As October reaches its end, the crypto market has managed to ignite hopes for investors and traders with some quick mid-week gains. Here are some crypto predictions for BTC, ETH, and altcoin prices.

The crypto market cap tested the $1 trillion mark on Oct. 26, with Bitcoin (BTC) price, Ethereum (ETH) price, and most altcoins noting record gains on their daily chart. The greens on the daily and weekly charts tempted investors to get back into the crypto market, spiking trade volumes and short liquidations.

Still, pretty much like everything else, the gains, rallies, and bullish sentiments were limited. The battered BTC price action soon fell prey to consolidation, and the rest of the market followed as the crypto market cap dropped down to $990.39 billion at press time.

Bitcoin price and the larger altcoins sudden gains opened the doors for bullish speculations going into the month of November.

Here are the three of the biggest crypto predictions for November 2022. Make sure to also read the Top 5 Altcoins to Watch in November 2022.

Bitcoin Price Prediction November 2022: BTC to Hit $30,000

The first crypto prediction for November 2022: Bitcoin price was down 70% from its November 2021 all-time high price of $69,000. After almost a year after the BTC price made a new all-time high, many in the market expect price action to pick up again.

The recent gains 8% weekly gains freed BTC price action from the rangebound momentum it had moved in for almost a month. Data from Messari showed that the Bitcoin price was finally up by almost 16% from the June 2022 cycle low.

Despite short-term uncertainty, data from CryptoQuant presented a healthy long-term on-chain view of the top crypto. One long-term bullish trend was that BTC reserves continued to trend downwards while USDC reserves continued to be deployed.

Other than that, Bitcoin weekly price chart showed price action deviating from the long-term downtrend that was in play since March 2022. Furthermore, BTC RSI also seemed to pivot from the long-drawn downtrend that was in play since November 2021.

Bitcoin price breaking above the $23,900 mark in November could aid the uptrend to the $30,000 resistance level.

That said, recent findings by Matrixport predicted that BTC could begin to rally, reaching $63,000 by March 2024, when the crypto would undergo mining reward halving. The forecast was made by Matrixport Markus Thielen, who bases the assumption on the fact that BTC could repeat the bullish price action seen in the lead-up to the July 2016 and April 2020 halvings.

During both the time periods before halving, Bitcoin price started to gain momentum 15 months ahead of the halving. As per this assumption, the BTC price could start its bullish momentum next month.

Ethereum Price Prediction November 2022: ETH to Reach $2,000

The second crypto prediction for November 2022: Ethereum already has investor eyes glued to its price after gaining almost 20% in the last week. The ETH price managed to clear the crucial $1,500 resistance, with price trading at $1,534 at press time.

Last year, Ethereum managed to outperform Bitcoin in terms of gains, but throughout 2022, ETH calmly followed BTC’s lead. The last week, however, saw ETH price chart higher gains than BTC price and most of the top 100 cryptos by market cap.

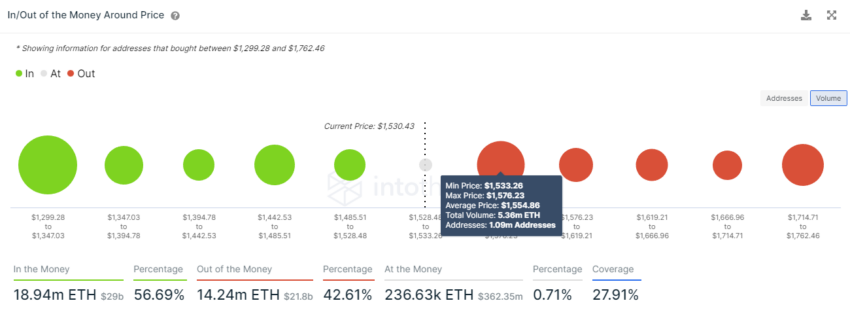

Notably, the ETH In/Out of Money Around Price indicator presented some resistance at the $1,554 mark, after which the road to $2,000 could be clear.

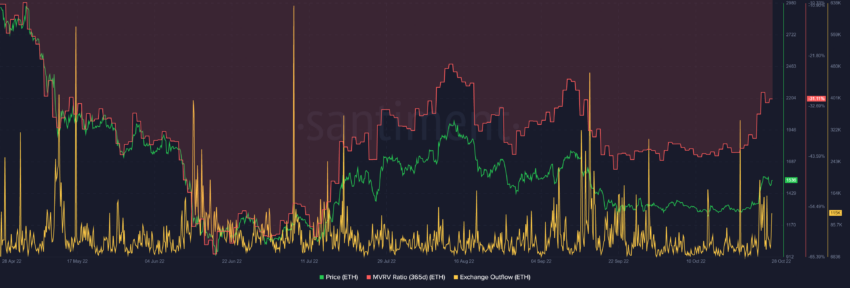

With the long-term MVRV ratio starting to reverse and exchange outflows noting large withdrawals, the ETH price could be preparing for a breakout. An Ethereum price breakout above the $1,750 mark could confirm an ETH bullish price action above $2,000 in November.

Altcoin Season: Altseason in November 2022?

The third crypto prediction for November 2022: Altcoins have taken a backseat for the most part of this year, with Bitcoin consolidation paving the way for larger market losses. Despite a few mid-cap altcoins occasionally pumping, there hasn’t been much action for altcoins.

That, however, can change for the better, with Bitcoin prices turning bullish. Notably, the altcoin market cap seemed to be charting a recovery from the lower $900 billion mark.

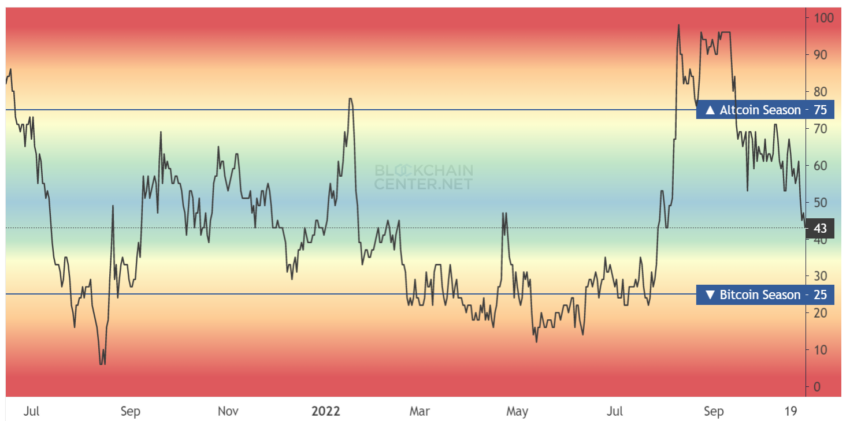

Even though the altseason index still showed no signs of an altseason in play, it was testing a key support barrier.

A move by the Altcoin Season Index above the 75 mark could mark the beginning of an altseason in November. If the Bitcoin price above the $30,000 scenario plays out well, altcoins could continue to rise in tandem with the top crypto.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.