ZKsync (ZK) has experienced a significant downturn in network activity over the past few months. The Layer-2 (L2)protocol has witnessed a sharp decline in user demand, reaching its lowest point year-to-date.

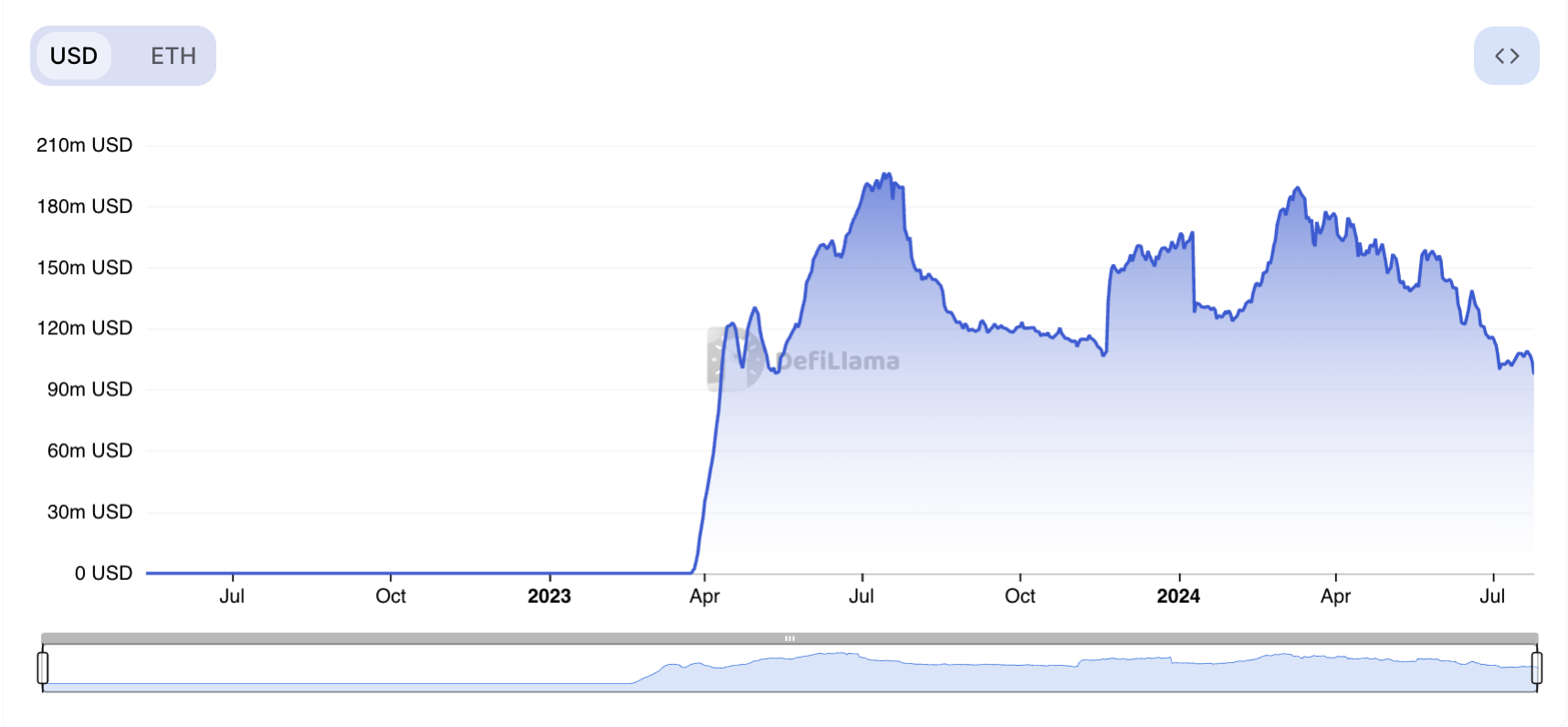

Also, the network’s DeFi Total Value Locked (TVL) has contracted to its lowest level since April 2023. These events coincide with a downtrend in ZK’s price.

