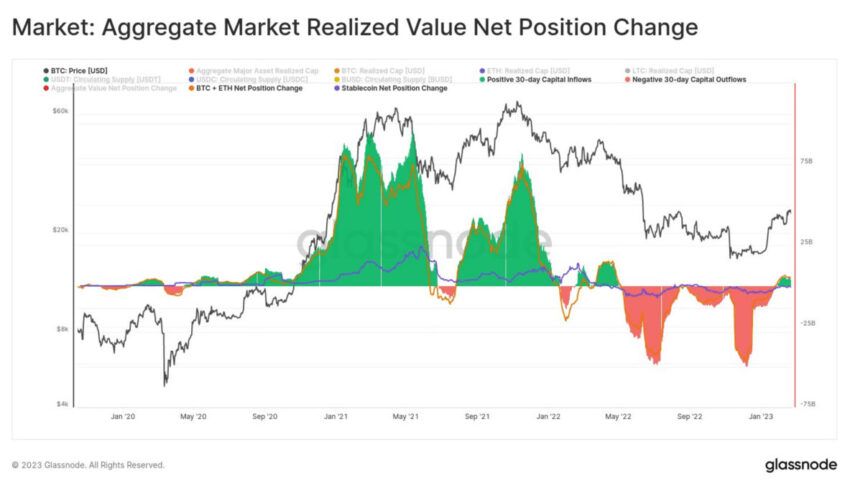

Money is returning to crypto markets faster than it is leaving as capital flows turn green again for the first time in nine months.

According to blockchain analytics provider Glassnode, 30-day capital flows in crypto are back in positive territory.

Furthermore, the aggregate market realized value net position is back in the green for the first time since April 2022.

For the past nine months or so, this metric has been in negative territory as more capital flowed out of crypto markets than into them.

Since the beginning of 2023, crypto market capitalization has increased by 36%. This has been a result of more than $300 billion re-entering the space.

Nevertheless, markets are still 63% down from their November 2021 peak levels when total market capitalization topped $3 trillion.

Bitcoin Whales at 3-Year Low

Another positive metric is that the number of Bitcoin whales has fallen to a three-year low. This means that the asset has become more distributed and less concentrated among just a handful of whale wallets.

Greater asset distribution is better for the entire ecosystem as it removes the specter of market manipulation by a few bag holders.

On Feb. 27, Glassnode also reported that the percent of the BTC supply last active has just reached an all-time high of 28.2%. This shows that adoption and network usage have been steadily growing, despite the bear market.

The crypto bullishness comes at a tough time with macroeconomic woes still looming and global regulators on the warpath.

There have been talks of an outright ban by the IMF (International Monetary Fund). Furthermore, SEC Gary Gensler has reiterated his opinion that all cryptos aside from BTC are securities.

If China is the example, banning something will not stop people from wanting it or acquiring it. The more that politicians and bankers crack down, the more lucrative crypto could become. There will always be forward-looking nations that remain open to the industry and assets.

Crypto Market Outlook

Markets are in the green during this Monday morning’s Asian trading session. Total capitalization has gained 1.8% on the day to reach $1.13 trillion at the time of press.

However, the majority of high-cap assets have remained range bound for the best part of this month.

Bitcoin (BTC) had gained 1.4% to reach $23,557 at the time of writing. Meanwhile, Ethereum (ETH) was trading up 2.3% on the day at $1,640.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.