DEX aggregator 1inch Network witnessed considerable growth in Q2, 2023. The total number of unique users is just under 5 million.

Messari published a report on the state of DEX aggregator 1inch Network, providing metrics showing that the platform grew remarkably in Q2 2023. Among the report’s major highlights is that its user base grew by a sizable 38% from the last quarter.

1inch Network Experiences Growth in Q2 2023

1inch Network was one of the best performers in DeFi in Q2, 2023, with a lot of progress made. In Q1, 2023, the total number of users was 3.56 million, with this figure experiencing a considerable jump to 4.94 million in Q2. That equated to a 38% jump between the quarters.

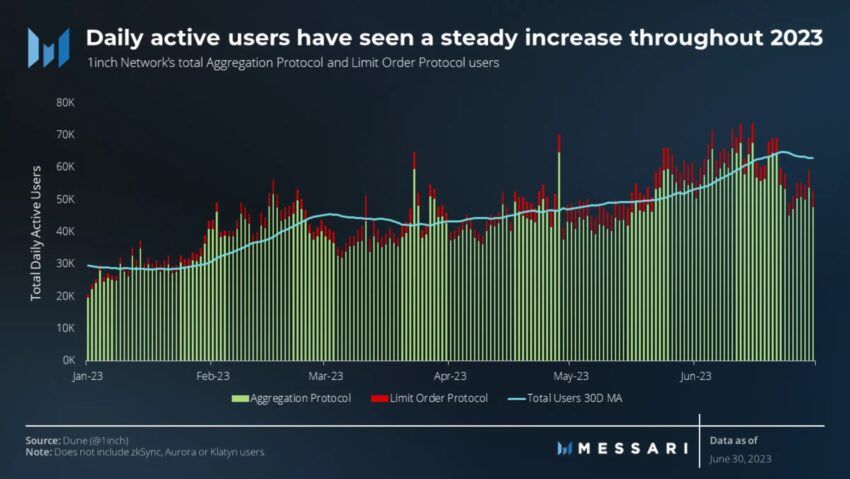

Daily active users have also experienced a steady increase, hitting a peak of about 65,000 in June 2023. The Limit Order Protocol also had its user base increase from 261,000 in Q1 to 438,000 in Q2, which is about a 68% increase over the quarters.

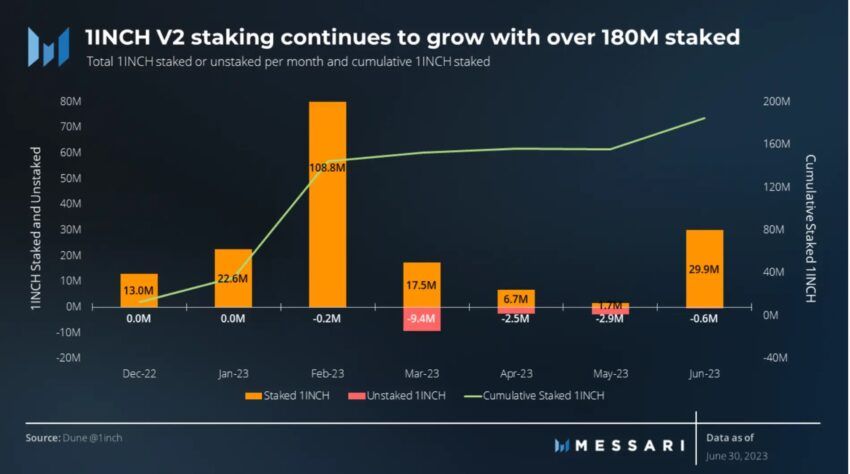

1inch network experienced a good second quarter by other metrics as well. Users have staked an increasingly large amount on 1Inch V2, with the total sum amounting to 184 million 1INCH tokens. That is a 20% jump from the quarter before.

The interval of May-June was when the most significant jump took place in Q2, with the staked 1INCH tokens jumping from 1.7 million to 29.9 million. The reason for this jump is 1Inch’s Unicorn Power, a voting mechanism.

Overall, it’s a sharp turn from the events of late 2022. At the time, the price of 1INCH tumbled as investors offloaded $8 million worth of tokens.

With quarter-on-quarter (QoQ) numbers indicating a positive trend, 1inch Network stands out as one of the major players in the decentralized finance (DeFi) space. Check out our guide on the protocol to learn more: What Is 1inch Exchange?

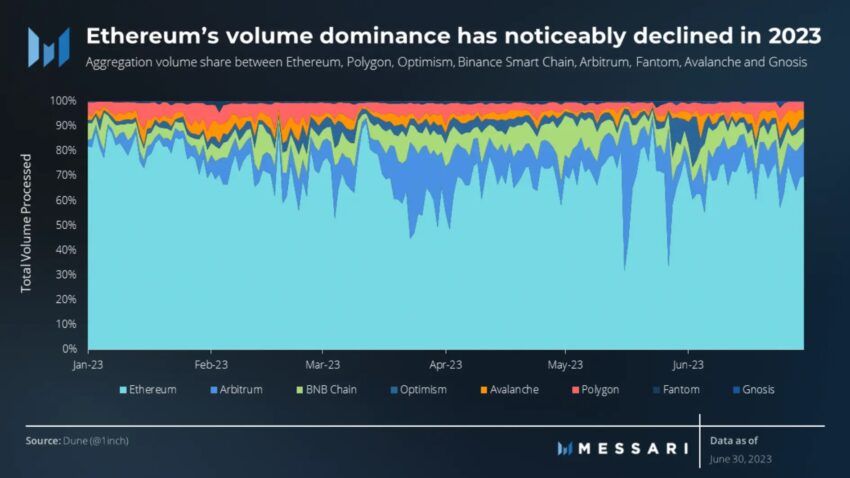

Ethereum Volume Dominance Down

Another notable highlight from the report is the fact that Ethereum’s volume dominance has experienced a notable decline. While it still remains the most significant network on 1inch network, with 71% of the total volume, it saw a decline of about 10% over the second quarter.

Messari suggests that the drop in Ethereum usage may suggest that users are migrating to more cost-effective networks. The rise of Arbitrum is good evidence of this, and the thought is further consolidated by the fact that it went through the smallest volume decrease.

It is also worth noting that Q2 saw an overall decrease in aggregation volumes across all major chains. Ethereum’s drop was 42.5%, while Fantom underwent the biggest drop of 53.3%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.