frameworks to mitigate the downside risks.

These frameworks require regulatory approval to give assurance to institutions and large investors that their funds are safe.

More Interest in Ethereum

The cryptocurrency ecosystem continues to mature, bringing in larger institutional investors on a regular basis. Bitcoin remains the dominant cryptocurrency with over 60% market share. And this tends to be the first port of call for new users.

Considering Ethereum has a very different operational model than Bitcoin, Ethereum may drive additional interest as a high-risk, high-reward investment.

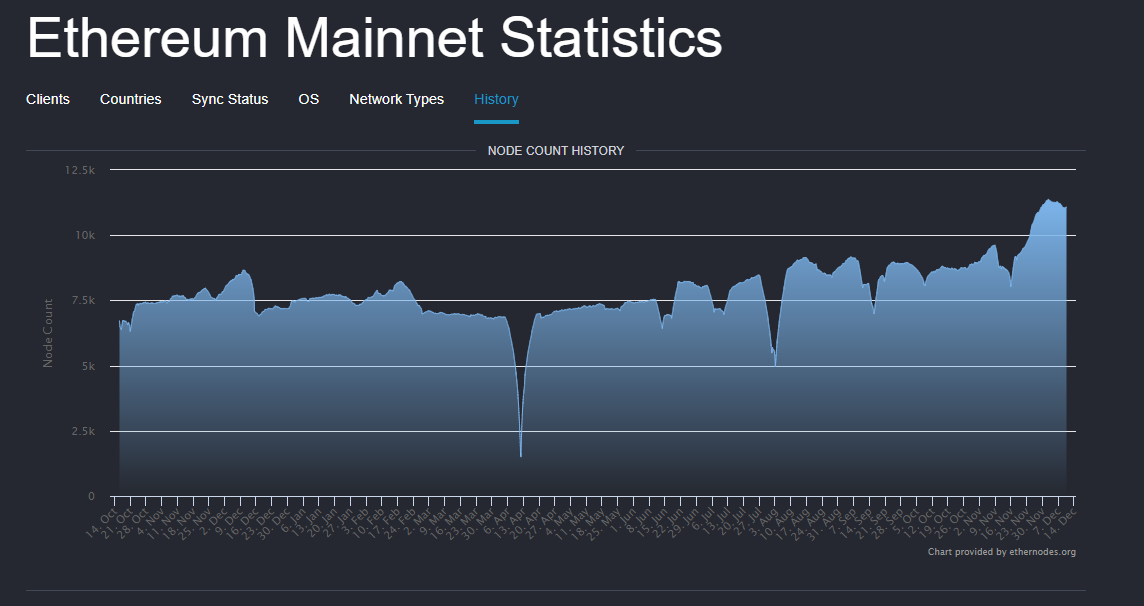

The Ethereum 2.0 Beacon Chain launched at the beginning of December. And data from ethernodes suggests that the smart contract blockchain is more secure and usable than ever.

The upgrade changed how Ethereum transactions will be processed, moving from a Proof-of-Work (PoW) model to a Proof-of-Stake (PoS) model. Ethereum appears to be gaining more exposure as a mainstream asset. And this latest IPO suggests that investors are taking notice.

According to Grayscale, the digital asset manager with over $10 billion in crypto assets under management (AUM), there are many growing ‘Ethereum-only’ investors.

Michael Sonnenshein, Managing Director at Grayscale, recently stated:

“Over the course of 2020, we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. […] There’s a growing conviction around Ethereum as an asset class.”

Grayscale currently owns approximately $2 billion worth of Ether on behalf of its investors, a number that will more than likely continue going up.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.