ZKsync Struggles To Keep Users

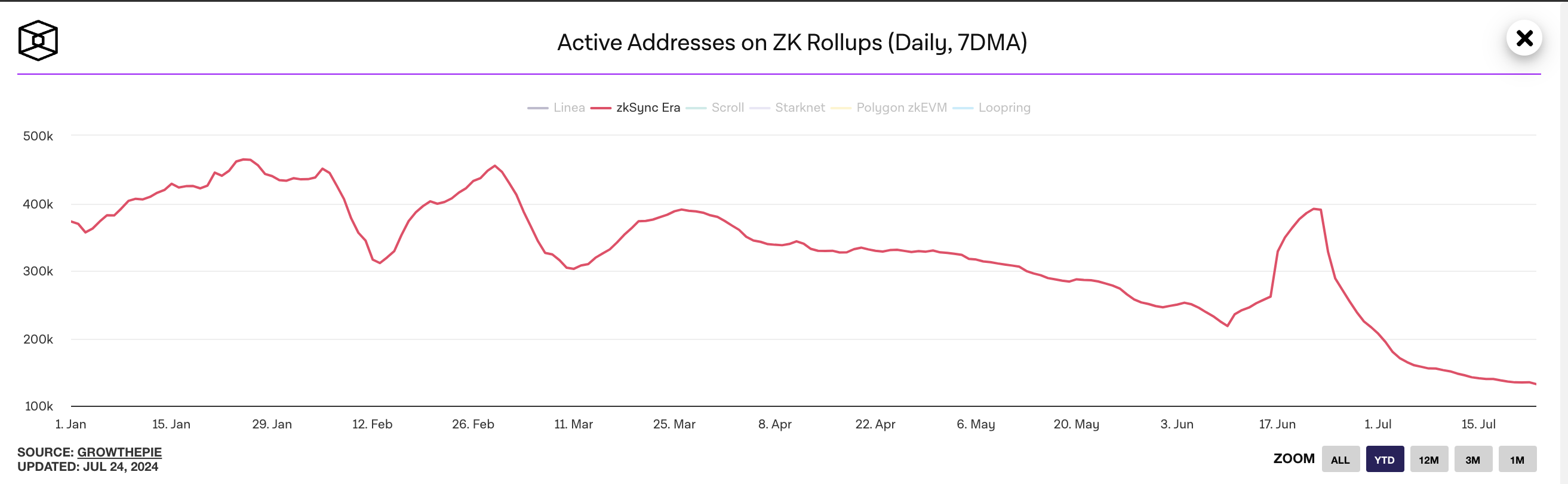

An on-chain assessment of activity on the ZKsync network reveals a steady decline in user demand since June 23. According to information from The Block’s data dashboard, the network’s daily active addresses observed using a seven-day moving average have since dropped by 66%.

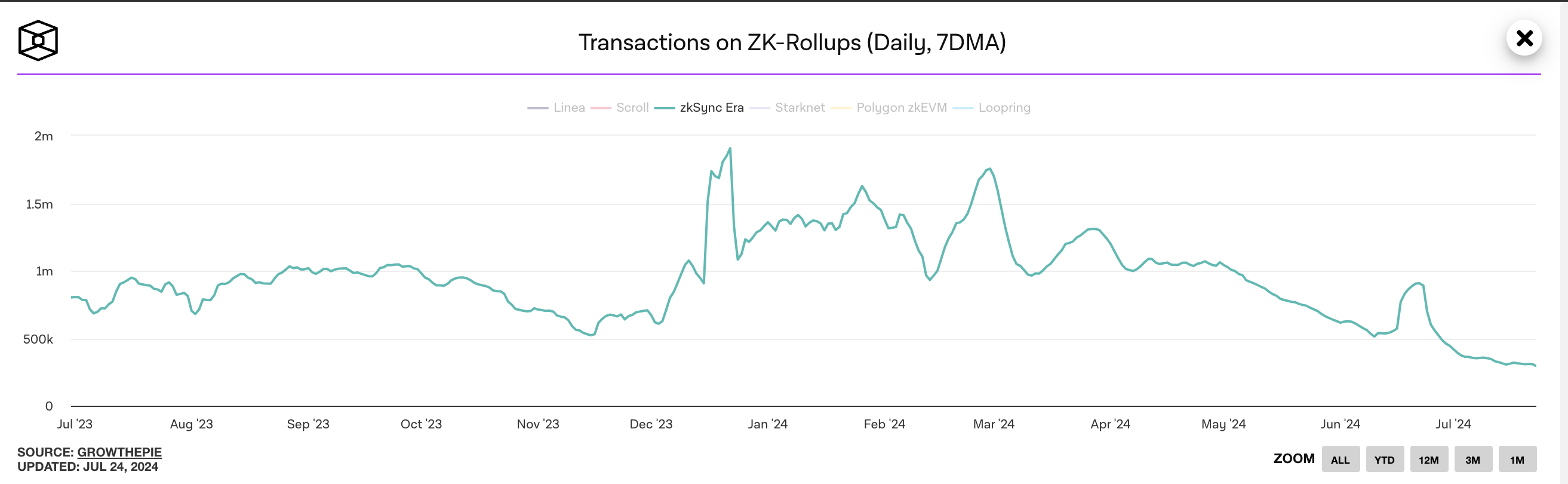

Due to the decline in the number of active unique addresses on ZKsync, the daily count of transactions completed on it has also plummeted. According to data from The Block, this has trended downward since February 28. On July 23, it plunged to its year-to-date low of 293,000.

A decline in daily active addresses and transaction counts on ZKsync indicates a decrease in user activity on the platform. This highlights an obvious decline in interest in using the L2 for things like NFT trading or DeFi activity.

For example, while the broader market rally has led to an uptick in the total value of assets locked (TVL) across multiple networks in the last month, ZKsync’s TVL has declined.

Read More: What Is zkSync?

At press time, the network’s TVL was at its lowest level since April 2023, at $96 million.

