Last week, crypto markets faced dwindling activity, with global crypto market capitalization slipping by 3% as traders exited to avoid losses.

Despite this slowdown, some crypto stocks remain firmly on investors’ radar, mostly due to institutional adoption and ecosystem developments that could drive renewed momentum. Some of them include COIN, MIGI, and ELWS.

Coinbase (COIN)

Coinbase closed Friday’s session at $312.59, up 1.92%. The stock is in focus this week, with institutional adoption news fueling investor sentiment.

On September 23, Caliber, a diversified real estate and digital asset management platform, announced that it chose Coinbase Prime as its institutional trading and custody platform to support its Digital Asset Treasury (DAT) Strategy.

Through Coinbase Prime, Caliber will access deep liquidity and institutional-grade custody.

If this news continues to fuel buying activity through the week, COIN’s price could strengthen toward $329.26.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, if selling pressure mounts, the price risks a retreat below $293.61.

Mawson Infrastructure Group Inc. (MIGI)

MIGI closed Friday’s trading session at $0.50 per share, recording an 8.54% gain for the day. The stock’s positive movement has drawn attention from market participants, particularly as the company recently provided new operational and corporate updates.

In a release dated September 17, the company reaffirmed that it continues to operate normally across its U.S. facilities, with its Midland, Pennsylvania site remaining a core hub supported by long-term site tenure.

Importantly, the company addressed its Nasdaq listing status, noting that it has engaged advisors and presented a compliance plan to the exchange. Mawson has since secured an extension to regain compliance, allowing it more time to maintain its listing.

Given these updates, if buying momentum builds through the week, the stock has the potential to push above the $0.53 level.

Conversely, MIGI could retreat and test support near $0.47 if selling pressure picks up.

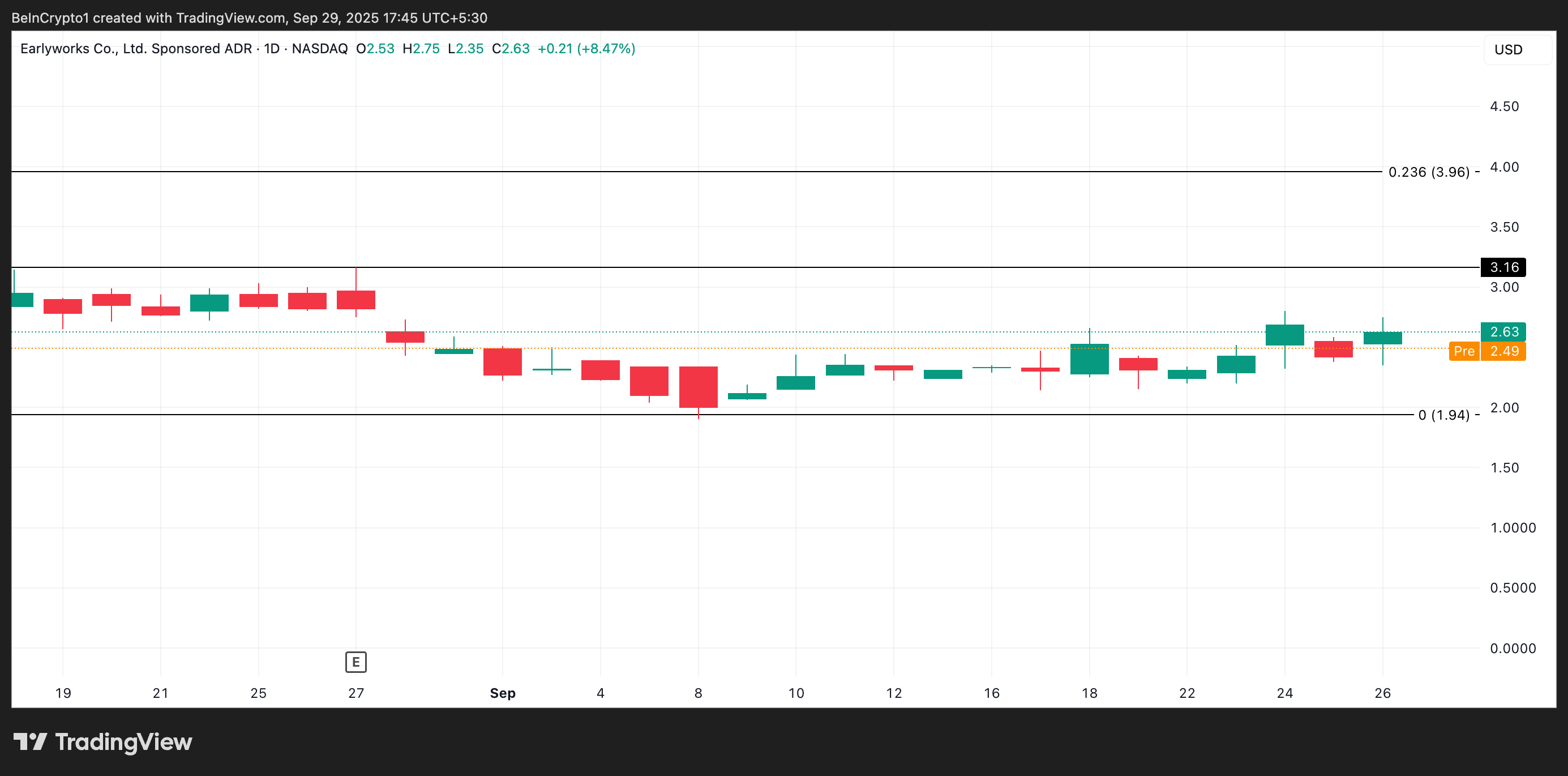

Earlyworks Co., Ltd. (ELWS)

Earlyworks’ shares ended Friday’s trading session at $2.63, gaining 8.47%. The strong move puts the stock in focus this week as traders weigh the company’s latest regulatory update.

On September 23, Earlyworks announced that the Nasdaq Hearings Panel granted it a final extension until October 29 to regain compliance with the exchange’s continued listing standards.

This extension marks the last opportunity for Earlyworks to meet Nasdaq’s requirements. The company is working on equity financing initiatives to regain compliance, but if it fails to do so by the new deadline, its securities will be delisted.

Given the heightened attention around compliance and financing progress, price action in ELWS could swing sharply.

If buying momentum builds this week, the stock’s price may climb toward $3.16.

Conversely, sustained selling could push shares below $1.94.