The price per ZK, the native token of the zkSync Era, an Ethereum Layer 2 (L2) scaling protocol, plummeted to its all-time low of $0.13 on July 5. Although its price has since rallied by 33%, the altcoin remains at risk of shedding these gains.

An on-chain assessment of ZK’s performance shows that its current price gains merely mirror the broader market rally and are not due to a spike in demand for the altcoin.

zkSync Benefits From General Market Rally

As of this writing, ZK trades at $0.17. Amid the broader market uptick of the past week, the token’s price has risen by almost 15%.

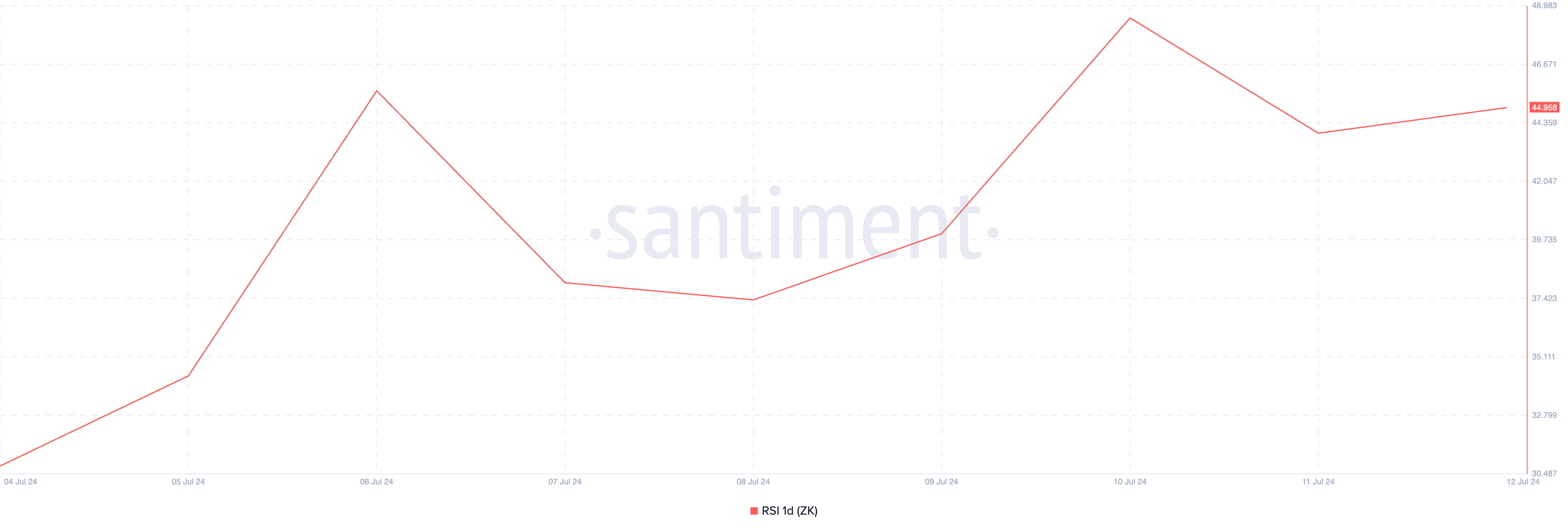

However, this price surge is not backed by an actual demand for the L2 token. An assessment of its Relative Strength Index (RSI) shows that while ZK’s price has risen, there has not been any considerable rally in its on-chain demand. At press time, the token’s RSI is below the 50-neutral line at 44.95.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset might be overbought and a price correction or reversal might occur. On the other hand, RSI values below 30 suggest that the asset might be oversold, and a rebound could happen.

At 44.95, ZK’s RSI shows that buying pressure remains considerably low.

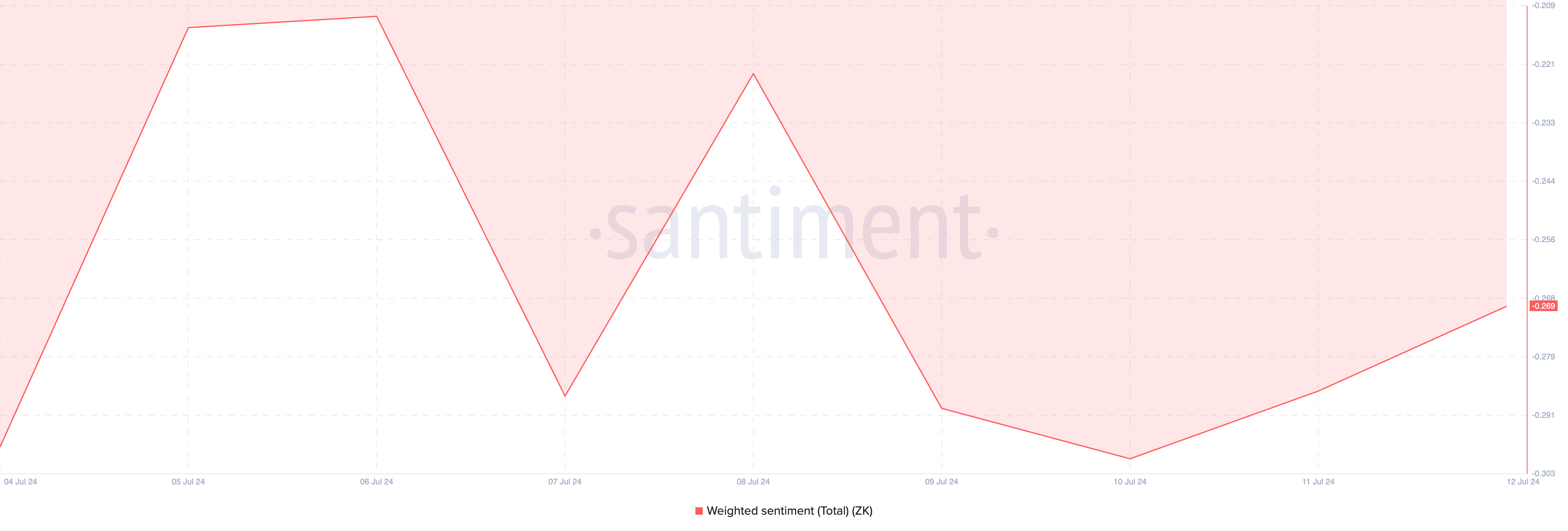

Further, negative sentiments continue to trail ZK. Despite its 33% price uptick in the past 14 days, market participants remain cautious. This can be gleaned from its consistently negative weighted sentiment. As of this writing, the token’s weighted sentiment is -0.26.

Read More: What Is zkSync?

This metric tracks the overall mood of the market regarding an asset. It considers the sentiment trailing the asset and the volume of social media discussions.

When an asset’s weighted sentiment value is below zero, most discussions on social media platforms are fueled by negative emotions like fear, uncertainty, and doubt, often precipitating a decline in value.

ZK Price Prediction: Price May Head Back Toward All-Time Low

ZK’s falling Accumulation/Distribution (A/D) Line, as observed on a one-day chart, confirms the drop in the demand for the altcoin. At -4.47 million at press time, it has declined by 30% since July 5.

This indicator gauges the cumulative flow of money into and out of an asset over a specified period of time. When it declines in this manner, it suggests that liquidity is flowing out of the asset, indicating distribution.

If this trend persists, ZK’s value will plunge to $0.16 and attempt to trade again at its all-time low.

However, if demand starts to trickle in, the uptrend will continue, and the altcoin may rally to $0.20.