ZK Price Prediction: L2 Token Witnesses Growing Bearish Bias

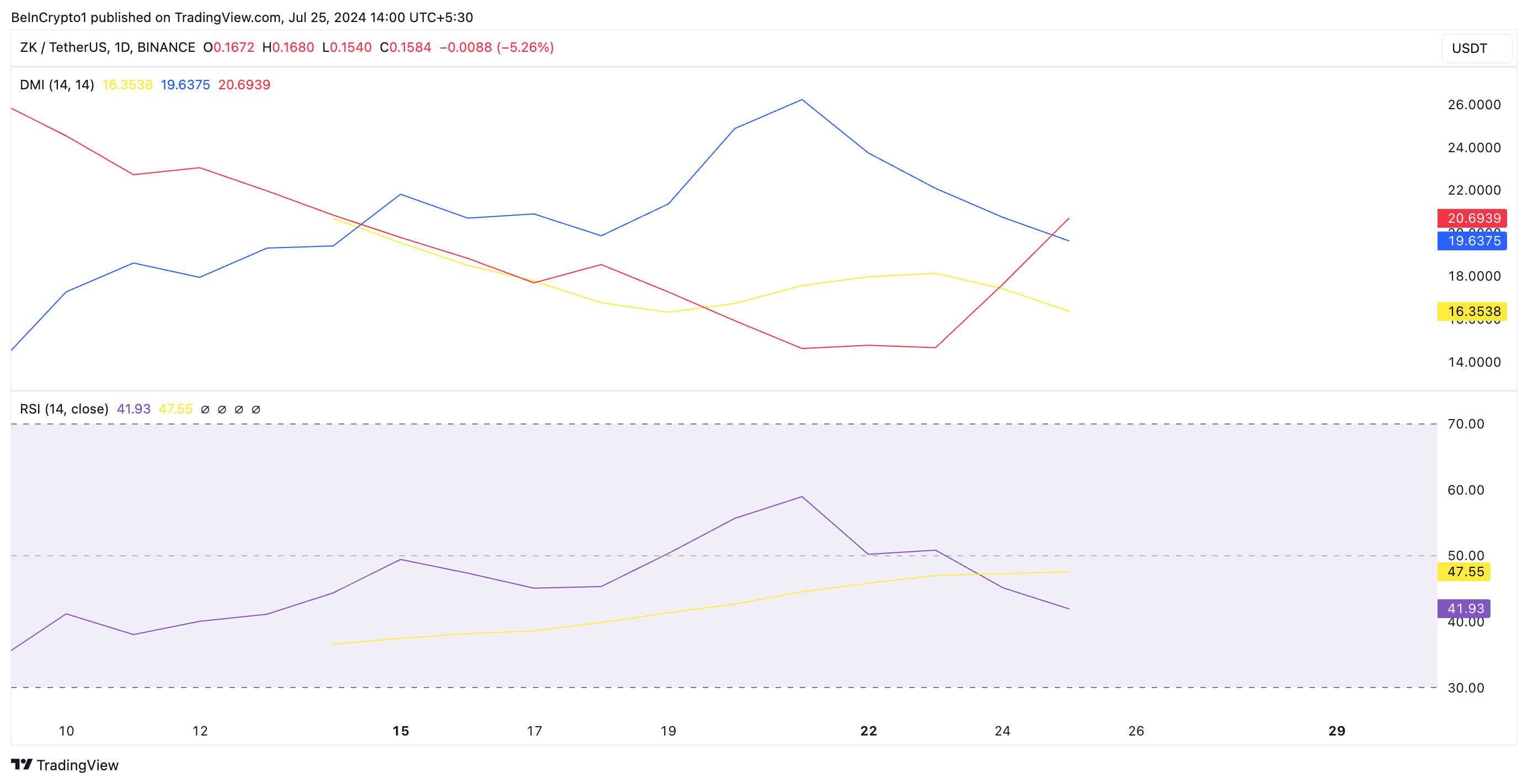

ZKsync’s native token, ZK, fell to an all-time low of $0.13 on July 5. Although it has since rallied by 21%, the altcoin is poised to lose some of these gains. As of this writing, ZK trades at $0.15, having declined by almost 10% in the past seven days.

Its Relative Strength Index (RSI) confirms the decline in ZK’s buying pressure. At press time, the indicator is 42.10 below its 50-neutral line and in a downtrend.

This indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset might be overbought and a price correction or reversal might occur. On the other hand, RSI values below 30 suggest that the asset might be oversold, and a rebound could happen.

At 42.10, ZK’s RSI suggests that selling pressure outweighs buying activity, highlighting that it is at risk of a potential decline.

Also, readings from ZK’s Directional Movement Index (DMI) reveal that its negative directional indicator (-DI) has crossed above its positive directional indicator (+DI).

An asset’s DMI measures its trend strength and direction. When the -DI intersects the +DI, it signals a shift in the market trend from bullish to bearish. It suggests that the asset’s downtrend is becoming stronger.

Read More: What are Zero-Knowledge Proofs? Securing Growth for Web3 Apps

If this trend continues, ZK’s price might fall to its all-time low of $0.13 or even trade below it at $0.09.

However, if buying pressure regains momentum, ZK’s price may climb up to $0.17.