Almost $1 billion worth of Bitcoin options contracts are set to expire this Friday. Moreover, markets have recovered from their post-ETF launch dip, but can the derivatives’ expiry event push prices higher over the weekend?

Around 22,000 Bitcoin options contracts will expire on February 2. This week’s expiry event is much smaller than last week’s massive month-ender, but it is still almost a billion dollars worth of contracts.

Bitcoin Options Expiry

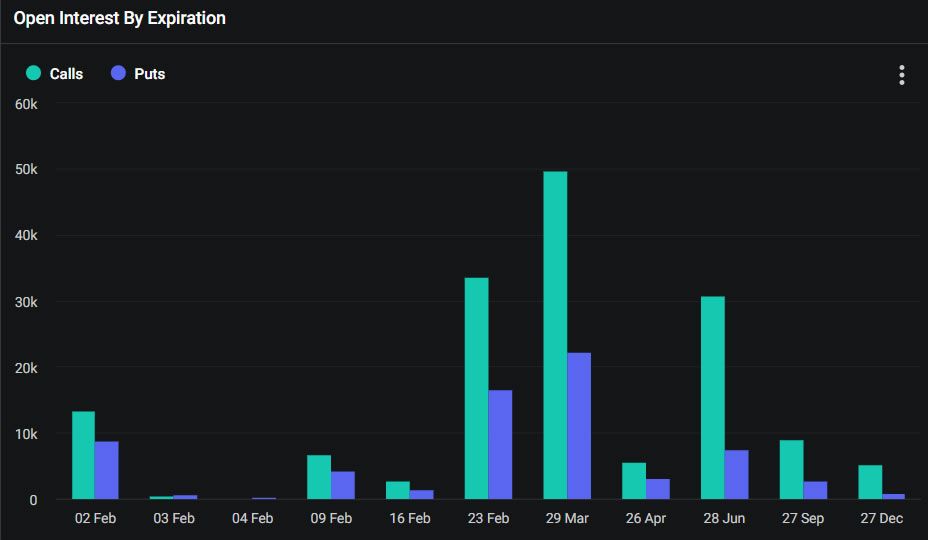

The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $960 million, according to Greeks Live. The put/call ratio is 0.66, which means more calls or long contracts are being sold as puts or short contracts.

The max pain point, or the price at which most losses are made, is $42,000. However, there is still a lot of open interest at the $50,000 strike price, with 14,191 call contracts at that level. They have a notional value of $610 million, according to Deribit.

There is also a lot of OI at $45,000, with 12,307 call contracts at that strike price.

The crypto market was relatively flat this week, commented Greeks Live, which added that relative and implied volatility was “trending lower for major terms.”

“Bitcoin spot ETFs are starting to bring incremental capital to the crypto market as the grayscale sell-off slows. The next big buzz is speculation on Bitcoin halving, which remains a bullish tone this year.”

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Crypto Market and Ethereum Option Update

In addition to the expiring Bitcoin options, 230,000 Ethereum contracts are expiring this Friday. These have a notional value of $530 million and a put/call ratio of 0.33, meaning three times more sellers of long contracts.

The max pain point for ETH options is $2,300, which is the current spot market price.

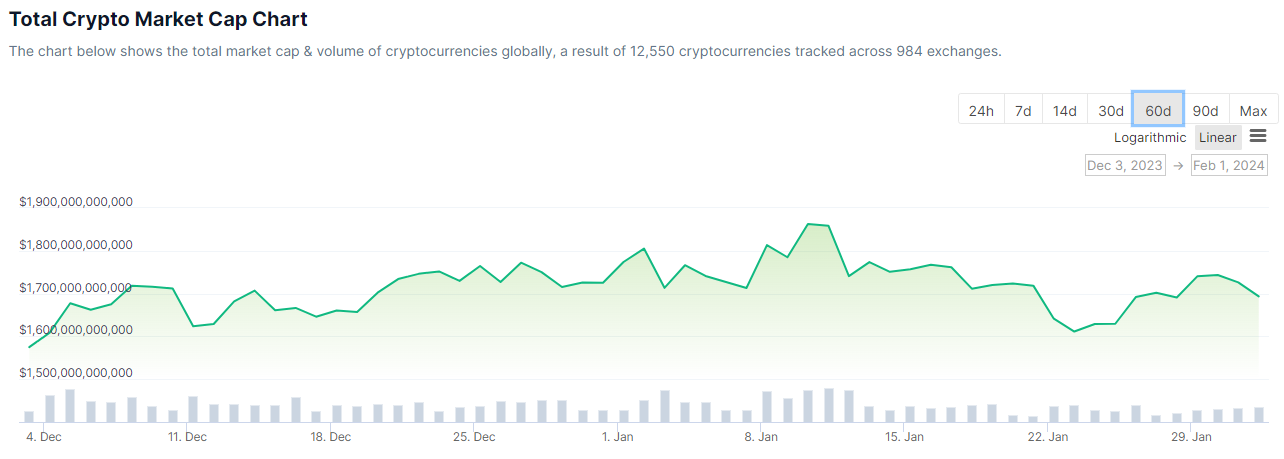

Crypto markets have gained 2.3% over the past 24 hours as total capitalization reaches $1.73 trillion. However, spot markets remain within a sideways channel that has formed over the past two months.

Bitcoin prices have gained 2.6% to reclaim the $43,000 price level during the Friday morning Asian trading session. The asset has failed to top $44,000 since ETF launch day, so it is unlikely that the options’ expiration will have much impact.

ETH prices are up 2% as the asset reclaims $2,300, but it has been trading sideways for the past week.