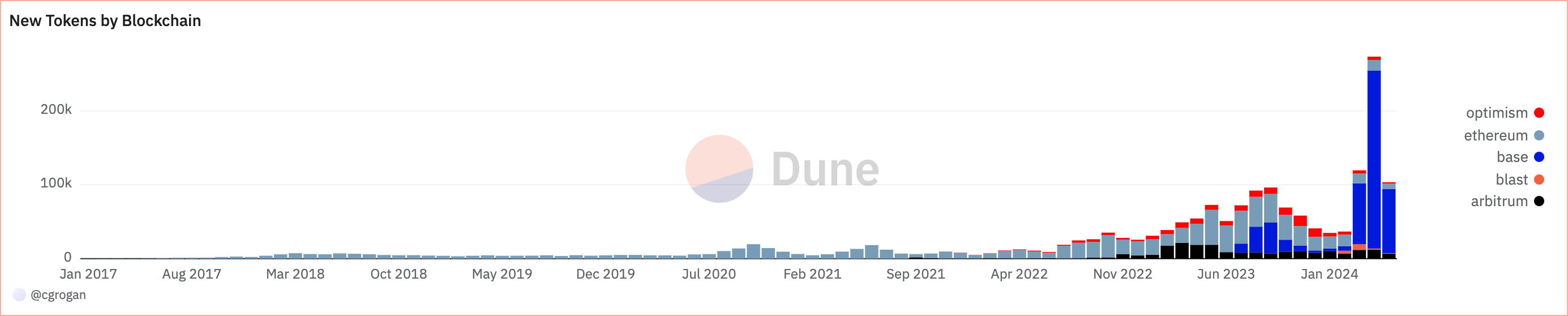

Coinbase Director Conor Grogan announced that nearly 1 million new cryptocurrency tokens emerged last month.

This number is twice the total created on the Ethereum blockchain from 2015 to 2023. These developments underscore the volatile and often precarious nature of investing in new crypto ventures.

New Meme Coins Take Over Crypto Market

Grogan highlighted these figures through the Dune dashboard chat, indicating a significant expansion in the crypto sector.

The bulk of this surge in token creation occurred on the Ethereum and Solana blockchains. Specifically, Ethereum saw 376,642 new tokens, while Solana experienced an average daily creation of over 20,000 tokens.

Notably, 886% of the new tokens on the Ethereum blockchain, amounting to 327,553, debuted on Coinbase’s layer-2 network, Base. This platform has attracted many developers, especially those focusing on meme coins, due to its reduced operational costs.

Read more: 7 Best Base Chain Meme Coins to Watch in 2024

Furthermore, the total value locked (TVL) on Base has soared by 627% since the beginning of the year, now reaching a remarkable $5.4 billion, according to L2beat. Meme coins are the primary reason for this increase.

However, the crypto community has also criticized the rapid proliferation of meme coins. Many in the community view these tokens as high-risk, pointing out that they are often scams to exploit trading bots and inexperienced investors.

“Most of them are just spam to farm sniper bots. I saw a guy launching tokens with gibberish names on base just to rug-pull bots that auto-bought,” an X user commented on Grogan’s post.

Moreover, the regulatory environment has been less stringent for meme coins compared to more traditional or innovative crypto projects. Chris Dixon of Andreessen Horowitz has criticized this regulatory approach, arguing that it fosters an ecosystem rife with trivial projects at the expense of more meaningful, blockchain-based solutions.

Investing in this market involves substantial risks. Crypto Koryo, a data scientist, emphasizes the high-risk, low-reward nature of meme coin investments. The barrier to creating new coins has significantly lowered, leading to market saturation.

“Back then, deploying an ERC-20 token wasn’t something the average Joe could easily do. But today, anybody can do it,” Koryo states.

Koryo advises investors to diversify substantially if they choose to engage with meme coins. He warns that without adequate diversification, an investor’s portfolio could drop to zero.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Moreover, on-chain sleuth ZachXBT recently reported that developers abandoned several meme coin projects on the Solana blockchain. This led to a staggering $26.7 million loss for investors.